Lloyds (LSE: LLOY) shares have produced disappointing returns for investors so far in 2020. Due to the economic uncertainty associated with Covid-19, Lloyds’ share price has fallen more than 50% year to date.

Can the FTSE 100 stock return to the 60p level it was trading at most of last year? I think it’s certainly possible. That said, there are a few things that need to happen for Lloyds’ share price to rebound.

Lloyds shares: a play on the UK economy

Firstly, the UK economy needs to strengthen. Lloyds shares are essentially a proxy for the UK economy. When it’s firing, the shares tend to do well. When the economy’s struggling, the shares tend to underperform.

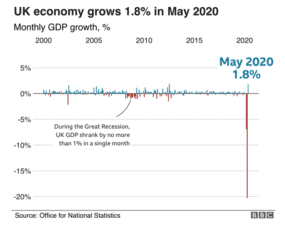

Right now, the UK economy is very much in the doldrums, due to Covid-19. The situation has improved since April – when there was a record 20.4% decline in GDP. However, the figures are still pretty grim. For Lloyds shares to fully recover, we need to see more of a sustained economic recovery. Ultimately, the extent of the recovery is likely to depend on what happens with Covid-19, and whether we see a vaccine in the near future.

Source: BBC

A lifting of the dividend ban

Another thing we need to see for Lloyds’ share price to recover is a lifting of the ban on banks’ dividends. In March, the Bank of England (BoE) banned UK banks from paying out dividends in order to bolster their finances in the wake of Covid-19. This significantly reduced the appeal of owning bank stocks.

If this dividend ban is lifted, sentiment towards the UK banks should improve. This could boost Lloyds’ share price. I’ll point out that the chairman of the Royal Bank of Scotland recently called on the BoE to lift curbs on dividends by autumn in order to make the UK banks attractive to investors again.

Low interest rates: bad news for Lloyds

Ideally, we also need to see interest rates rise. Low interest rates are bad news for banks such as Lloyds. That’s because they earn a chunk of their income from the spread between the interest rates they charge to lend money and the interest rates they offer to borrow money. The higher interest rates are, the larger the spread banks can charge.

With UK interest rates at a record low of just 0.1%, it’s not good for Lloyds. If we were to see UK interest rates rise in the future (which I’m not expecting to happen in the near term, to be honest), Lloyds’ share price could rise.

Digital bank threat

Finally, for the share price to recover, Lloyds needs to ensure it continues to innovate. Right now, traditional banks face a huge threat from digital banks such as Monzo and Revolut and FinTech firms such as Transferwise. These kinds of innovative firms have the potential to disrupt the industry and capture a significant amount of market share.

Will Lloyds’ share price ever go up?

In summary, I think Lloyds’ share price has the potential to go up in the future. However, there are several things that need to occur for this to happen. Realistically, it could be a while before Lloyds shares return to the 60p level.