Looking for the best cheap UK shares to buy right now? Here are two I think deserve serious attention right now.

RWS Holdings

The projected rise of artificial intelligence (AI) poses a risk to a vast range of companies. This includes RWS Holdings (LSE:RWS), which provides translation and localisation services to businesses around the globe.

Yet, while this disruptive threat demands serious attention, I think the company may not be as affected as some fear. This is because some of the sectors it covers — think legal services, life sciences, and aerospace and defence, for instance — require 100% content accuracy all of the time.

Should you invest £1,000 in Associated British Foods right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Associated British Foods made the list?

For instance, any inaccuracies in jet design documentation could compromise safety, leading to costly mistakes or even catastrophic outcomes. Is it likely that companies will want to entrust such responsibilities AI? I’m not so sure, meaning businesses that have specialist technical knowledge like RWS will remain in high demand.

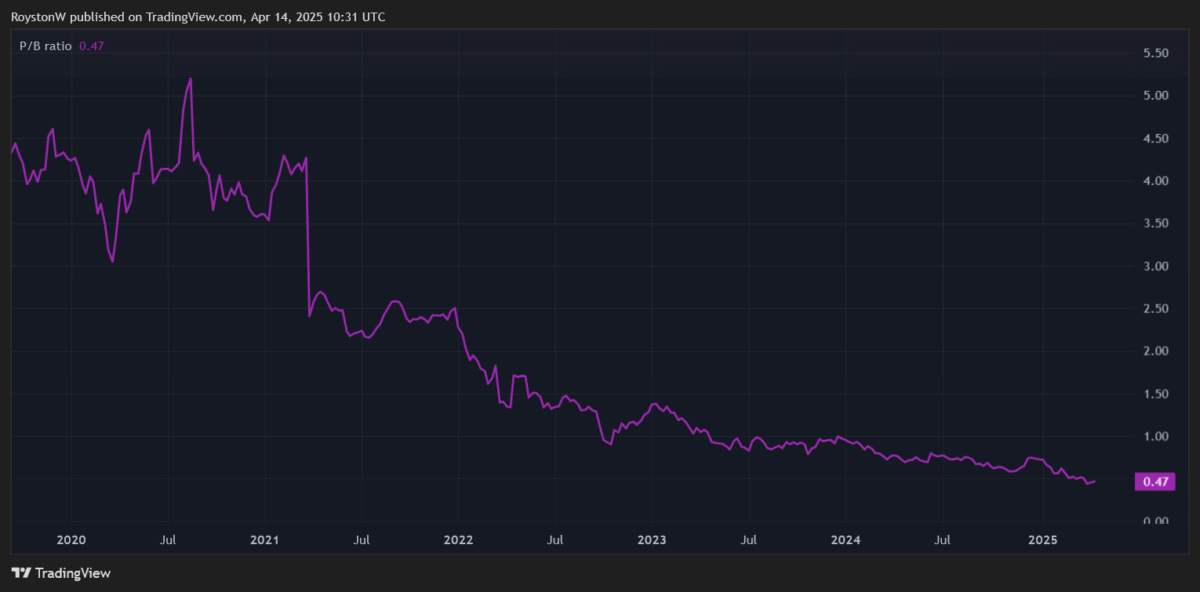

At current prices, I think the company could be a brilliant bargain share to consider. At 115p, it trades on a forward price-to-earnings (P/E) ratio of 5.7 times, and its price-to-book (P/B) ratio is under 0.5.

Any P/B below one indicates that a share is cheap relative to the value of its assets.

Finally, with an 11% forward dividend yield, RWS shares have one of the highest dividend yields on the London stock market today. Cash payouts here have risen consistently since 2016.

It’s important to note that RWS’ sliding share price has pumped the yield up to current levels. I’m optimistic that they’ll rebound, but there could be more turbulence in the near term if worries over AI and the broader economy grow.

The Renewables Infrastructure Group

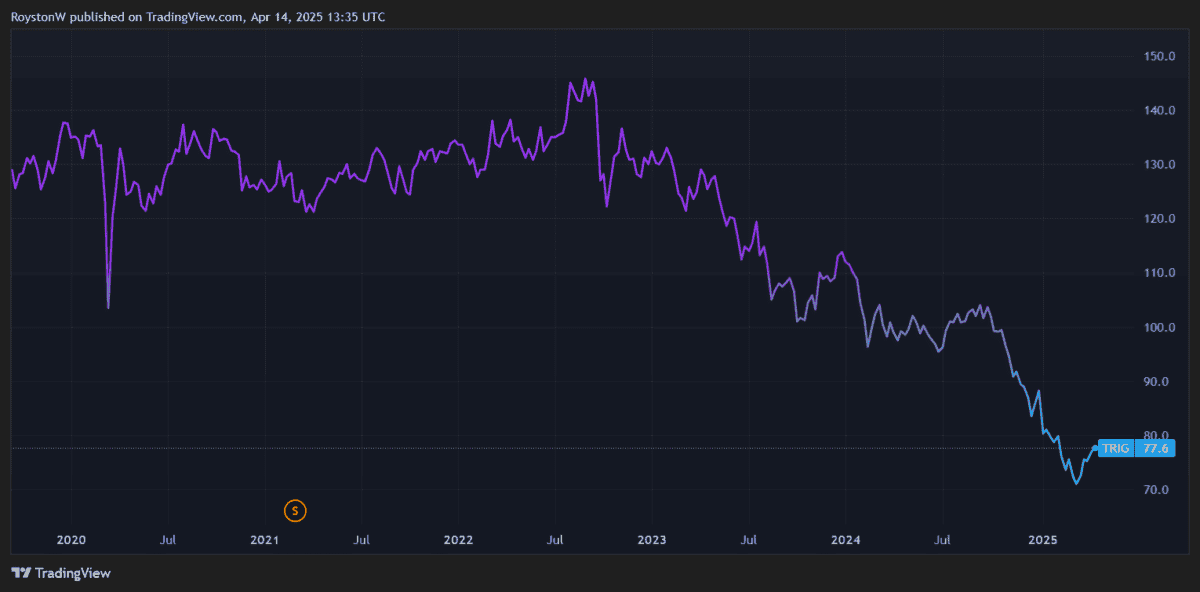

Utilites stocks like Renewables Infrastructure Group (LSE:TRIG) have been hit badly by higher-than-usual interest rates since late 2022. And while rates are beginning to come down, signs of returning inflation could hamper any further plans by central banks to loosen monetary policy.

Yet it’s my belief that this threat to Renewables Infrastructure is more than baked into the cheapness of its shares. Today, the company trades at 77.9p per share, which is 33.4% lower than its estimated net asset value (NAV) per share.

On top of this, its forward P/E ratio is an undemanding 9.6 times. And the firm’s corresponding dividend yield is a huge 9.7%.

I think extreme price weakness in recent years may have created an attractive buying opportunity for patient investors. While the company may endure some near-term turbulence, I think profits could soar longer term as global energy demand increases.

The International Energy Agency (IEA) forecasts that power demand from data centres alone will double between now and 2030, a sum equivalent to the entire electricity consumption of Japan today. With countries taking steps to reduce their fossil fuel uptake, renewable energy stocks have considerable earnings potential.

Renewables Infrastructure is one of my favourite plays on this theme. With solar, wind, and battery storage assets covering the breadth of Europe in its portfolio, it provides a diversified (and therefore lower risk) way for investors to gain exposure.