Thanks to a more recent price jump, someone who bought NatWest (LSE:NWG) shares 10 years ago would now finally be sitting on some capital gains.

A strong rise over the past 12 months means the shares now trade at 458.7p, up from 310.5p a decade ago. This means someone who invested £10,000 in the FTSE 100 bank in late April 2015 would have seen the value of their investment grow to £14,770.

The returns are even better when factoring in dividends. With cash rewards totalling 93.8p per share in that time, the high street bank would have delivered a total return of £17,790, or 77.9%.

Should you invest £1,000 in NatWest Group right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if NatWest Group made the list?

FTSE 100 returns

On the face of it, that may not be considered a bad return given the challenges NatWest’s faced in that time. A period of political turbulence that dented investor demand for UK assets, prolonged economic weakness caused by Brexit, the pandemic and interest rate hikes, and a housing market downturn have all taken their toll on the bank’s performance.

However, these challenges have been shared by a vast number of other FTSE 100 stocks. Yet the shares have delivered a lower average total return of 5.9% a year since April 2015, below the 6.4% that the Footsie’s provided.

Can things pick up going forwards? And should I consider buying NatWest shares for my portfolio?

More price gains?

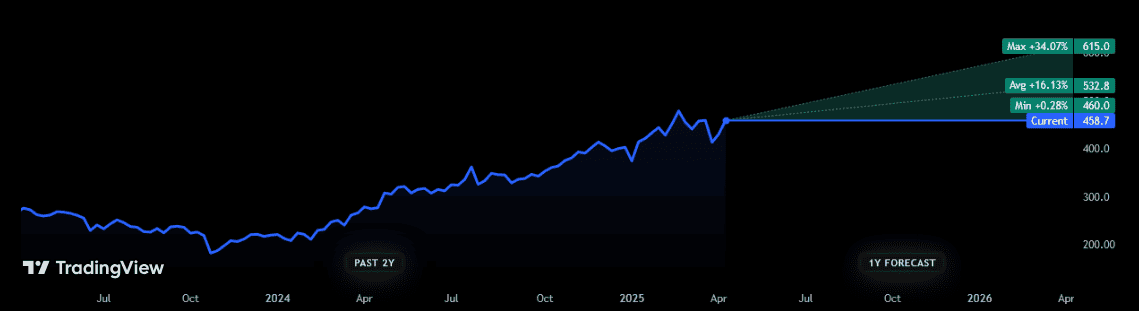

The bad news is that forecasts for NatWest’s share price aren’t available for the next 10 years. But estimates are available for the next year, providing a valuable indicator for the bank’s possible direction of travel.

Encouragingly, each of the 17 analysts with ratings on the bank expect it to gain value during the next 12 months. The average price target among this grouping is 523.8p, around 16.1% higher from current levels.

Banks like NatWest faces a number of significant challenges over the next year. So if it’s trading at a relatively high valuation, the potential for such price gains could be extremely limited.

At 487.5p, NatWest shares trade on a forward price-to-earnings (P/E) ratio of 7.9 times, which is far below the five-year average of 10-11 times. This on paper bodes well.

Should I buy?

However, in reality, I’m not convinced. It’s my opinion that the cheapness of NatWest’s shares fairly reflect the bank’s price prospects going forwards.

The bank’s soared more recently on hopes of Bank of England rate cuts that could boost the UK economy. The trouble is that interest rate reductions could carry a net negative for retail banks by pulling down their already weak margins.

NatWest’s own net interest margin (NIM) was a stick-thin 2.13% in 2024. If this falls further, it’s tough to envision how the bank may generate strong profits, even if the British economy gains momentum.

Other threats include rising competition — and particularly from challenger banks — putting margins under further pressure and sapping revenues. This danger’s especially severe in the key mortgage market.

On the plus side, NatWest’s strong balance sheet underpins expectations of more market-beating dividends for investors. Its CET1 capital ratio was 13.6% at the end of 2024, within target rage of 13-14%.

But on balance, I think I could target better overall returns by buying other FTSE 100 shares today. I don’t imagine buying NatWest shares any time soon.