Aston Martin (LSE: AML) shares have performed woefully for ages. In the three months leading up to Christmas, the share price was skidding downhill like a car on an icy bend. But that 34% drop was nothing compared with what had gone before — down 93% in the previous five years!

The FTSE 250 stock has fallen another 44% since Christmas Eve and currently sits at just 58p. This means anyone who made a £10k investment when presents were still under twinkling trees would now have just £5,600.

What has gone wrong?

There are a few key reasons why the stock has crashed, but most relate to the luxury automaker’s balance sheet. At the end of 2024, Aston Martin’s net debt was approximately £1.16bn, reflecting a 43% increase from the previous year.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

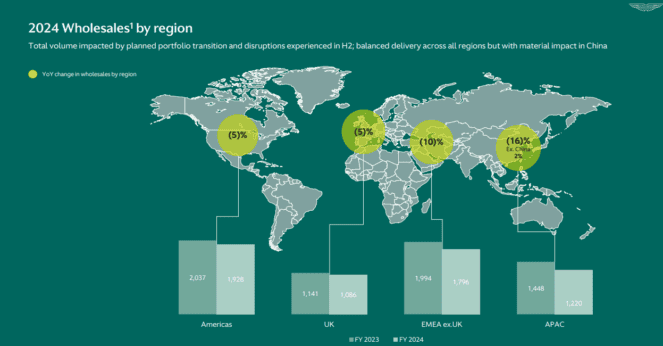

The annual pre-tax loss came in at £289m, up from £240m, on revenue of £1.58bn (down 3%). Supply chain issues and weak markets saw wholesale volumes slip 9% to 6,030 vehicles. China sales were especially bad, as they have been for most luxury goods companies.

Taking necessary measures

To shore up the balance sheet, the Yew Tree Consortium, led by executive chairman Lawrence Stroll, increased its stake in the carmaker to 33%. The company also sold its minority stake in the Aston Martin Aramco Formula 1 team, raising about £125m from both transactions.

On top of this, Aston will cut roughly 5% of its global workforce.

CEO Adrian Hallmark commented: “By strengthening the balance sheet, this investment provides additional headroom to support our future product innovation and business transformation activities, which combined, will accelerate our progress into being a sustainably profitable company.”

This fundraise is well-timed, as the company will need “additional headroom” now that President Trump’s 25% tariffs on all foreign-made carmakers have been announced. The company doesn’t have the capital to set up manufacturing stateside, so these looming taxes will almost certainly heap more pressure on margins.

New models on sale

Aston does have a refreshed line-up of vehicles, including high-margin special edition models like Valkyrie, Valour, and Valiant. Deliveries of Valhalla, its hybrid supercar, are due to start in the second half. The CEO says this is the “strongest product portfolio in our 112-year history.”

Meanwhile, the development of its first electric vehicle (EV) has been put on the backburner for a few years. This makes sense to me as we don’t even know whether Aston customers will really want EVs by 2030. Or whether government net-zero targets will be watered down.

Recovery potential?

I’ve often looked at Aston shares over the past 18 months and thought they could stage an epic comeback at some point. But that would ultimately depend upon improving fundamentals and we’re not seeing that.

The firm’s history of losses and balance sheet risk means I don’t feel comfortable investing here. Also, the sheer amount of uncertainty being unleashed by the developing global trade war isn’t going to be great for sales of almost anything.

Right now, the stock market is crashing due to these fears. In this situation, I want to be adding shares of resilient companies to my portfolio. Ones that I think can weather this Category 5 hurricane and possibly emerge stronger.

Unfortunately, I don’t think that’s Aston Martin.