FTSE 100 constituent Burberry (LSE:BRBY) released its Q3 trading results this week. Unsurprisingly its sales have been affected by the pandemic, but the brand still boasts a strong and loyal following. It also shows signs of recovery and strength in its appeal to a new and younger market. But the British luxury brand will likely face ongoing headwinds in the coming months, so are shares in Burberry a good investment today?

Burberry’s Q3 sales slip

In Q3, full-price sales enjoyed double-digit growth and increased in rebounding markets across the Americas, Mainland China and Korea. But the pandemic continues to pose problems. Overall, underlying sales fell 9%.

Some 49% of Burberry’s stores are fully open, with the rest operating with restrictions or closed. The FTSE 100 company expects full-year trading to improve as its gross margins benefit from full-price inventory sales. It’s reducing its costs according to plan and is successfully reducing inventory.

US sales fell 8% year-on-year, meanwhile sales across Europe, the Middle East, India, and Africa (EMEIA) fell 37% due to store closures and a reduction in tourism. Nevertheless, the Asia-Pacific region enjoyed a hike in sales growth of 11%, which is encouraging.

Meanwhile, digital sales saw 50% full-price growth and Mainland China saw a triple-digit rise in digital sales.

The Marcus Rashford effect

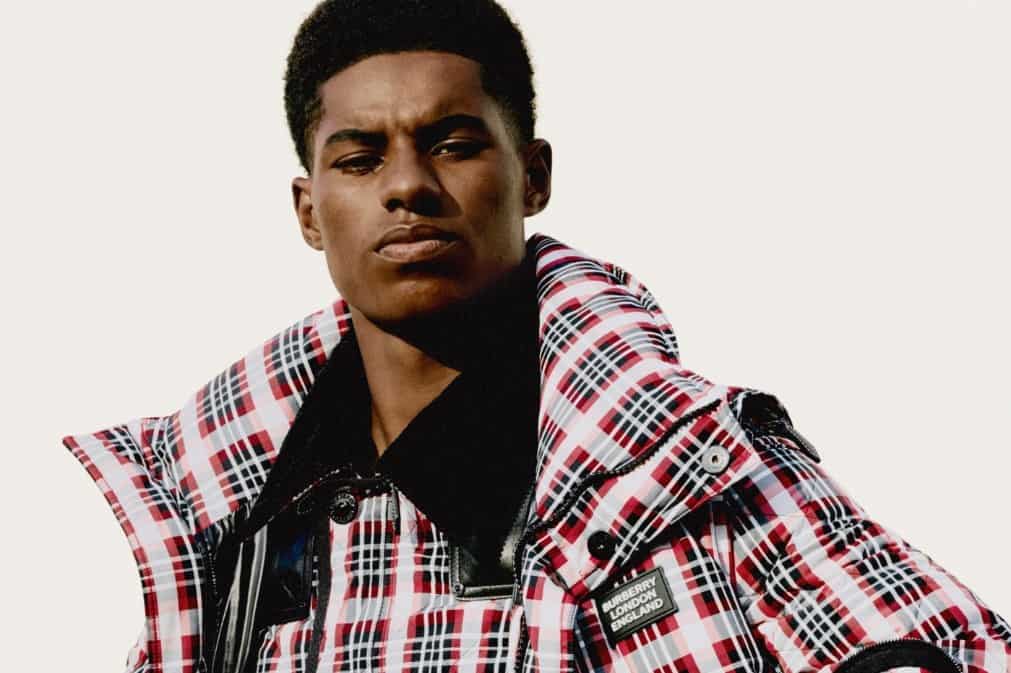

Burberry is known for its innovative advertising campaigns and shrewd marketing strategies. Its festive collaboration with footballer Marcus Rashford was particularly positive for the brand. Rashford is a spokesperson and advocate for ending child poverty and supporting youth-related causes. His ability to make a difference has been steadily mounting throughout the pandemic.

His wholesome, philanthropic image is a great asset to Burberry. And this was clear by the success of its social media engagement during his campaign.

A FTSE 100 stock for the future

The FTSE 100 company is also investing heavily in improving its sustainability rating. In Q3 it achieved its highest ever score in the 2020 Dow Jones Sustainability Index. High fashion remains one of the worst contributors to environmental destruction. In that vein, environmental, social and corporate governance (ESG), is increasingly important to investors. Therefore, publicly listed companies must embrace it if they want to be a viable addition to an ESG conscious investor’s portfolio.

Burberry is doing just that. It’s focusing more closely on diversity, the use of renewable practices, and has done its bit in supporting the Covid-19 relief effort by manufacturing PPE at cost.

That’s all good news. But with key customer China going back into lockdown and the virus still ravaging the world, the next few months will likely pose a challenge. However, as a long-term investment, I think Burberry looks like it will recover. The rise of the affluent Chinese consumer is likely to continue to attract new customers to the brand, and it’s got its finger on the pulse of the digital age.

But Burberry’s price-to-earnings ratio is a high 61, earnings per share are almost 30p, and its dividend yield is a low 0.6%. As much as I think this is a great FTSE 100 company with a sustainable business, I think its shares are expensive and won’t be investing for now.