2019 is shaping up to be the most turbulent and troublesome for share investors, right? Not if you’re a dividend investor.

Given the current geopolitical and macroeconomic environment, I’m not suggesting that market makers don’t need to be on their toes right now. What I am saying, though, is that there remains a galaxy of great stocks out there that are still in great shape to deliver stunning shareholder returns, even in this most trying of times for the global economy.

Blasting through £100bn?

I’ve spoken before about the bullish outlook for dividend investors in particular this year, and latest research from Link Asset Services underlined the possibility for huge gains from UK-listed stocks.

Should you invest £1,000 in Barclays right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Barclays made the list?

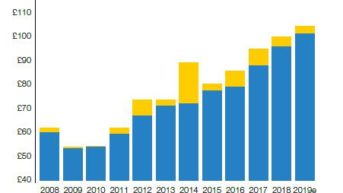

The financial services specialist’s chief executive Justin Cooper said that he expected 2019 “to break new dividend records,” beating the all-time high of £99.8bn shelled out by companies last year (up 5.1% year-on-year).

This year, total dividends are predicted to rise 4.2% — including the payment of special dividends — on an annualised basis to hit £104.1bn. Without these supplementary dividends, a total of £101.1bn is predicted, up from £95.9bn in 2018.

Last year’s rise to record highs was thanks to a combination of higher profits, the struggling pound, and the payment of special dividends, Link Asset Services said.

Of the biggest contributors to last year’s dividend jump, FTSE 100 stalwart British American Tobacco sits at the top of the tree, having shelled out a total of £900m. The mining sector was a big driver of last year’s increase, too, dividends here jumping 66% from 2017 levels.

Stick with stocks

During the next year, UK shares will yield a collective 4.8%, Link Asset Services commented. It added that the FTSE 100 yields 5%, while the country’s mid-caps yield 3.3%.

Its forecasts underlined why we here at The Motley Fool believe that stock investing is the best way for savers to put their money to work. Cash savings return just 1.5%, the company commented, property some 2.8%, and the 10-year gilt has also dropped back recently — to 1.24% in the fourth quarter — because of concerns over the state of the global economy.

The risks are rising

A word of warning from Justin Cooper, though: while dividends are expected to strike fresh summits in 2019, he asserted that Link Service Assets’s forecasts “are not especially bullish,” citing more specifically that “one or two companies face difficulties and the easy wins from the mining sector are behind us.”

And things could go from bad to worse over the longer term, the business commenting that “if the world does sink into a recession in the next couple of years, or Brexit goes badly, the drop in dividends is likely to be in the 10-15% range.”

As I said at the top of the piece, though, right now remains an historical opportunity to make a mint from stock markets. With a sound investment strategy and some decent research, there’s no reason why 2019 can’t be the year that you create game-changing income flows from UK shares. Indeed, there’s no shortage of guidance out there to help you to hit your investment goals in the near-term and beyond.