According to the latest data, UK business confidence is at its lowest level since 2022. But the best times to invest are often when things look the most bleak. Sentiment might be weak, but I can see several potential opportunities. As always, the key is figuring out which companies have the best prospects.

Business sentiment

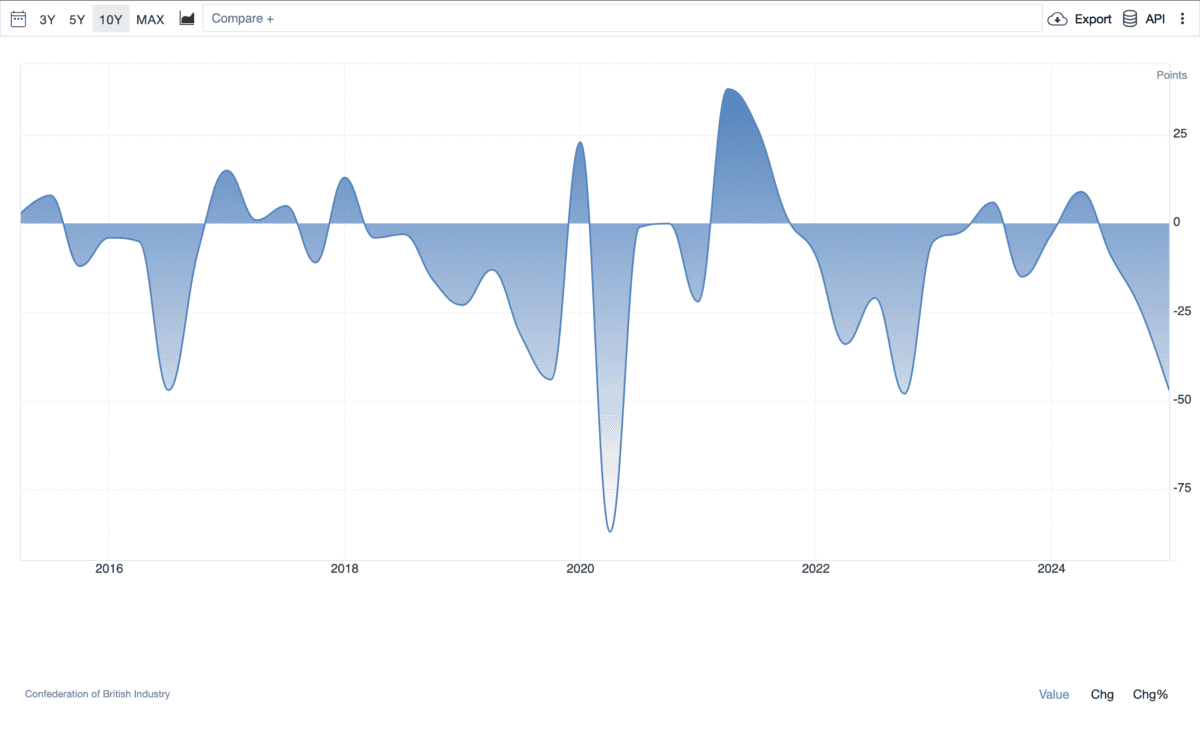

The only time in the last 10 years UK business confidence has been lower than it is now was during the Covid-19 pandemic. That’s pretty uninpsiring stuff, but investors who were buying back then have done very well.

UK Business Confidence 2015-25

Should you invest £1,000 in London Stock Exchange right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if London Stock Exchange made the list?

Source: Trading Economics

It’s easy to see why. Uncertainty around tariffs in the US and higher staff costs back home are making things difficult for businesses, but the impact’s likely to vary significantly from one business to another.

That makes a big difference from an investment perspective. And historically, the best times to invest have often been when sentiment has been at its lowest.

Gross margins

In terms of tariffs, a 10% import tax essentially increases a company’s costs by 10%. But the effect on a business with a 50% gross margin isn’t the same as it is on one with a 20% gross margin.

A firm with a 20% gross margin needs to boost its sales by 8% to offset the effect of a 10% tariff. And it needs to do this without increasing costs, which usually means higher prices.

| 20% Gross Margin Business | Before 10% tariff | After 10% tariff | 8% increase |

| Sales | £100 | £100 | £108 |

| Cost of Goods Sold | £80 | £80 | £80 |

| Tariff | £0 | £8 | £8 |

| Gross Profit | £20 | £12 | £20 |

The equation however, is much more favourable for a company with a 50% gross margin. A 5% increase is enough to offset the effect of 10% import tax.

| 50% Gross Margin Business | Before 10% tariff | After 10% tariff | 5% price increase |

| Sales | £100 | £100 | £105 |

| Cost of Goods Sold | £50 | £50 | £50 |

| Tariff | £0 | £5 | £5 |

| Gross Profit | £50 | £45 | £50 |

There’s a lot more to it than this. But other things being equal, a company with wider gross margins has an advantage when it comes to offsetting higher costs.

Games Workshop

Given this, Games Workshop (LSE:GAW) looks like a very strong stock to consider. Obviously, Warhammer products are things people want but don’t need, and investors should remember this.

That means there’s a risk of demand faltering if household budgets come under pressure. But the company’s in an excellent position when it comes to offsetting tariffs.

Games Workshop generates 44% of its sales in the US, but its gross margin in 2024 was above 70%. That means the firm will need to raise prices by less than 3% to offset a 10% import tax.

The company’s strong intellectual property also reduces the risk associated with raising prices. Put simply, there’s no danger of customers going elsewhere to find its products cheaper.

Buying UK shares

In addition to US tariffs, Games Workshop should be unaffected by UK wage increases, since it already pays its staff more than the increased National Living Wage. That’s another advantage.

Business confidence in the UK might be low, but the best time to buy is often when there’s pessimism around. And some companies probably have less to worry about than others.