Nvidia (NASDAQ: NVDA) stock has lost a bit of its shine in recent months. Since peaking at $149 in early January, it has dropped 33% to just under $100 (as I type).

That said, the Nvidia share price is set to open around 5% higher today (23 April). The reason? Soothing words around China tariffs from President Trump, who has also distanced himself from the notion of removing the US Federal Reserve chair. The whole US stock market is ready to jump higher today.

Unfortunately, a de-escalation in the US-China trade war is unlikely to lead to Nvidia being allowed to export its dumbed-down H20 AI accelerators to China. The two superpowers are still locked in a battle for global supremacy, with AI technology at the forefront of that.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

On 15 April, Nvidia announced that it expects to take a charge of up to $5.5bn in this quarter due to export restrictions. In light of this, I think it’s worth taking a look at the latest Nvidia growth and share price targets.

Growth forecasts

Let’s start with Q1 this year, which is due to be reported towards the end of May. Right now, analysts expect the semiconductor colossus to generate earnings per share (EPS) of $0.89. That’s down slightly from recent forecasts.

Having said that, this figure would still be 46% higher than the EPS of $0.61 achieved in Q1 last year.

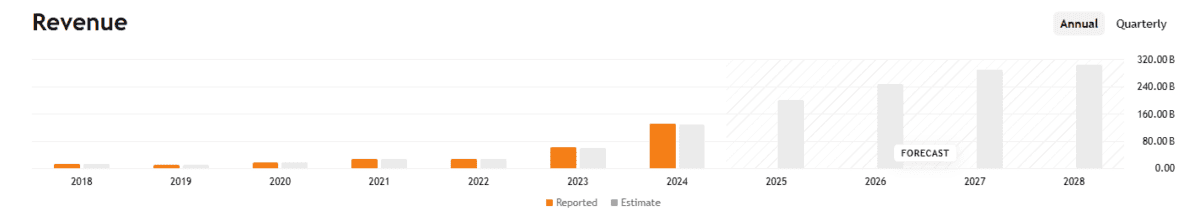

In terms of revenue, Nvidia is forecast to post $43.1bn (65% year-on-year growth). For context, that would be roughly 51% more than the firm’s entire 2023 financial year (spanning most of 2022, before ChatGPT was released).

In other words, Nvidia is now making significantly more per quarter than it was making per year just a couple of years back!

Turning to the full year, analysts currently see revenue surging 54% to $201bn, with EPS of $4.43 (48% growth). Then revenue is forecast to jump above $300bn by FY29. Hardly pedestrian!

Share price target

Remember that these figures are forecast even when AI-related sales to China are progressively being choked off. The mind boggles to think how fast Nvidia would be growing if it was free to sell its most powerful AI chips to Alibaba, Tencent, Baidu, ByteDance, and the rest.

In this scenario, you would have to assume high double-digit growth for years on end, probably putting the firm’s market cap significantly higher than its current $2.4trn.

Alas for shareholders, the Chinese AI sector is now turning to Huawei as Nvidia exits the AI market altogether. This issue, combined with tariffs and the risk that US tech giants could lower their AI-related spending, has hurt sentiment for Nvidia shares.

In response, many analyst teams have recently been lowering their price targets. Bank of America Securities, for example, has reduced its target from $200 to $160.

The current consensus among Wall Street analysts is $164 — roughly 66% higher than the current level.

Based on this year’s EPS estimate, the stock’s forward-looking price-to-earnings (P/E) ratio is just 23. This is forecast to fall to a little under 18 by next year.

Nvidia doesn’t come without risk, including rising competition and supply chain uncertainties related to the brewing trade war. But at its current valuation, I think it’s worth considering for long-term investors.