The FTSE 100 index has fallen around 11% this week, slipping well below 7,000 for the first time since December 2018. The cause is the coronavirus. At this stage, nobody can be sure when the outbreak will end, or its human and economic costs.

Since it is tough to predict when the FTSE 100 will stop falling, I will not be trying to buy the bottom. But I will be looking for buying opportunities. That may sound like a contradiction, but let me explain.

The prices of individual shares are being dragged down by the decline in the overall market. For those stocks that pay dividends, the trailing 12-month dividend yield increases as the share price get cheaper. Dividing the dividends per share by the price of a share gives the dividend yield. So you can see the yield increases if the share price drops or the dividend increases, and vice versa.

Should you invest £1,000 in Lloyds Banking Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Lloyds Banking Group made the list?

So I looked for companies that can maintain their dividend, at the very least, because as share prices fall the yield increases. I looked for companies that have debt-to-equity of less than 50%, interest coverage of 5 times or more, a current ratio of greater than 2, and trailing 12-month dividend cover of 2 or more. Companies with a track record of paying dividends through recessions in industries that are more resilient to slowdowns are preferred.

I ended up with one pick that I believe has the best prospect for at least maintaining its dividend, but there are others out there.

Drumroll, please

Halma (LSE: HLMA), describes itself as a life-saving technology company. Its markets are for fire detection and suppression, water treatment and analysis, gas detection, safe storage and transfer, and surgical instruments, among others.

Based on the 2019 fiscal year report it covered its dividends three times with earnings, and its interest expense was covered by operating profits 21 times over. Debt at Halma stands ar around 27% of equity, suggesting good solvency, and the current ratio has consistently been over two, indicating good liquidity.

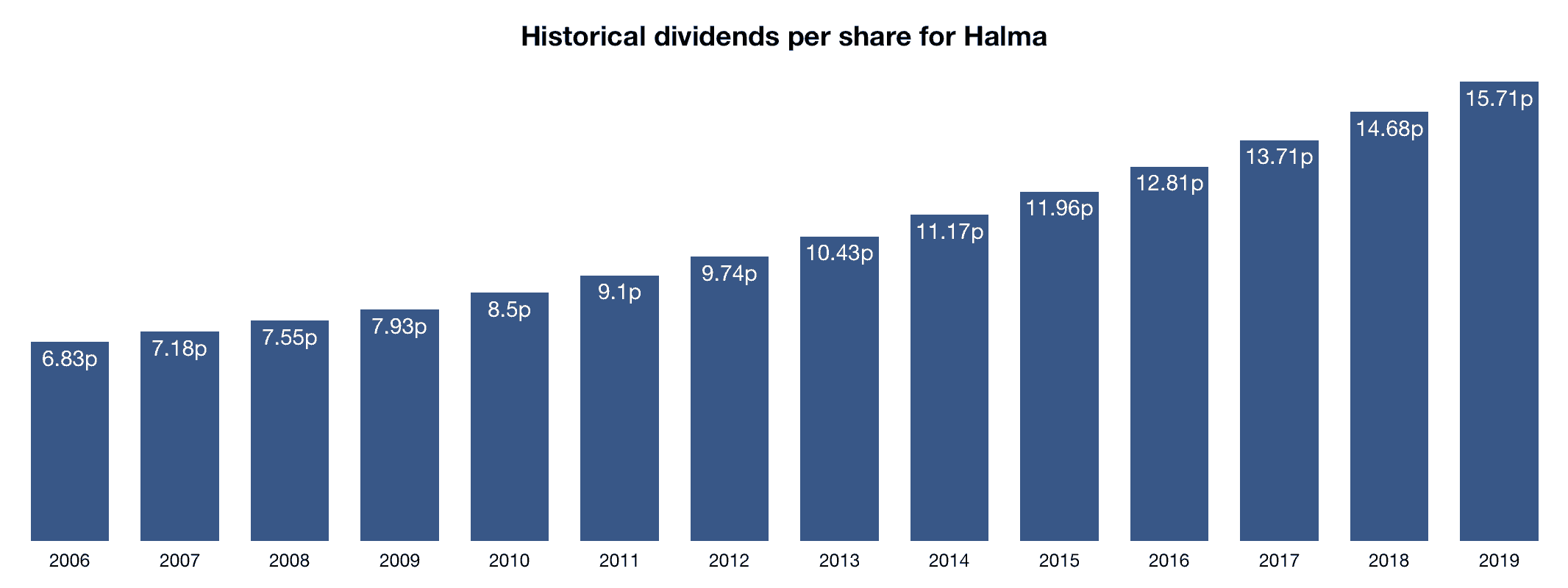

A track history of paying increasing or stable dividends through tough times was also important, and Halma has one.

Even through the financial crisis, Halma increased its dividend.

Is there an opportunity?

The average yield on the FTSE 100 has been around 3.5% over the last 25 years. Halma’s trailing 12-month yield is below average right now at 0.8%, based on a share price of 1,929p. But it is better than the yield of 0.7% priced at the February 2019 all-time high of 2,244p. The price would have to fall to 1,571p for a yield of 1%, and to 785p for 2%.

I did take a look at Halma last month. I thought it was an excellent company then and I still do now. This is not just an income stock. Revenues and profit growth are still ticking along nicely, as Halma expands through organic growth and acquisitions. So the expectation is that Halma’s share price should outperform the market once this sell-off ends.

In the meantime, a dividend yield of 0.8% will provide cash that can be reinvested. Given that Halma has increased its dividend by 6.6% per year on average after holding the stock for 10 years, the dividend yield could be 1.5% and 3.5% after 25 years.

Taking the opportunity to buy now, while Halma’s shares are getting cheaper, could pay off handsomely in the long term.