It’s fair to say 2020 has been a challenging year for Royal Dutch Shell (LSE: RDSB) investors. As a result of Covid-19, and the subsequent drop in demand for oil, Shell’s share price has plummeted. Year to date, shares in the FTSE 100 oil major are down about 50%.

Can Shell’s share price recover? I think it’s possible. That said, there are a few things that need to happen for the FTSE 100 oil stock to rebound.

Shell share price: oil prices need to rise

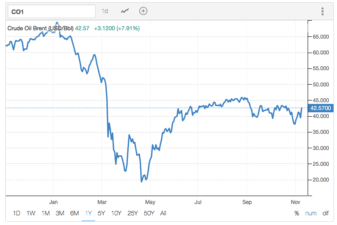

In the short term, Shell desperately needs oil demand to pick up and oil prices to rise. According to oil sector analysts, Shell’s breakeven oil price is currently a little under the $40-per-barrel mark.

Currently, the price of Brent crude oil is just over $40 per barrel. This means Shell isn’t going to make huge profits in the current environment. Adjusted earnings for the third quarter of 2020, for example, came in at $955m, versus $4,767m for the same period last year.

Source: Trading Economics

If the oil price was to pick up to say $50 per barrel post-Covid-19 however, it would be hugely beneficial to Shell. This kind of rise in oil prices would most likely result in Shell’s share price rising significantly.

Yesterday’s Covid-19 vaccine news is an encouraging development here. A vaccine could certainly boost demand for oil.

Dividend track record

In the past, Shell was a very reliable dividend payer. The company’s track record (it hadn’t cut its payout since WWII) was one of the main reasons a lot of investors owned the stock.

Shell’s income appeal was reduced dramatically this year however, when it slashed its quarterly dividend payout from 47 cents to 16 cents. There are probably quite a few investors who dumped the stock after that cut.

Shell now needs to prove to investors it can be a reliable dividend payer from here. The company has made a good start – recently it raised its payout for Q3 by 4% to 16.65 cents. However, it has a long way to go to rebuild its reputation as a reliable dividend payer.

Shell needs a clear strategy

Finally, for Shell’s share price to rebound fully, I think the group needs a clear long-term strategy. Its current strategy is unclear and I think this is turning a lot of investors off the company.

Let’s face it, in the long run, renewable energy is the way forward (you can find out more about renewable energy stocks here). And, on this front, Shell hasn’t done a lot. The oil major says that part of its strategy is to “thrive in the energy transition by responding to society’s desire for more and cleaner, convenient and competitive energy.” However, so far, its actions have been underwhelming.

By contrast, energy rival BP recently announced a huge transformation programme to pivot to low carbon energy. By 2030, BP aims to have developed around 50GW of net renewable generating capacity – a 20-fold increase from 2019.

Investors these days are increasingly focusing on sustainability. For Shell to attract institutional and private investor interest in the same way it did in the past, I think it needs to make a major move towards clean energy. Its unclear long-term strategy could be holding its share price back.