Exchange-traded funds (ETFs) can be a great way to invest in the stock market. Not only can they provide you with exposure to a whole range of companies through just one trade, but they can also be extremely cost-effective as they tend to be much cheaper than actively-managed funds.

With that in mind, I want to highlight one of my favourite ETFs right now. If I could only buy one in 2020, this would be it.

A focus on quality

The iShares Edge MSCI World Quality Factor UCITS ETF is a global equity ETF that provides exposure to 300 companies within the MSCI World index. It’s listed on the London Stock Exchange under tickers IWQU (USD) and IWFQ (GBP) meaning you can invest in it easily through online brokers such as Hargreaves Lansdown. Its ongoing charge is 0.30% per year.

What I like about this particular ETF is instead of just tracking an index such as the FTSE 100 or the MSCI World, it provides exposure to a portfolio of ‘high-quality’ companies. It does this by selecting companies that:

-

Demonstrate strong and stable earnings

-

Have low debt levels

-

Allocate a high percentage of company earnings to shareholders

So what you’re ultimately getting is exposure to a diverse selection of leading companies with strong balance sheets, are able to generate relatively consistent earnings, and treat shareholders well.

World-class companies

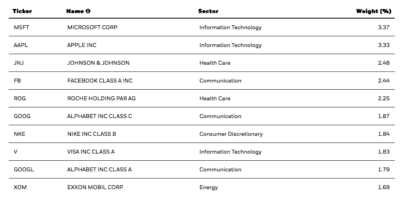

Looking at the full list of holdings (which can be found on the iShares website), there are some fantastic businesses in the portfolio. Not only does the ETF have exposure to some of the most attractive companies in the FTSE 100, such as Unilever, Diageo, and AstraZeneca, but it also has exposure to the likes of Apple, Nike, and Visa, which are all listed in the US, and Roche and Adidas, which are listed in Europe. It’s an excellent mix of companies, in my view.

Top 10 Holdings

Source: iShares. Data as of 17/02/20.

Good performance

The performance of the iShares Edge MSCI World Quality Factor UCITS ETF since its inception in 2014 has been very good. For example, for the five years to 31 January, it returned 9.96% per year (in USD terms). By contrast, the FTSE 100 returned 5.8% year.

It’s worth noting it did underperform the S&P 500 over the five years to 31 January (which returned 12.37%), but that’s mainly because it has more balanced sector exposure compared to the S&P (i.e. slightly less exposure to technology), which is a good thing from a risk-management perspective.

Downside protection

I’ll point out that I’d expect this ETF to potentially outperform in a bear market, due to the fact the companies in the portfolio have been selected for their robust balance sheets. These kinds of companies tend to hold up a little better when markets are falling.

Overall, there’s a lot I like about this iShares ETF. I see it as a cost-effective way to get exposure to a portfolio of world-class companies that have strong and stable earnings.