If you’re one of those looking to play the rental property market then a recent report on the most-lucrative regions to invest in from Zoopla makes for essential reading.

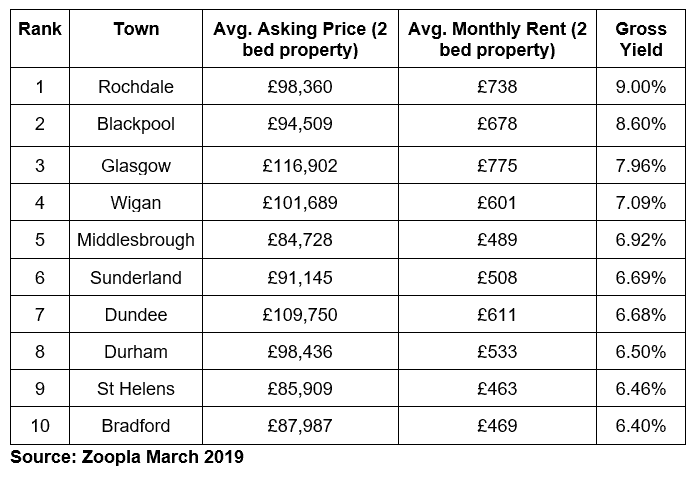

According to the online property listings portal, Northern England and Scotland are the places to buy property if you’re looking to turbocharge your investment returns. At the top of the list comes Rochdale in Greater Manchester, where an average two-bedroom home price sits a shade under £100,000 and boasts an average monthly rent of £738. This translates into a chubby gross annual yield of 9%

The North West region is featured next on the list too, thanks to popular seaside resort of Blackpool which provides an 8.6% gross yield. And the Scottish city of Glasgow rounds out the top three with a gross yield of just below 8%.

Bringing up the rear of Zoopla’s Top 10 most lucrative buy-to-let destinations is Bradford, but even here investors can dial into a giant 6.4%.

The suffering South

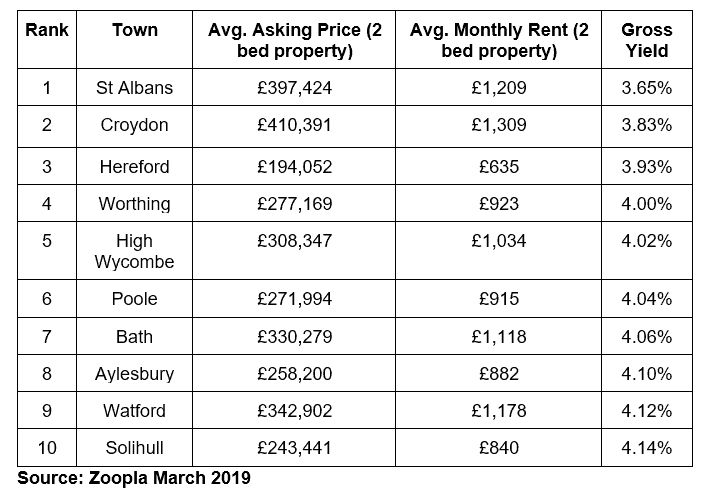

Returns in the South of England are much less electrifying, however. As Zoopla comments: “House price growth has slowed, but property is still considerably more expensive in these locations, meaning that even with higher rents, the returns are more limited for landlords.”

Earning the unwanted title of least lucrative buy-to-let destination is St Albans. With the average two-bedroom house price of just below £400,000 and an average rent of £1,209 the gross annual yield sits at around 3.7%.

According to Zoopla, the South West of England and London are the worst places to buy purely in terms of gross yearly yield, these regions yielding just 4.2%.

Low-paying London

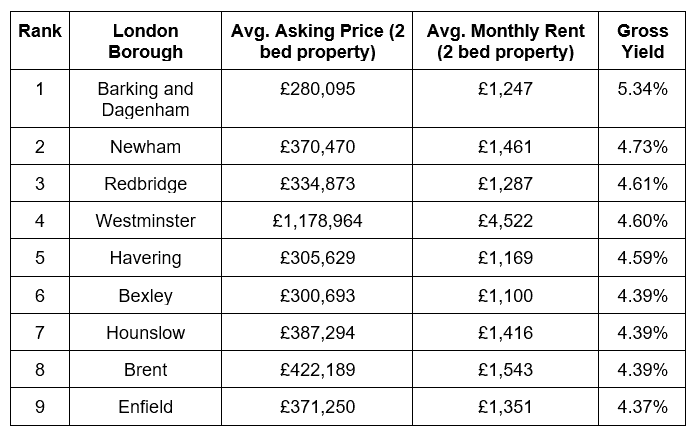

Despite these numbers, recent industry data from Experience Invest showed that property demand in London could well be picking up. For this reason it’s a good idea to look at how annual returns in the capital currently compare.

Top of the best-performing boroughs was Dagenham and Redbridge, where an average asking price of around £280,000 and a monthly rent of £1,247 combine to produce a gross yield of 5.3%.

This clearly sits some way below the gross annual yield of 9% up in Rochdale but things could be worse — the worst-paying borough of Hackney produces returns of just 3.3%.

What should you do?

In terms of pure gross yield, the buy-to-let market still clearly offers plenty of opportunity to make big returns, and particularly so if you take the plunge in the northern fringes of Britain.

But in the real world, things really aren’t as brilliant as they seem. I don’t want to be a party pooper, but by the time you factor in reduced tax relief, increased costs and ribbons of red tape, suddenly participation in the lettings market is neither as profitable nor as straightforward as it once was. And conditions are likely to get even tougher as measures to soothe the country’s homes shortage intensify. My tip: give buy-to-let a miss and find other ways to make your cash work for you.