UK shares have been struggling this month after the early April announcement of fresh US trade tariffs. The shocking news wiped as much as 30% off certain stocks and almost 1,000 points off the FTSE 100.

But as a result of the chaos, there could be some lucrative opportunities for investors. Many dividend stocks have seen their yields soar as prices fall. I’ve uncovered two in particular that look attractive right now – MAN Group (LSE: EMG) and Greencoat UK Wind (LSE: UKW).

For investors seeking reliable dividends, these two could be worth considering.

Should you invest £1,000 in Pennon Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Pennon Group Plc made the list?

MAN Group

MAN Group is down 27% this year, despite a decent set of 2024 results. They included a share buyback announcement and dividend increase. However, even though revenue and earnings increased by 23% and 27%, respectively, earnings per share (EPS) missed expectations. Worst of all, the asset manager cut its guidance for the coming year.

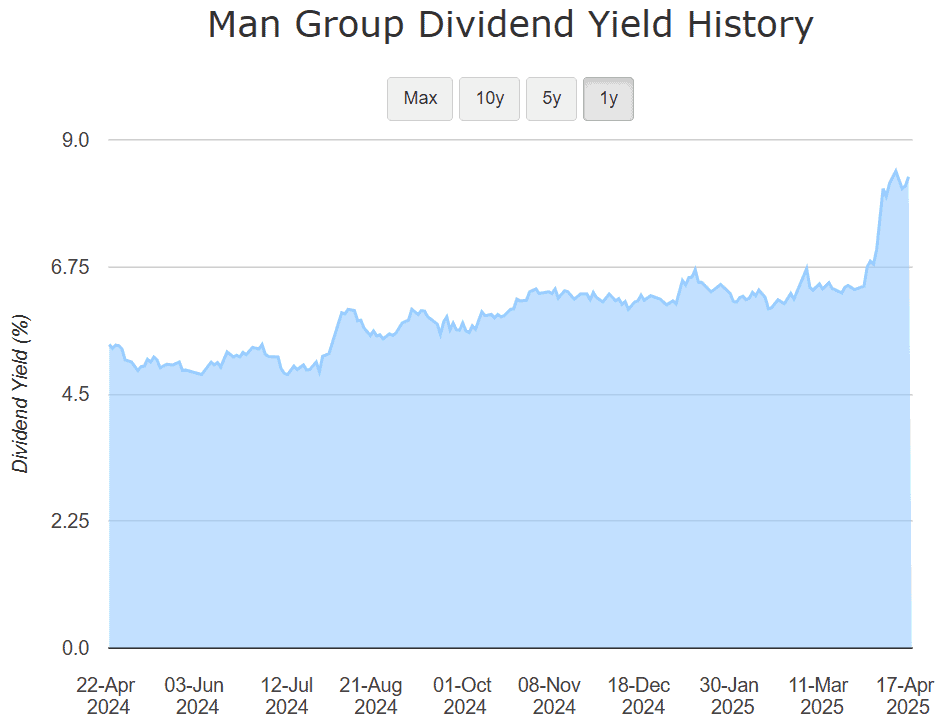

The results didn’t initially have a large negative effect on the stock. But after the announcement of a 10% trade tariff on UK goods, it took a tumble. Now down 27% year to date, the stock’s dividend yield has soared from 6% to 8.3%. At this level, it looks like an attractive option for income investors.

The company has a long track record of returning cash to shareholders through both dividends and buybacks. In fact, it has returned over $2bn to shareholders since 2018. Plus, the dividend is well covered by earnings and supported by a solid balance sheet, with net cash of $700m at the end of 2024. That provides a cushion against any short-term volatility in earnings.

That said, there are risks. The firm’s future performance is closely tied to market sentiment and global fund flows, both of which can be hit hard during uncertain times. If volatility spikes or investor appetite fades, assets under management (AUM) could fall, putting pressure on earnings and distributions.

Still, with the shares trading at just eight times forecast earnings and yielding over 8%, the risk-reward balance could be compelling for long-term income seekers to consider.

Greencoat UK Wind

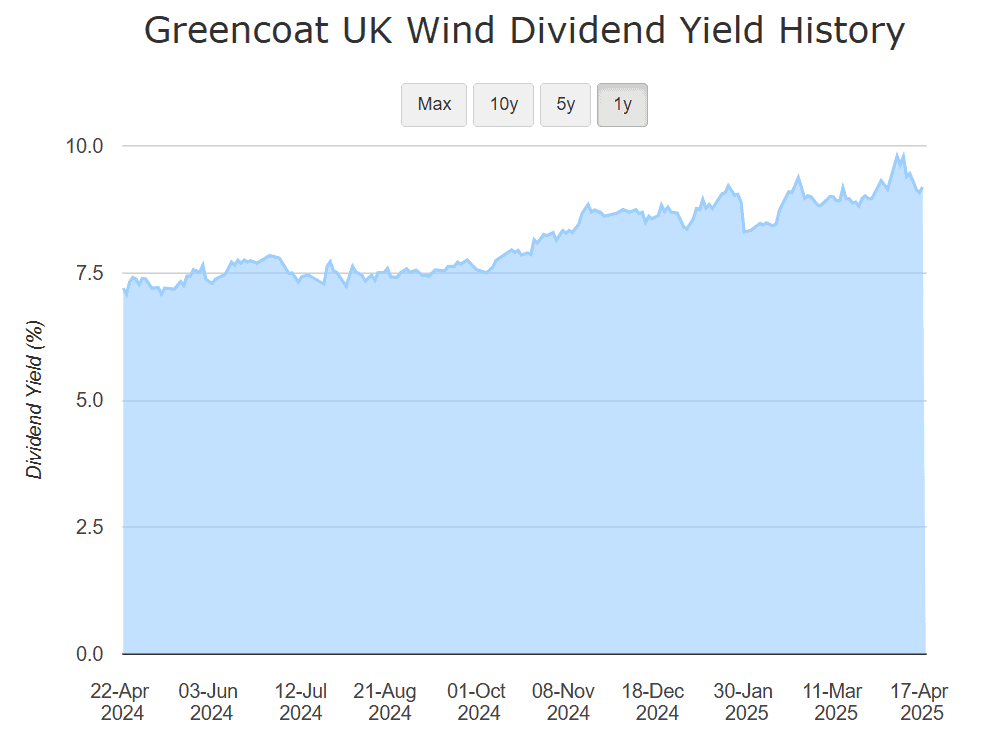

Greencoat UK Wind is a green energy stock that has seen its share price drop significantly (down 15% in the past year) pushing its dividend yield to an enticing 9.2%. As a renewable infrastructure investment trust, Greencoat owns a diversified portfolio of operational UK wind farms.

Its revenues are largely inflation-linked, and its cash flows are supported by long-term power purchase agreements. This makes it a relatively defensive income play.

The trust has delivered consistent dividend growth since listing in 2013 and remains committed to increasing its payout in line with inflation. Its 2024 annual results showed solid performance, with net asset value (NAV) per share stable and cash flow generation strong enough to support its target dividend for 2025.

However, the recent sell-off has been driven by a wider de-rating across the renewables sector, partly due to rising interest rates. As rates have climbed, income-focused investors have shifted towards gilts and other fixed-income assets, putting pressure on listed infrastructure trusts.

That said, with interest rates expected to fall later this year, it could be well-positioned for a re-rating. In the meantime, investors are being paid a healthy yield to wait so it could be worth further research.