In the disruptions caused by the Covid-19 pandemic, reliance on innovative technologies from tech stocks has skyrocketed. This digital transition is fundamentally changing the way businesses, schools, and even governments are operating, with all three types of organisations seeking digital talent management solutions.

The opportunity

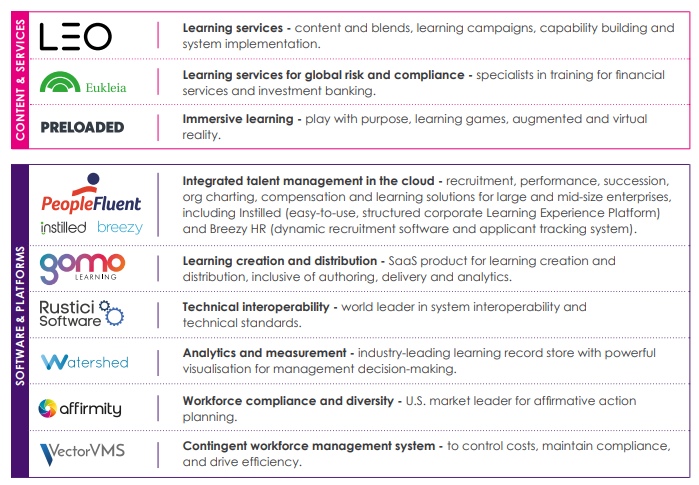

Learning Technologies Group (LSE:LTG) provides a variety of digital learning services and software for such organisations. The tech stock has a vast array of learning platforms and services within its portfolio. Each can be configured to other systems for seamless integration with existing client processes.

Image Source: Learning Technology Group 2019 Annual Report

LTG can quickly adapt to a client’s needs, giving it a serious competitive advantage in a market that is projected to be worth £325bn by 2025!

The industry space is highly fragmented. Many smaller players exist, and some companies rely on in-house technology to train their staff. As a result, there is a lack of standardisation, which can make the experience very clunky as well as reduce the cost-effectiveness of these learning programmes.

LTG’s growth strategy is one of consolidation. The management team seek out smaller companies whose technology or services compliments their existing portfolio. The team also targets sectors that suffer enormous consequences from an untalented workforce – such as aerospace, finance, and pharmaceutical industries.

The most recent acquisitions are Open LMS, a Moodle-based platform, from Blackboard Inc in March 2020, and eCreators, Australia’s largest Moodle provider, in October 2020.

Combined, these two acquisitions make the tech stock the world’s largest providers of Moodle-based e-learning solutions. Put simply, companies can use the platform to create, personalise, and track learning & examination programmes for employees and students alike.

The financials

The acquisitive nature of the business makes it relatively capital intensive as it bolsters its portfolio. So far, however, these acquisitions appear to be complimenting operations with revenue, profits, and margins all growing at double-digit rates.

| £m | 2019 | 2018 | 2017 | 2016 | 2015 | Avg. Year-on-Year Growth (%) |

| Revenue | 130 | 94 | 51 | 28 | 20 | 60 |

| Operating Profit | 16 | 1.3 | 1 | -0.2 | 1.2 | 92 |

| Operating Profit Margin (%) | 12.3 | 1.4 | 1.9 | -0.9 | 6 | 20 |

| Goodwill Proportion (%) | 42 | 42 | 38 | 45 | 36 | 3 |

The risk factor

However, there is a caveat to this approach to growth. As I have previously written, there are many ways in which acquisitions can destroy value rather than create it.

So far, this does not appear to be the case with Learning Technologies Group. However, it is worth being aware of the proportion of goodwill to total assets. As a reminder, goodwill represents the premium paid when acquiring another business. In my view, it doesn’t serve as a useful asset regarding the direct creation of value for shareholders. Seeing a large portion of goodwill is a concern.

If this proportion continues to increase beyond 60%, then it suggests one of two things. Either the firm is paying too much, or acquisitions are occurring too frequently, preventing the creation of firm value.

The Covid-19-accelerated global shift to digital learning platforms has expanded the opportunities for companies like Learning Technologies Group. Given its established reputation and diverse portfolio of offerings, I think this tech stock is on course for some explosive returns over the next decade.