If you’re interested in stock market investing, I would highly recommend reading Fundsmith’s Annual Letter to Shareholders 2019. Not only is it an enjoyable, jargon-free read, but it also contains a number of top investment tips from portfolio manager Terry Smith that could help you become a better investor. Here’s a look at some key takeaways from this year’s letter.

Investing doesn’t need to be complicated

The first great tip from the 2019 annual letter is that investing doesn’t need to be complicated. Since its inception in 2011, Fundsmith has delivered amazing returns for investors (25.6% last year) and has been the number one performer in the Investment Association’s Global sector by a wide margin. It’s achieved this with a very simple three-step investment strategy:

-

Buy good companies

-

Don’t overpay

-

Do nothing

It goes to show that a simple strategy can generate fantastic results.

Highly profitable companies tend to do well

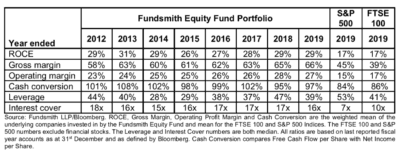

The next takeaway is that a focus on highly profitable companies can generate strong returns over the long run. Take a look at the table below. You’ll see that Fundsmith companies generally have a much higher return on capital employed (ROCE) than the market average.

Source: Fundsmith

Smith believes that in the long run, portfolio returns tend to be similar to the investment returns (the ROCE) generated by the companies themselves.

Value investing has flaws

Smith believes value investing has major flaws. He says that many cheap stocks are cheap for a reason – ”they are not good businesses.”

He also points out that if the value investor does get it right, they then need to sell the stock, incur a transaction fee, find another undervalued stock, and start all over again. In other words, value investing is not a buy-and-hold strategy.

To sum up his views on value investing, he quotes Warren Buffett: “It’s far better to buy a wonderful company at a fair price, than a fair company at a wonderful price.”

Don’t be concerned about star managers

The topic of avoiding ‘star’ portfolio managers also comes up in the letter.

Here, Smith believes investors are focusing on the wrong issue and says that “it makes no more sense to avoid funds run by star fund managers any more than it does to avoid supporting sporting teams because they have star players.”

In his view, the problem is not star managers, but instead, when star managers change their strategy. As an analogy, he points out that if Cristiano Ronaldo played as goalkeeper, Juventus would probably not perform as well.

Be careful of hidden costs

Finally, Smith points out that it’s important to be aware of hidden costs when investing in funds. He believes that too many investors focus on the Annual Management Charge (AMC) or the Ongoing Charges Figure (OCF) of funds, which don’t include transaction costs.

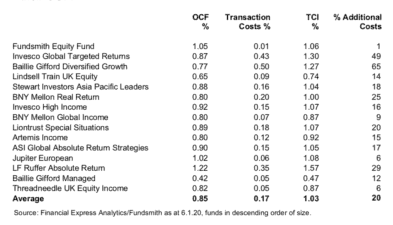

The table below shows the total costs for the 15 largest equity and total return funds in the UK:

Source: Fundsmith

As you can see, transaction costs can increase total fees substantially.

However, Smith says investors shouldn’t “obsess” over fees to the extent that they lose focus on performance. I think this is a great point. These days, it seems everyone is turning to index investments because they’re cheaper. Fundsmith is more expensive than your average market-tracking index fund, but its long-term returns have been far higher.