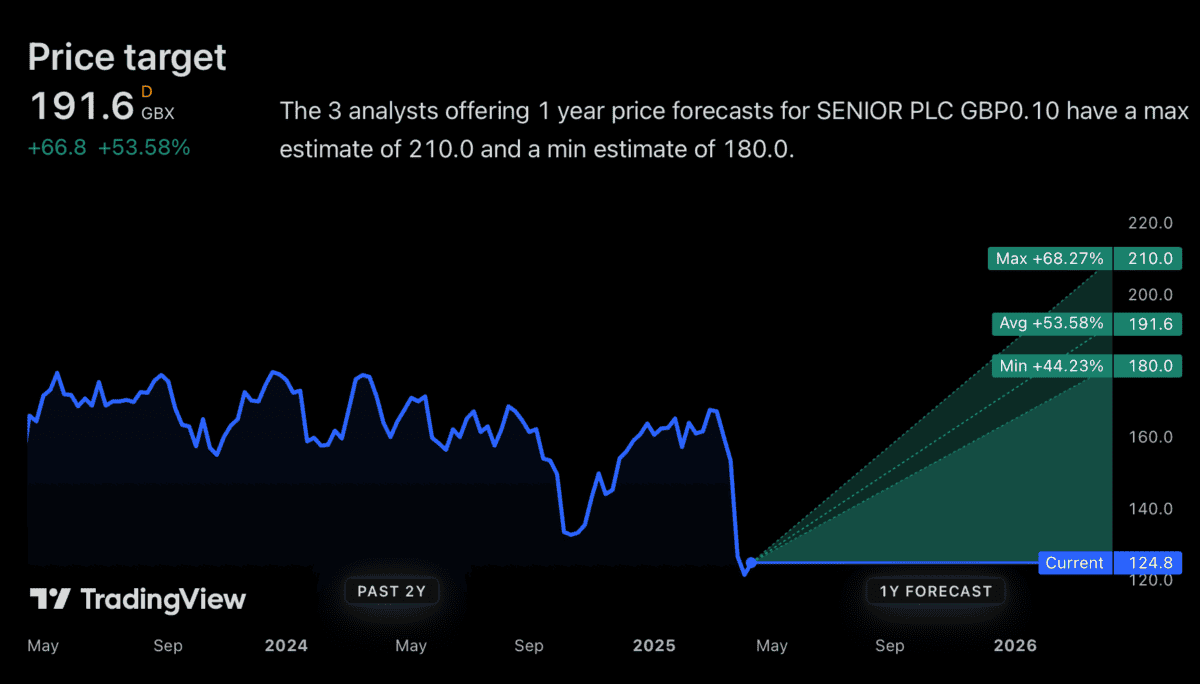

Shares in FTSE 250 manufacturing firm Senior (LSE:SNR) have fallen 25% this year. As a result, the average analyst price target is more than 50% above the current level.

Source: TradingView

I’m sceptical of the idea the stock is set for a big recovery in the near future. But I do think there’s a lot to like about the underlying business – and investors should take note.

What does Senior do?

Senior is a specialist in fluid conveyance and thermal management (FCTM). In other words, it makes pipes and tubes that liquids flow through and systems that keep machines cool.

At the moment, around two-thirds of the firm’s revenues come from its aerospace division. This is a heavily regulated industry, which creates a high barrier to entry for competitors.

The trouble with this, however, is that the industry is a duopoly. And when Boeing and Airbus get into difficulties – as they have done recently – there isn’t really anyone else to sell to.

As a result, 2024 was a difficult year for the company. Revenue growth was only 1% and earnings per share were down 30%, which highlights the risks with the business.

Transition

There isn’t much Senior can do to sort out Boeing’s ongoing problems. But it is making moves to put itself in a better position going forward.

The firm is selling off its aerostructures business (which makes structural parts for planes) to focus on its core FTCM strengths. This will change the company in a number of ways.

First, it should lead to higher profits – the aerostructures unit makes up around 28% of total revenues but made a loss in 2024. Divesting this should significantly boost margins.

Second, it will mean Senior’s aerospace division only makes up around 50% of its revenues. This should reduce the overall risk that comes from depending on a couple of key customers.

Outlook

Given the ongoing difficulties at Boeing, I’m not convinced Senior’s share price is set to climb 50% in the next year. But management have set some very ambitious targets for themselves.

The firm is targeting 5% annual organic revenue growth, operating margins of 15%, and a return on capital employed of between 15% and 20%. That’s almost unrecognisable from 2024.

| 2024 | Medium-term target | |

|---|---|---|

| Revenue growth | 1% | 5% |

| Operating margin | 4.80% | 15% |

| Return on capital employed | 6.80% | 15%-20% |

Whether or not the company can hit these targets remains to be seen. But if it can, I think the current share price is a clear bargain.

Officially, the stock trades at a price-to-earnings (P/E) multiple of 20, but that’s based on 2024’s profits, which were unusually weak. As things normalise, I expect this ratio to contract sharply.

Cyclical investing

Warren Buffett says that the key to investing well is being greedy when others are fearful. It can be hard to know when there’s fear around, but I think Senior is one of the easier cases.

The firm has been going through an unusually difficult time, but investors with a long-term focus should be able to look beyond this. And there could be a lot to be optimistic about.

I’m considering adding the stock to my portfolio because divesting its aerostructures business could be transformational. As a result, I’m rather hoping it doesn’t climb 50% any time soon.