Despite a steady flow of good news stories, the Helium One Global (LSE:HE1) share price has been largely unmoved in recent months. It’s as though investors are waiting for something big to happen.

Although production at the Galactica-Pegasus project in Colorado — in which it has a 50% interest — is due to commence in the fourth quarter, it’s a relatively small discovery.

It’s the group’s mine in Tanzania that really counts. The legal paperwork, including confirmation of the government’s 17% minority stake, is expected to be signed shortly.

Then the hard work – including raising the estimated $75m-$100m needed to commercialise production – will start.

But I want to know what the helium’s worth. Only when this question’s been answered is it possible to understand how the company should be valued.

So here goes…

Reserves

Mining’s a complicated business. And a report from an international reserves auditor — looking at the potential of the Rukwa mine — confirms this.

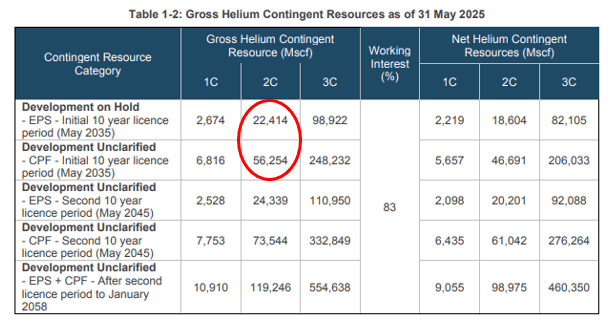

Amid the plethora of numbers, the one I’m focusing on is the estimated contingent resource. This is defined as gas that’s “potentially recoverable from known accumulations… not yet considered mature enough for commercial development due to one or more contingencies”.

In the case of Helium One, I think it’s fair to say that one such uncertainty is the fact that the helium isn’t conventional dry gas. Instead, it’s found in water aquifers. The group’s boss says this is a “unique play”, which casts some doubt on its recoverability.

I’m going to use what’s described as the “best” or “most realistic” estimate of helium reserves. To meet this definition, there has to be at least a 50% chance this amount will be exceeded.

Finally, I’m only considering the helium that’s likely to be extracted during the initial 10-year licence period. After all, there’s no guarantee that the present arrangement will be extended.

Based on these assumptions, it’s estimated there’s 78,668 Mscf (thousand standard cubic feet) of gas potentially available.

Price

To work out what this could be worth, we need to value helium. Presently, market conditions are favourable to sellers. The unique properties of the gas, especially when it comes to cooling, make it particularly useful in the medical industry.

Demand’s currently outstripping supply. And it cannot be manufactured. Therefore, prices should remain high.

But one of the curiosities of the helium market is that there’s no spot price. Instead, contracts are negotiated individually. I’ve seen price estimates of $200-$2,500/Mscf.

Let’s assume $1,000/Mscf is typical. On this basis, the gas is worth $78.7m. Remember, this is the retail value. It doesn’t take into account the cost of production nor the government’s share.

Maybe this explains the group’s lacklustre share price.

But…

However, I think it could take off if investors were given compelling evidence that more gas could be extracted.

In a best-case scenario, the prospective resource — defined as “potentially recoverable from undiscovered accumulations by application of future development projects” — could be as high as 3,227,556 Mscf. This includes helium outside the licence area.

This would have a retail value over $3.2bn, dwarfing Helium One’s market-cap of £58m. And it could be higher if my price assumption is too low.

But given all this uncertainty, making an investment would be too risky for me.