Tesla (NASDAQ:TSLA) is a popular stock at the moment. Not only is it one of the most purchased shares in the US, but it’s also one of the most bought shares here in the UK. Last week, Tesla was the eighth most bought stock on Hargreaves Lansdown.

Yet not all investors are bullish on Tesla. Hedge fund manager Michael Burry, who rose to fame after he predicted the 2008/09 housing market crash and featured in the Hollywood blockbuster The Big Short, is one investor who’s bearish on the stock. After Tesla’s amazing share price surge in 2020, he expects the stock to fall.

‘Big Short’ investor targets Tesla stock

In a tweet to Tesla CEO Elon Musk last week, Burry revealed that he’s shorting TSLA stock at present. This means that he has borrowed Tesla shares and sold them, with the expectation that he will be able to buy them back at a lower price. He hinted in his tweet that he sees the stock as very overvalued right now.

“So, @elonmusk, yes, I’m short $TSLA, but some free advice for a good guy… Seriously, issue 25-50% of your shares at the current ridiculous price. That’s not dilution,” he tweeted.

The hedge fund manager also included a spreadsheet in the tweet detailing Tesla’s financial performance against traditional carmakers. Tesla currently sports an industry-high market capitalisation yet has profits that are well below those of other major automotive players such as Toyota, BMW and Volkswagen.

Up 600% this year

Should UK investors be worried that a legendary investor is shorting TSLA? Personally, I think they should be slightly concerned.

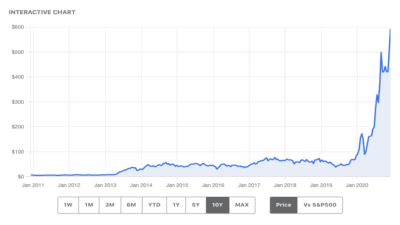

Tesla shares have rallied nearly 600% this year – boosted recently by the company’s coming inclusion in the S&P 500 index – and at present the stock sports a whopping market capitalisation of $568bn. That’s high. That valuation suggests the company is going to completely dominate the automotive industry going forward.

High valuation

Looking at revenue and earnings estimates for FY21, Tesla’s forward-looking price-to-sales ratio is 12.7, while its price-to-earnings ratio is 147. These valuations don’t leave a lot of room for error. The stock is priced for perfection.

Even Elon Musk seems to acknowledge the share price is high. In a recent letter to his employees, he warned that Tesla stock could “get crushed like a soufflé under a sledgehammer” if the company’s profit margins don’t improve.

I think it’s worth looking at the chart to put Tesla’s recent share price rise in perspective. As you can see, the rise this year has been exponential. I’ve seen these kinds of share price surges before, and usually, they don’t end well for investors.

Source: fool.com

I will point out that I think Tesla is a great company. Its cars are excellent and its technology is best-in-class. However, looking at the valuation, I think caution is warranted towards Tesla stock today.

All things considered, I think there are better stocks to buy right now.