Last week’s UK market crash did not happen because investors suddenly became aware of the outbreak of SARS-CoV-2. Individual stocks with significant supply-chain exposure or sales to China had already moved lower.

What sunk the UK market, and markets in continental Europe and the US, was the outbreak gaining a foothold at home. Today, the FTSE 100 is down again.

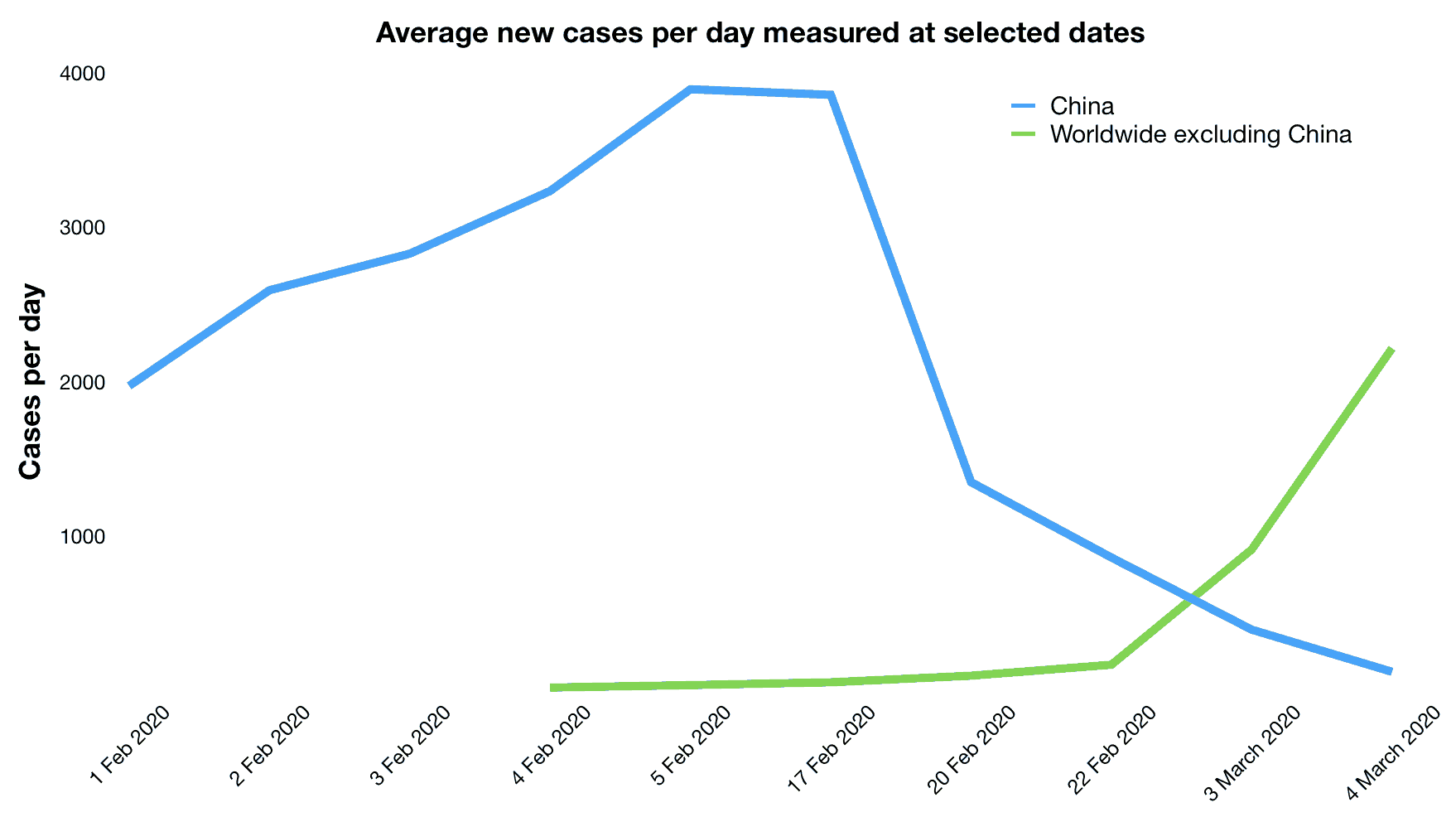

The average daily rate of new cases in China increased until mid-February 2020. Since then it has decreased. It appears that the outbreak has peaked in China but at a cost. The workshop of the world shut for about a month.

Outside China, the rate at which new cases are identified is increasing, and the pandemic has not yet peaked. It will peak, almost certainly, when summer rolls around. It may peak sooner, but until it does, volatility will plague the markets. There will be more days like today, and more weeks like last week.

Consumer choice

Flybe collapsed this week. Although the coronavirus outbreak was not the root cause, as the airline had been struggling for years, it played a role. Fewer people are booking flights out of fear of being in an enclosed space with others, cancellations, and potentially undesirable destinations.

Consumers drive the economy. When they change their behaviour, it affects the economy. When they are less economically active, which will be the case during a viral outbreak, companies sell fewer products and services. Those companies earnings will fall, and since stock market valuations are properly based on expectations of future earnings, stock prices decline.

I think stocks will fall further before the viral outbreak is contained. The longer it takes, the more damage will be done and the greater the price declines.

Protective measures

Estimates for how many people will be infected or when things will get back to normal are incredibly varied. Regular investments should continue through these tough times. Some will advocate delaying investing until the markets recover, but since nobody knows when that will be, it is not sound advice.

There is no good evidence for the success of trying to time the market compared to investing on a regular basis, especially when dividends are involved. That is, of course, only true if the long-term prospects of the investment are positive.

The FTSE 100 or 250 market indices are safe bets for long-term investment. Some companies may fail and fall out of an index but will be replaced by others that are on the rise.

Some individual stocks may therefore not be suitable long-term investments. Sifting the good from the bad requires research, conducted either by the investor or others. Multiple opinions are better. Challenges to an investment thesis can reveal its weaknesses and strengths.

Opportunity knocks

Timing the market – trying to guess when it is going up or down – is not the same thing as identifying a market opportunity. Some stocks are currently trading at discounts to their intrinsic values at the moment. If the discount is suitably large, why not make the purchase now?

Some dividend-paying stocks my be offering higher than average yields because they are priced more cheaply now. If the dividend is secure, and the yield is where an investor wants it, then they should probably buy.

Bear markets are a feature of investing. They come and go, but the principles of investing do not change.