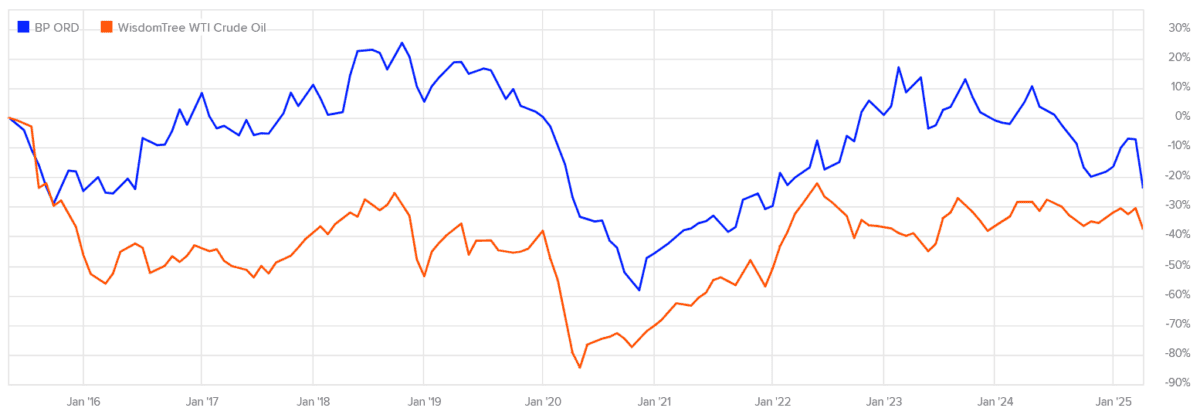

A fall in oil prices over the last decade has prompted a corresponding fall in BP (LSE:BP.) shares over the period. At 359.4p per share, the FTSE 100 oil major is now 23.6% cheaper than 10 years ago when it was trading at 470.1p. This means that someone who invested £10,000 back then would have seen the value of their investment dwindle to £7,644.

But BP shares aren’t quite the dumpster fire they appear to be at first glance. Thanks to a steady stream of blue-chip-beating dividends — working out at 253.5p per share since mid-2015 — a £10k investment in the company would have delivered a total return of £13,037, or 30.4%.

The first rule of investing isn’t to lose money, says investing guru Warren Buffett. So someone who invested in the oilie 10 years ago would have passed that test. In fact, they’d have made a profit.

Should you invest £1,000 in BP right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BP made the list?

Yet compared to the broader FTSE 100, the return on BP shares has been pretty poor over the period. They’ve provided an average annual return of 2.7%, well below the Footsie average of 6.4%.

But can they provide a better return moving forwards? And should I consider buying the company today?

Bright forecasts

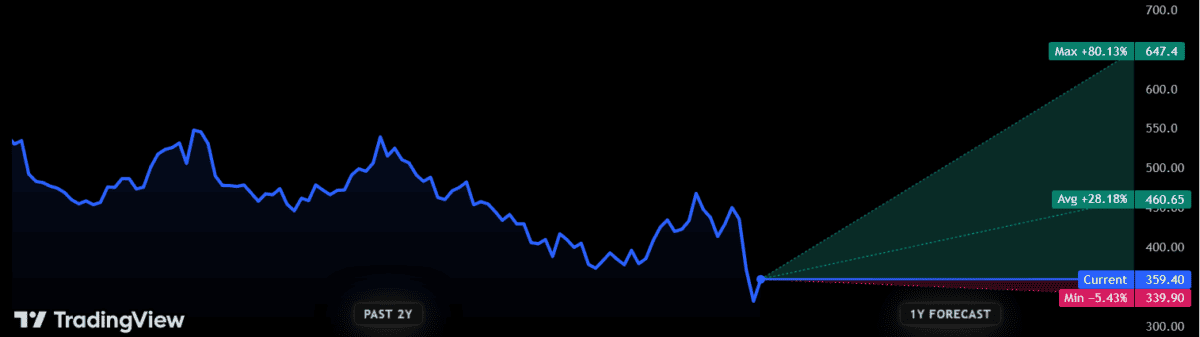

Unfortunately, forecasts for BP’s share price through to 2035 are unavailable. But estimates are available for the next 12 months. And broadly speaking, they’re pretty optimistic.

There are currently 26 analysts with ratings on BP shares right now. And they’ve slapped an average price target around 460.7p on them, up more than a quarter from current levels:

The opinion on BP’s price direction does vary among this grouping however. One analyst thinks the oil producer will fall to around 339.9p per share over the next year.

But as you can see, current projections are positive. One especially bullish forecaster thinks BP will move within a whisker of 650p, a level not seen April 2010.

Should I buy BP shares?

BP knows its share price has disappointed over the past decade. So it’s recently taken steps to overhaul its strategy to boost cash flows and get its debt down. This includes pivoting away from green energy to focus on oil production. It’s also seeking to cut operating costs across the group.

Unfortunately though, BP’s decision to prioritise fossil fuels comes at a time when oil prices are sinking again. Brent crude sank to four-year lows this month on fears of a global trade war, signs of an economic slowdown, and news of rising output from OPEC+ countries.

Commodity markets are famously volatile however. And factors like a falling US dollar and reduced rig activity Stateside could help oil recover ground.

But on the whole, the outlook for crude prices is pretty bleak, which is a worrying omen for BP. Indeed, HSBC has cut its average price forecasts to $68.50 and $65 per barrel for 2025 and 2026 respectively. That compares with $67.70 recently.

This could not only spell trouble for BP’s share price, but given the company’s huge debts, I fear it may also cause a sharp dividend cut. Net debt’s estimated to have been $27bn at the end of Q1, up $4bn from December.

Given its bleak prospects for the next year and beyond, I’m happy to avoid BP shares right now.