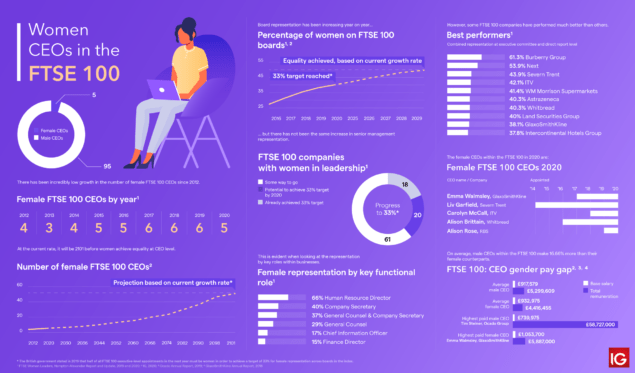

Did you know only five companies in the FTSE 100 are headed by female CEOs? According to data from IG.com, the current growth rate suggests it’s going to take until the year 2101 to achieve a 50/50 balance. And there’s a big pay gap too. The top-paid male boss is Ocado‘s Tim Steiner. He’s on a total package worth around 10 times that of the top female CEO, Emma Walmsley of GlaxoSmithKline.

Gender stereotypes?

Is it down to gender stereotypes? Which image of a boss do you think works best for, say, a top bank? The aggressive gung-ho Fred ‘The Shred’ Goodwin, whose leadership brought Royal Bank of Scotland to its knees? Or Alison Rose, currently guiding that same bank’s successful recovery (albeit with a coronavirus-led share price hit at the moment)?

During the banking crisis, the cartoons I saw depicted fat cat bankers, invariably as men in braces, with fat cigars and wads of cash. Was that unfair? If you want an insight into the macho male image of finance and investment, I recommend a read of Liar’s Poker by Michael Lewis.

Stereotypes are generally unfair. Obviously we want our top companies to be run by the very best people, regardless of gender. For example, I rate Glaxo’s Emma Walmsley and AstraZeneca‘s Pascal Soriot as two of our top CEOs, both running excellent companies with long-term focus.

How would a small portfolio of only those five companies run by female bosses look? GlaxoSmithKline, yes. I’m a long-term bull when it comes to the UK’s top pharmaceuticals firms. And my admiration for the progress made at RBS has led me to rate the bank as a buy for some time. RBS is riskier now. But the shares are cheaper than they’ve been for a long time. And I’m upbeat about the long-term potential.

Female CEOs

Carolyn McCall’s ITV is next. I’ve not been a great fan of the company. But my negativity has been largely tied to its dividend, which I’ve seen as excessive amid a time of earnings pressure. It’s now suspended the 2019 final dividend, and has withdrawn 2020 dividend plans. In the light of that, and the virus crash, I think the shares look oversold.

Whitbread, headed by Alison Brittain, is another whose share price has nosedived during the health crisis. We’re looking at a fall of a shade under 50%. I think Whitbread has a strong enough balance sheet to survive the crisis. But I can’t help thinking the dividend should be withdrawn in the short term.

Finally, one of my favourite cash cows is Severn Trent. Headed by Liv Garfield, Severn Trent has the disadvantage of operating in a regulated business. But against that, it has a very clear view of its long-term income and pays one of the most reliable dividends on the market. Its shares are down 24%, and I think that’s unfair for such a defensive stock.

I rate these companies as well above the median in terms of quality of management. And if you buy all five and hold them for the long term (by which I mean at least five years, preferably 10, or more), I reckon you’d be looking at a well-diversified start to a FTSE 100 retirement portfolio.