Zoom (NASDAQ:ZM) shares are up about 300% since the company’s IPO. It might be tempting for some UK investors to buy this stock when some people are still working from home. But is it too late to load up on these shares?

Zoom shares surge

On 18 April 2019, Zoom Video Communications enjoyed a terrific IPO start. Many investors or, better said, speculators rushed to buy the company’s shares.

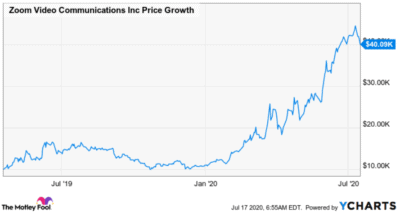

I wouldn’t say Zoom shares fell dramatically after the IPO rally. But at the end of 2019 all the previous gains were erased. Then, after the beginning of the lockdown period in March the shares began rising at a really fast rate. As can be seen from the graph, if you had invested $10,000 in Zoom, your stake would be worth about $40,000 today. From a technical perspective it seems they are due for a correction.

How about the company’s fundamentals? To start with, I quite agree that distance working will probably continue for a while. Some companies will likely allow their employees to work from home even after the end of the pandemic. It’s quite practical for many employers since they don’t have to pay rent and many other relevant expenses. So, companies like Zoom should grow well. And so should Zoom shares.

I also agree with my colleague Michael Baxter that investing in high-tech shares might be some sort of a hedge against low GDP growth. In fact, in the past few years, well-established ‘cyclical’ companies like banks and miners didn’t do particularly well in terms of earnings. This is because the real global economy started slowing down long before the pandemic. But high-tech excelled.

But is Zoom a reasonable company to invest in?

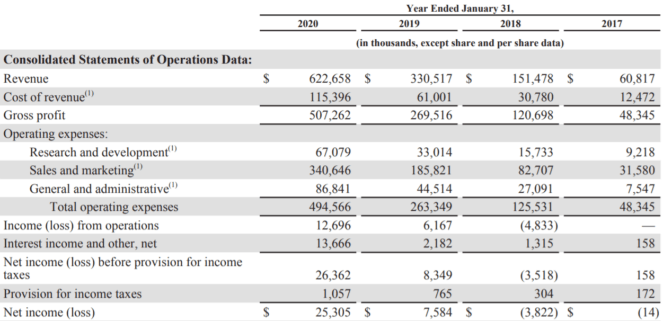

Here are the company’s revenues and earnings over a four-year period.

Source: Zoom Video Communications

Looks like impressive revenue growth, doesn’t it? In 2019, Zoom managed to make a small profit of $7.58m. In 2020, Zoom’s net profit totaled $25.3m. All very well. But how about the valuations? The earnings-per-share (EPS) for 2020 was $0.09, whereas the stock price now is about $268. This brings us to the price-to-earnings (P/E) ratio of 2,977. Remember that a P/E of 20 is average, if not high. I appreciate that earnings might increase dramatically by 2021. But the thing is that you’d pay a high price today, if you decide to invest now.

And how about the competitive landscape? Well, the high demand for video conferencing is matched by many suppliers. Plenty of firms offer a wide variety of very similar services. Think about Microsoft Teams, Skype, Cisco Webex Teams, Adobe Connect, Blue Jeans by Verizon and many other alternatives.

It’s not obvious that Zoom can easily compete with all these companies, and Zoom shares are trading at a really high premium to many other high-tech firms. For example, Microsoft’s shares are trading at a P/E ratio of about 30. Don’t forget that Miscrosoft is a very well-established corporation with a high credit rating.

A perfect buy for Brits?

I understand how tempting it might be for Brits and investors from other countries to buy high-tech stocks. The US offers plenty of opportunities to do so. What is more, investing in overseas companies might be good in terms of diversification. But Zoom shares aren’t, in my opinion, a great fit for a value investor.