UK growth stocks have played a valuable role in my investment portfolio in recent years. While many of my blue-chip FTSE 100 dividend stocks have delivered underwhelming returns, most of my growth stocks have risen in value, powering my portfolio higher.

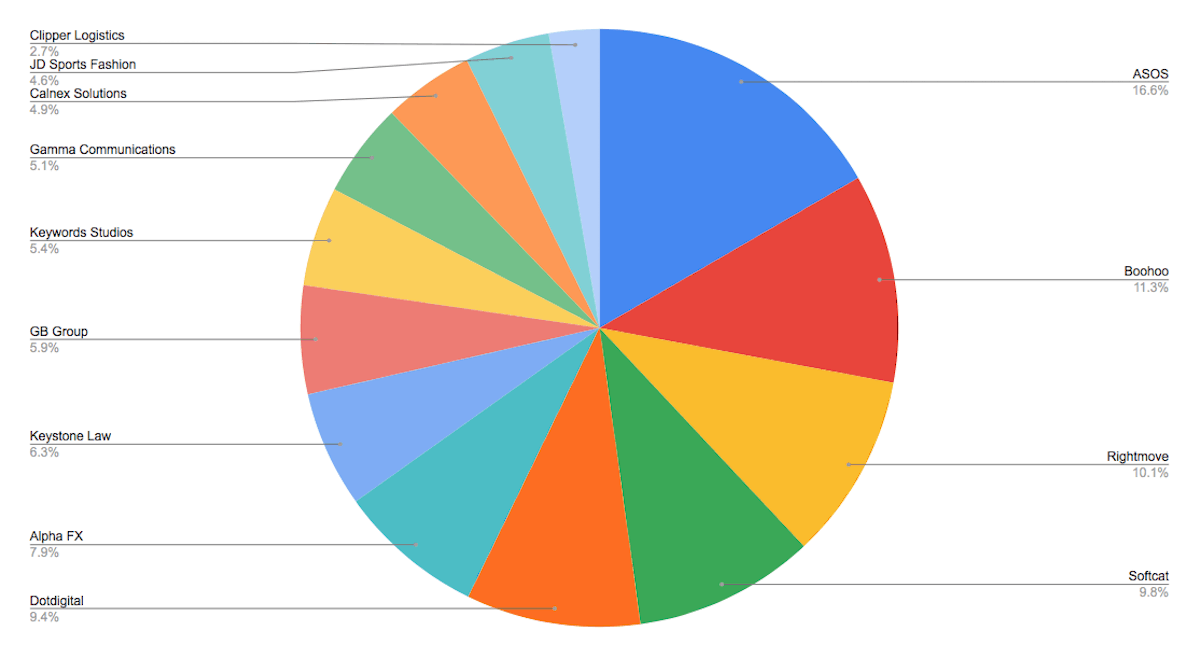

Today, I’m going to give Motley Fool readers some insight into my portfolio by listing the 13 UK growth stocks I currently own. Combined, these stocks represent about 25% of my overall portfolio.

My UK growth stocks

Should you invest £1,000 in JD Sports right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if JD Sports made the list?

Within my UK growth stocks chart above, you can see my two largest holdings are online fashion retailers ASOS and Boohoo. I own these stocks because I expect the e-commerce industry to get much bigger in the years ahead and I think these companies should benefit.

After ASC and BOO, my next largest growth stock holdings are property website group Rightmove and IT infrastructure company Softcat. I like these companies because they have good long-term growth track records and are very profitable.

DotDigital, Alpha FX, and Keystone Law are three more under-the-radar UK growth stocks I own. DotDigital is an innovative tech company that offers a digital marketing platform. Alpha FX is a founder-led financial services firm that specialises in foreign exchange risk management. Keystone is a disruptive platform-based law firm. All three companies are growing rapidly and are very profitable.

The next three holdings, GB Group, Keywords Studios, and Gamma Communications are all UK tech stocks. GB Group specialises in identity management while Keywords Studios offers technical services to the video game industry. Gamma provides unified communication services, helping businesses enable their employers to work remotely. I think all three are well-placed for growth in today’s digital world.

Finally, I have smaller positions in 5G network testing specialist Calnex Solutions, JD Sports Fashion, and Clipper Logistics.

Higher-risk shares

I’ll stress that all of these stocks are higher-risk. Many of them are small-cap stocks which means their share prices can be very volatile at times. Additionally, most trade at high valuations meaning there’s valuation risk. If growth slows, their share prices could fall.

However, I’m comfortable with these risks. They also represent a relatively small proportion of my overall stock portfolio. So, if one or two of these stocks were to underperform, my overall portfolio wouldn’t take a huge hit.

How my growth stocks have performed

In terms of performance, my growth stocks have performed quite well. With the exception of Calnex and Gamma (which are both relatively new holdings for me) all of these stocks have delivered double- or triple-digit returns.

|

What’s my secret to success? Well, for starters, I focus on companies that are already profitable and generating consistent growth. I find this dramatically increases the chance of success with UK growth stocks.

Secondly, I tend to focus on companies that are highly profitable. Most of these have a very high return on capital employed (ROCE). Softcat, for example, has a five-year average ROCE of 62%.

Third, I tend to buy my growth stocks during periods of stock market volatility. This often provides more attractive entry points.

Finally, I hold my growth stocks for the long term. These gains haven’t come overnight. In most cases, they’ve come over several years.