Fintech stock Wise (LSE:WISE) hit the London Stock Exchange in a direct listing at a value of £8.8bn on 7 July 2021. A year ago, the company was valued between £3.6bn and £3.9bn. The Wise share price is currently sitting at 982p. With 994,589,856 ordinary shares at last count, Wise has a market cap of around £9.8bn today.

This has been a successful admission to the markets. And I can understand why: Wise is disrupting financial services, and unlike other tech stocks is not just bringing high revenue but also profits a decade after being founded. However, there are issues to address.

What is Wise?

Wise started in 2011 as TransferWise, offering low-cost international money transfers to everyday customers. Its goal was to make international money transfer cheaper, quicker, and more transparent than traditional banks. Wise is digitally native and does not offer cash services like, say, competitor Western Union, does.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

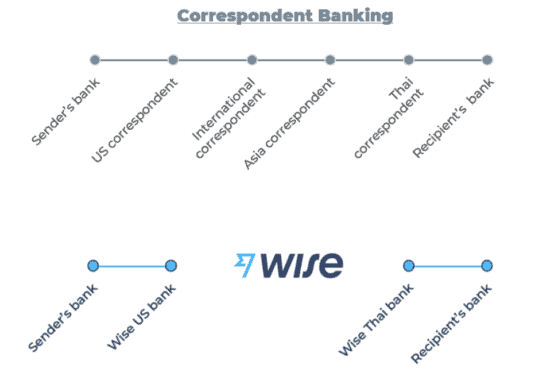

The technology Wise uses to provide for international payments is fairly simple to understand schematically. Traditional banking would have someone routing money from their bank through a host of correspondent banks to an account on the other side of the world. Wise has built itself as a middleman between local payment services in multiple countries.

Source: Wise Prospectus

Wise moves money by taking a client’s currency into its own account here and moving currency from its account to the client’s over there, at an agreed exchange rate. Removing the intermediaries and manual checking of correspondent banking is how Wise keeps costs and time down.

I do think Wise has a good business model. Pandemic aside, the world is becoming more mobile. That speaks to an increased demand for moving money between countries. Digital money is becoming the norm, obviating the need for Wise to have high street shops. And people everywhere are moving online. That means shopping around for money services is easier, and so long as Wise can stick to its value proposition, it should continue to attract clients.

Wise share price

The typical early Wise user was a fairly affluent tech-savvy European. It has since expanded globally and moved onto business customers. If now offers more sophisticated banking services like international payments and multi-currency accounts. This has kept revenue growth high.

Table 1: Wise condensed income statement 2019–2021

| 2019 | 2020 | 2021 | |

| Revenue | £177.9m | £302.6m | £421.0m |

| Gross profit | £110.4m | £188.1m | £260.5m |

| Operating profit | £12.2m | £23.6m | £44.9m |

| Profit for the year | £10.3m | £15.0m | £30.9m |

| Diluted EPS | 0.56p | 0.80p | 1.58p |

Source: Wise Prospectus

Wise grew its revenues by 39% and doubled its profits over the 2021 fiscal year. Revenue growth is below the 70% seen in 2020 but operating and net profit margins are improving. But Wise shares are seemingly trading at 621 times earnings per share. That’s extremely high for a company with slowing revenue growth and established competitors.

Then there is the dual-class share structure, which gives the founders control but that kept Wise shares in the standard rather than premium, main market of the LSE. This locks Wise shares out of FTSE index inclusion and means losing long-term holders like index funds. However, a premium listing should be possible in five years, when the dual share class structure is due to expire.

I do like Wise shares, but I think its share price might be too rich for me at present. I will watch from the sidelines to see if anything changes.