The best time to buy shares is when nobody else wants to. That’s when prices are lowest and investors get the most for their money, which leads to the highest long-term returns.

While share prices have been coming down, there’s absolutely nothing to say they can’t fall further. Despite this, I think right now does look like a good time to start investing.

Stock market momentum

The stock market makes investors do unusual things. Normally, people gravitate towards buying when prices are low – that’s why events like Black Friday are so popular.

Should you invest £1,000 in Aviva right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Aviva made the list?

The opposite’s true with stocks. When things start turning down, investors often begin selling the shares they were previously buying, even though the prices are now lower than they were.

It’s easy to see why this happens – share prices change more often and more dramatically than the price of consumer electronics. And investors naturally worry about downward momentum. If a stock’s going to be cheaper tomorrow, selling it at today’s prices can look like it makes sense. But the best investors are the ones who are able to buy when stocks are falling.

Where are we now?

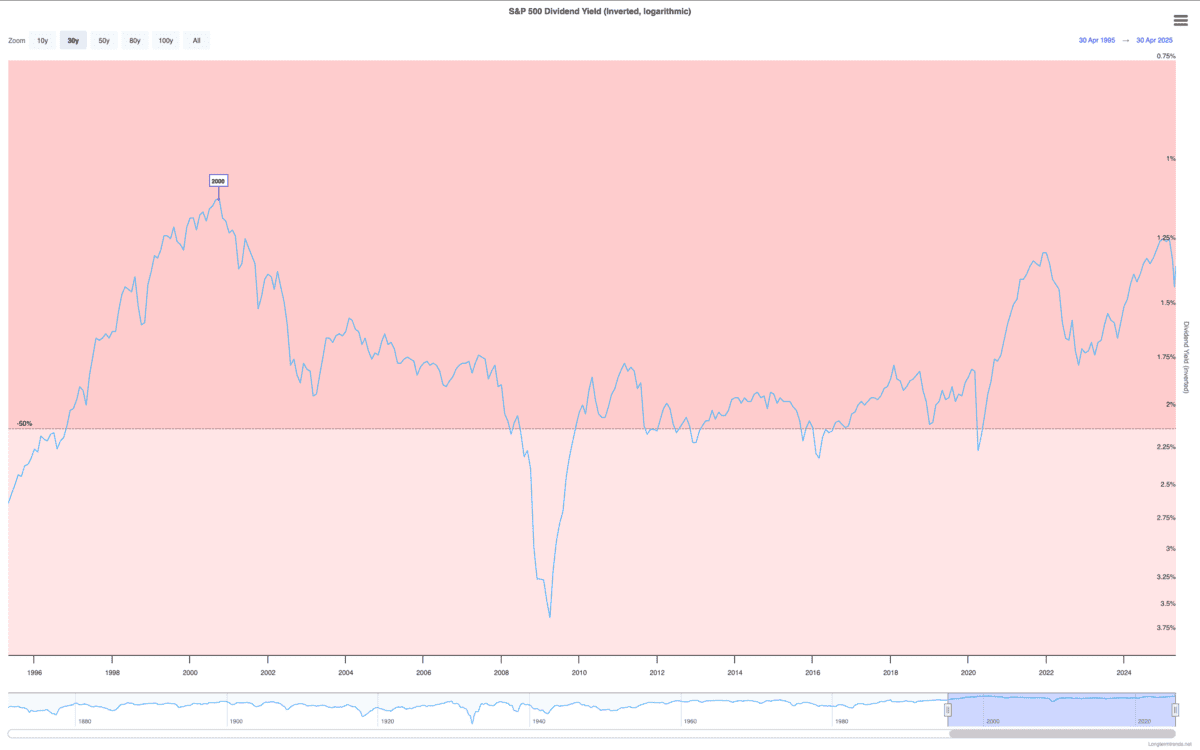

Share prices as a group have been volatile over the last couple of weeks. But while the FTSE 100 has recovered from its losses, the S&P 500 continues to keep working its way lower. Investors however, shouldn’t be too hasty when it comes to buying US shares. Despite the recent downturn, the S&P 500’s dividend yield is still historically low.

Source: Longtermtrends

The current 1.2% dividend yield’s also around a third of what investors might get from the FTSE 100. So there’s still a lot to be said for UK stocks from a value perspective.

On both sides of the Atlantic, I think the best strategy is to look for individual opportunities. In each index, there are stocks the market might be underestimating.

Finding value

Diageo‘s (LSE:DGE) a good example. The stock’s been falling steadily for the last three years, driven by short-term uncertainty and lower alcohol consumption among Millennials.

These are genuine issues, but there are also positive trends that shouldn’t be ignored. Despite declining alcohol consumption, spirits have been taking market share from beer and wine.

Furthermore, the stock looks unusually good value at today’s prices. The dividend yield’s around 4% and the price-to-earnings (P/E) ratio’s around 16.

Investors haven’t had the chance to buy the stock at these levels in a long time. And I think Diageo’s scale should give it a big advantage when it comes to adapting to shifting preferences.

Getting started

Could Diageo shares fall further from their current levels? Absolutely – historically low metrics are no guarantee the stock’s going to go up any time soon. Right now though, investors get a lot for their money. The strength of its brands is a unique asset that should give it a big advantage over competitors.

Finding the perfect time to start investing is nearly impossible. But for anyone thinking about it, I don’t believe there’s been a better time to consider buying Diageo shares in the last decade.