UK stocks have been out of favour recently. But that could be a good sign for opportunistic investors looking for shares to buy for the long term.

Warren Buffett says that investing well is about being greedy when others are fearful. And there are some signs the stock market might be underestimating UK shares.

Out of favour

A month ago, things were just starting to look positive for UK shares. But sentiment has turned negative again very quickly among both retail investors and institutions.

Should you invest £1,000 in Halma Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Halma Plc made the list?

A survey from the British Retail Consortium in March indicated improving confidence towards UK stocks from domestic retail investors. But the recent volatility might have shaken that up.

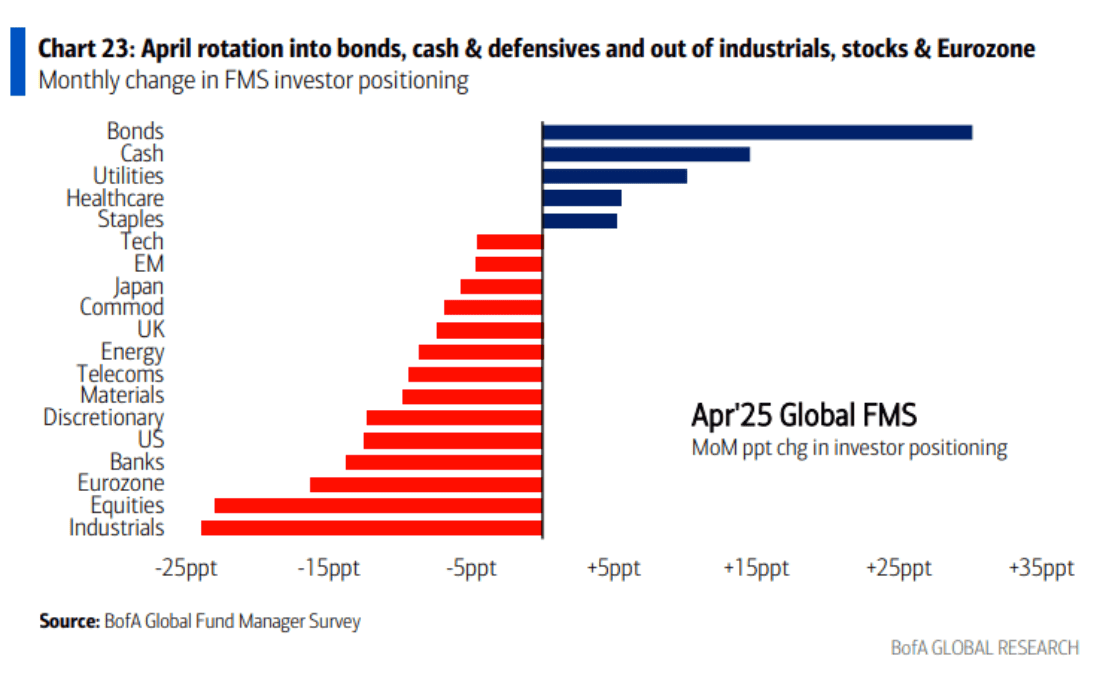

Bank of America’s research suggests things haven’t been much better at the institutional level. While fund managers moved towards UK stocks in March, this reversed in April.

This is largely the result of increased fears of a global recession causing investors to move away from equities in general. But I think it’s fair to say UK shares are out of favour again.

Opportunities

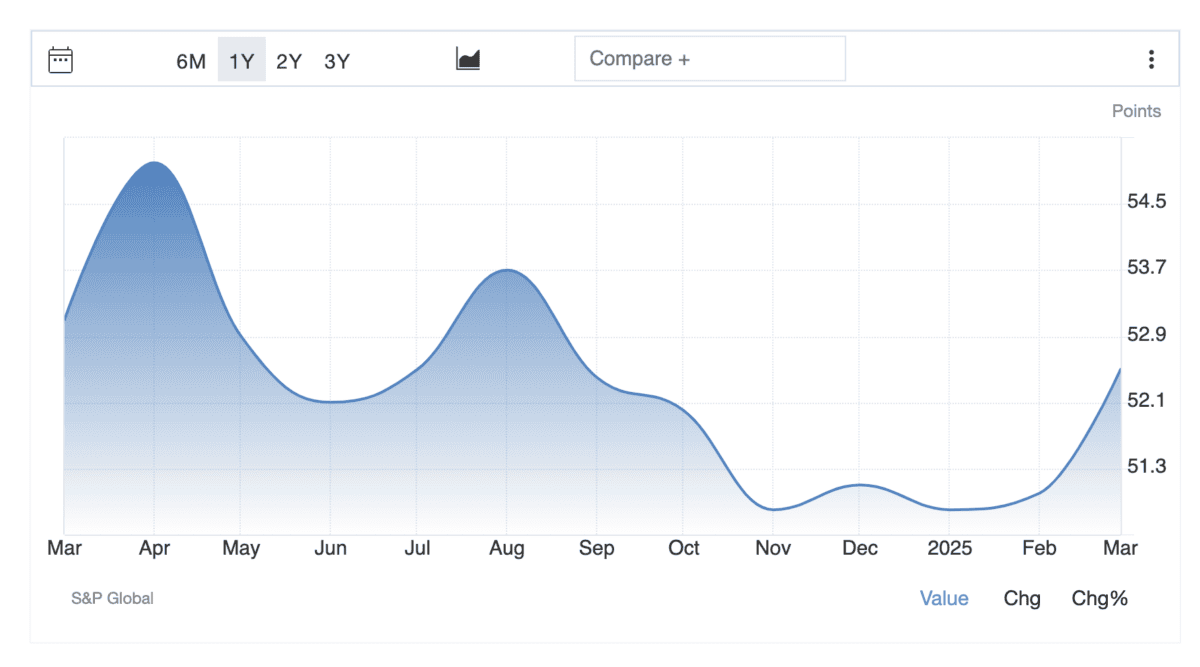

Despite this, there have been some clear positive signs for the UK. One of these is the latest Purchasing Managers Index (PMI) from the UK services sector.

UK Services PMI March 2024-25

Source: TradingView

The Services PMI is the result of a survey of managers in services companies about business conditions. It’s widely seen as a good indication about where the sector is heading.

A reading above 50 is a sign of growth. And the latest data from March is encouraging for two reasons – it’s higher than 50 and it’s above the February level.

That’s a very positive sign for the services industry in the UK. And the FTSE 100 has a number of shares that fit into this category.

Banks

One of the most obvious examples is Barclays (LSE:BARC). A strong service economy typically means higher demand for loans and the bank stands to benefit from this.

Investors need to weigh this against the risk of interest rates falling as inflation has been subsiding recently. This could lead to lower lending margins, which isn’t good for profits.

Barclays, however, has the unique advantage among UK banks of having a substantial investment banking division. And this should be boosted by decreased borrowing costs.

Furthermore, the relationship between interest rates and lending margins isn’t linear. Rates going from 4% to 3% typically impact profitability much more than a reduction from 2% to 1%.

A stock to consider buying

Investing well over the long term involves buying shares in quality businesses when investors are looking elsewhere. And UK stocks in general are out of favour with the market right now.

There are, however, some positive economic signs for investors to fasten onto. And Barclays has a diversified business model that makes it unique among UK banks.

All of this means investors might think about whether this is an unusually good time to buy the stock. Weak sentiment and positive economic data could be a powerful combination.