The concept of the invisible hand is one of the many contributions of the legendary Scottish philosopher and economist Adam Smith. In his book The Wealth of Nations, Smith wrote of a person who “intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention.” Smith argued that the common good is better served by allowing individuals to pursue their self-interest than by conscious design.

Smith’s insight must be examined in the context of the ideas of the 18th- and 19th-century Scottish Enlightenment. Smith’s contemporary, Adam Ferguson, believed that social structures were “the result of human action, but not the execution of any human design.” Similarly, the great philosopher David Hume wrote that “moral distinctions, therefore, are not the offspring of reason.” These arguments are often used to argue against a rationalist collectivist organisation of society and economies in favour of allowing the “invisible hand” of self-interest to prevail.

The invisible hand wins but is not without criticism

Indeed, the failure of a multidecade communist experiment in the former Soviet Union is a testimony to the strength of the argument, as are the differences between North Korea and South Korea. Meanwhile, since Hong Kong was peacefully transferred to China in 1997, China has become more like Hong Kong than Hong Kong has become like China, at least in economic matters.

The argument in favour of an invisible hand is not without its critics, and they even include Fyodor Dostoyevsky — an indication of just how influential the concept has been. In Crime and Punishment, Luzhin, the objectionable suitor to the sister of the main character, Raskolnikov, argues, “Science now tells us, love yourself before all men, for everything in the world rests on self-interest. You love yourself and manage your own affairs properly, and your coat remains whole.” Raskolnikov responds by noting, “Why, carry out logically the theory you were advocating just now, and it follows that people may be killed.”

Dostoyevsky’s criticism is valid, but thankfully, no one, other than the most extreme anarcho-capitalists, and certainly not Smith himself, has argued for unfettered self-interest. Instead, the invisible hand works best within a climate of a generally agreed common purpose.

The power of the invisible hand is best seen in the transition from previously collectivist economies toward more free enterprise and free trade. The encroachment of collectivist thinking and design on previous areas of free trade can be a negative.

What does it mean for investors?

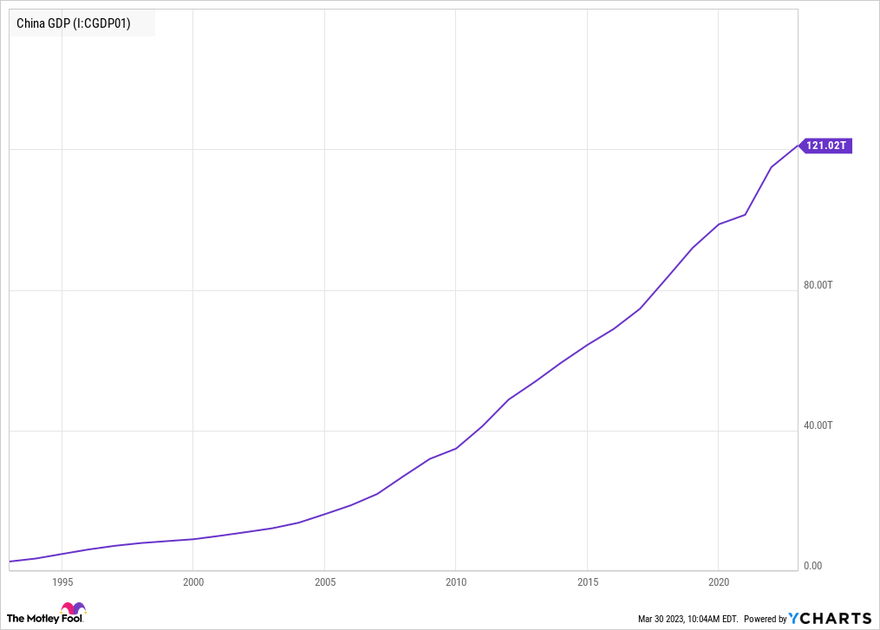

As noted above, unleashing the power of the invisible hand can bring significant benefits to an economy — something seen in the remarkable growth in China’s gross domestic product (GDP) over the last few decades.

Source: The Motley Fool Y Charts.

This chart indicates how investors can prosper with a basic understanding of the power of free trade. One area that investors might consider is mining commodities, with copper being a good example. China is responsible for about 55% of global demand. With its economy continuing to grow, it’s likely to continue to increase its demand for industrial metals like copper.

On the other side of the equation, it’s becoming increasingly hard to obtain mining permits due to regulation, environmentalist actions, and political obstacles. Because of this, collectivist action is limiting supply growth by the very “reason” and “design” that Hume and Ferguson alluded to. This is not the place to discuss the rights and wrongs of such developments, merely to note that the invisible hand of self-interest is not being allowed to work as it might in terms of supply while demand continues to grow.

Therefore, there’s reason to believe the prices of copper and other mining commodities could increase over the long term.