When it comes to shares, I’ve long been a fan of income investing.

Hold a clutch of higher-yielding dividend-paying shares; bank the dividends; buy more higher-yielding dividend-paying shares — and then rinse and repeat.

And I’m not alone of course.

Neil Woodford, and his successor at Invesco Perpetual, Mark Barnett, pursue just such a strategy. As do a number of other successful investment managers, among them Job Curtis at City of London Investment Trust (LSE: CTY), where dividends have risen without interruption for over 50 years.

Attractive logic

There are several reasons why I like such a strategy.

First, I’m drawn to the ‘bird in the hand’ argument. Growth shares are all very well, but if something happens to derail that growth, a share price can quickly head back to where it was when you bought it — leaving you with little or nothing to show for having invested your capital.

Not so with regular – and generous – dividends, of course. Moreover, dividend stalwarts such as Shell (LSE: RDSB), GlaxoSmithKline (LSE: GSK), and HSBC (LSE: HSBA) pay out every quarter, rather than twice-yearly.

Second, I like the capital allocation opportunity offered by income investing. Buy a growth share — or, for that matter, an investment fund denominated in ‘accumulation’ units, rather than ‘income’ or ‘distribution’ units — and your profits are continually being rolled-up into more of what you already hold: the share price (hopefully) just keeps going up.

Reinvesting dividends, on the other hand, offers the option of buying different shares, allocating capital to other investments, to take advantage of new opportunities that might present themselves.

And third, income investors have it easy when it comes to retiring. Instead of agonising over what to buy, they simply spend their existing dividend stream, rather than reinvesting it.

Dividend diversification

That said, equity income investing isn’t a universally popular strategy.

Some growth investors, for instance, carp that higher-yielding dividend-paying shares are dull plodders, rather than high-revving profit engines set to race ahead.

And other growth investors, meanwhile, point out that higher-yielding shares are often higher-yielding for good reason — they’re ex-growth, or their share prices have been marked down over concerns about dividend growth or even dividend sustainability.

Both objections can be valid points. Companies the size of Shell, GlaxoSmithKline, and HSBC certainly aren’t going to double in size overnight. And without doubt, a higher yield sometimes presages a dividend cut.

The trick, as in a lot of investing, is to take a balanced view, and spread your capital across a decent-sized and well-diversified portfolio. Risk can’t be totally eliminated — but it can be substantially reduced.

Track record

For those investors contemplating a switch to equity income investing, an analysis put out by The Share Centre recently makes for an interesting perspective on the approach.

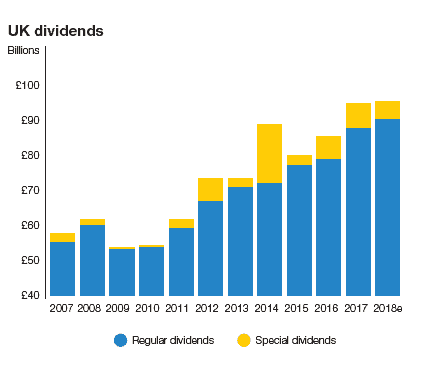

Here’s how the gross dividends paid by UK companies have grown over the past ten years, for instance:

Source: Link Asset Services UK Dividend Monitor

That’s right: total dividend payouts have grown from £57 billion — that’s right, billion — in 2007, to £94 billion in 2017. And that’s a period that includes the biggest recession since the 1930s, and a long period of sub-par economic growth since.

I don’t know about you, but for me, that’s a track record that speaks volumes about dividend growth and dividend sustainability.

Dividend cover doubles

There’s more. Looking forward, say The Share Centre analysts, dividend cover — a measure of how sustainable dividends are — has more than doubled in the past year, rocketing from 0.8 to 1.8 as company profits have climbed sharply.

In fact, in only two out of 19 industry sectors did dividend cover fall — property, and utilities. In every other sector, dividend cover rose.

Again, that provides a sense of reassurance. The future is uncertain, as we all know. But in thoery, company profits could halve and companies could still pay out last year’s level of dividends.

Income investing might not be for everyone, granted. But it’s done the business for me for many years, and I see no sign of that changing.

Put another way, that chart of robustly rising dividend payments shows little sign of coming to an end just yet.