The Supply@ME Capital (LSE: SYME) share price has rocketed up this week. Yesterday, it climbed about 40%. The day before, it surged about 75%. Over the last month, it has climbed more than 1,000%.

Naturally, after that kind of share price performance, the stock is getting plenty of attention. Tempted to buy Supply@ME Capital shares? Here are five things you should know.

Supply@ME Capital: business description

Let’s start with a bit of information about the business.

Should you invest £1,000 in Berkshire Hathaway right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Berkshire Hathaway made the list?

Supply@ME Capital is an early-stage financial technology (FinTech) company that offers an innovative platform for inventory monetisation. This platform enables businesses to improve their working capital position (generate cash flow) by releasing capital from their inventory.

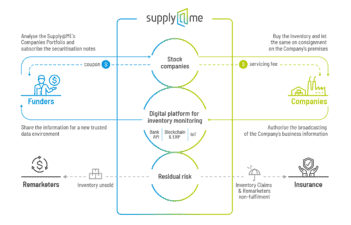

The way the platform works is that it aligns businesses seeking to monetise part of their inventory for cash with Inventory Funders such as banks and financial institutions. These Inventory Funders invest through the platform into portfolios of inventory assets via Securitisation Special Purpose Vehicles. Much like peer-to-peer lending, it’s a win-win for both parties.

Supply@ME Capital generates fee income from the platform.

Source: Supply@ME Capital

Growth potential

Supply@ME Capital certainly looks to have growth potential.

The company explained in its recent full-year results that whereas Just In Time (JIT) inventory strategies were previously the standard for manufacturing and trading businesses, following Covid-19, many businesses are consciously choosing to build up inventory. This can help them avoid supply chain shortages and subsequent loss of trade.

This is a positive development for Supply@ME Capital as businesses will look to monetise the higher volumes of stock being held. The company said in its full-year report that it “anticipates higher levels of demand for its services” as supply chains evolve post-Covid-19.

Meanwhile, the size of the European inventory financing market stands at just under €2trn, according to proactive research. This suggests there could be a huge opportunity here.

Strong progress

Looking at recent updates from Supply@ME Capital, the company appears to be making plenty of progress.

At 30 June, the company had 97 client companies in its portfolio and gross originations of €1.43bn. That’s up from 66 client companies and gross originations of €972m at 31 December 2019.

The company also said in a recent trading update that it is working with a large UK financial institution to launch a UK inventory monetisation pilot programme (up to now it has been focused on Europe).

The CEO just bought stock

It’s worth pointing out that CEO Alessandro Zamboni just purchased shares in Supply@ME Capital. According to regulatory filings, the insider purchased 1.63bn SYME shares through his company Orchestra Group on 17 August at a price of 0.6756p per share.

This is another positive development. I like the fact that management has ‘skin in the game’. All in all, the story looks very interesting, in my view.

Risks

Before you rush out to buy the stock, however, I’ll point out that there are plenty of risks to the investment case here.

It’s worth remembering that this is an early-stage business. It’s not yet profitable. Going forward, Supply@ME Capital’s share price could be highly volatile. This is not a stock for risk-averse investors.

Personally, I’m going to put this stock on my watchlist for now and monitor it from the sidelines. It certainly looks interesting. But it’s a highly speculative play. There are other small caps I like more than Supply@ME Capital right now.