Despite the turmoil of the past few days, the Greatland Gold (LSE:GGP) share price is currently (11 April) over 53% higher than it was a month ago.

Some of this resulted from a positive reaction to the news that the gold and copper miner has commenced a capital reorganisation. If the proposal is approved by shareholders, it will result in a newly-established parent company being listed on the Australian stock market (ASX). The group will also retain its current status on the UK’s Alternative Investment Market.

The group’s directors claim that Australia is “a natural listing venue for mining companies”. As a consequence, the plan — which is expected to be effective from June — is intended to improve liquidity and generate more investor interest in the stock. In conjunction with the restructuring, the company’s reserved the right to raise additional funds. Although, any rights issue will be restricted to 2.5% of the issued share capital.

Should you invest £1,000 in Segro Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Segro Plc made the list?

What else is happening?

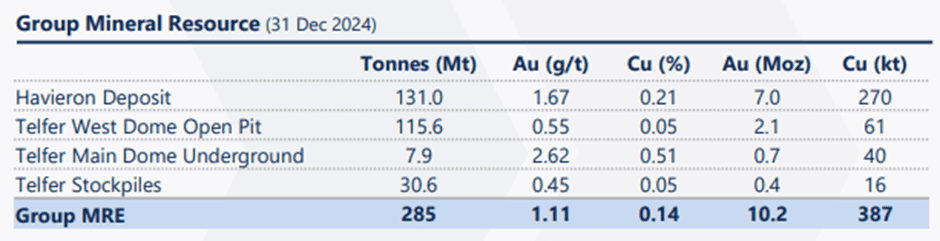

It’s been an eventful few months for the group. In December 2024, it acquired full control of the Telfer and Havieron projects.

The former is a working mine, which means the group’s moved from being a pure exploration company to a part-producer.

However, the latter requires substantial investment before it becomes commercially viable. Fortunately, the group’s entered into a non-binding letter of support to secure a debt facility that will “fund costs and expenses of the construction, development and operation of Havieron, corporate costs and any other expenses until project completion”.

What do I think?

The group’s clearly going in the right direction.

It appears to be fully funded, which means the significant dilution that longstanding shareholders have experienced looks to be a thing of the past.

And when it gets Havieron up and running, the group claims that it will have the second-lowest all-in sustaining cost of any ASX-listed Australian mine. If true, it will be one of the most profitable in the country.

However, I fear the group’s share price performance is becoming increasingly disconnected from its underlying business. And I suspect the recent gold price rally is to blame. Since the start of the year, it’s set a number of new record highs. Global uncertainty is behind this momentum.

Of course, this means Telfer’s output is worth more than previously. And it’s increasing the value of the group’s reserves.

But Haverion isn’t producing yet. Even if everything goes to plan, it won’t be generating revenue until the first half of 2027. Who knows what the price of gold will be in two years’ time?

And to get to this position, the group’s going to face numerous challenges. From an operational perspective, mining is possibly the most difficult industry to get right. This means valuing companies in the sector is difficult, especially ones that aren’t fully commercialised.

A quick look at the price targets of the three brokers covering the stock — 11p, 20p, and 21p — doesn’t help very much. The group’s current share price is 13.9p. To me, this simply reflects the uncertainty of buying shares like these.

Therefore, at the moment, I think Greatland Gold’s stock is one to keep on my watchlist rather than invest in.