Tesla‘s (NASDAQ:TSLA) share price has been on a roller coaster in recent months. After rising sharply at the back end of last year, it’s collapsed 29.5% since the start of 2025.

Signs of a growing image crisis, combined with fears over how a potential trade war could hit revenues and costs, have driven Tesla shares sharply lower. However, analysts believe the company should rebound before too long.

But just how realistic are these price estimates in the current climate? And should I consider buying Tesla shares for my portfolio?

Should you invest £1,000 in Nvidia right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Nvidia made the list?

A 22% price bump?

First of all, it’s important to note that forecasters are not unanimously positive about the motormaker’s share price forecast for the next 12 months.

Of the 48 analysts with ratings on Tesla stock, one believes the NASDAQ company will fall 55.1% in value over the next 12 months, to $120 per share.

That’s down from current levels of $267.40.

Having said that, broker consensus is overwhelmingly of the opinion that Tesla’s share will rebound sharply. The average price target among analysts is $326.30 per share, up 22% from current levels.

One especially bullish analysts thinks the company will rise 105.7% to $550 per share. That’s above December’s record closing highs of $479.86.

Sales slump

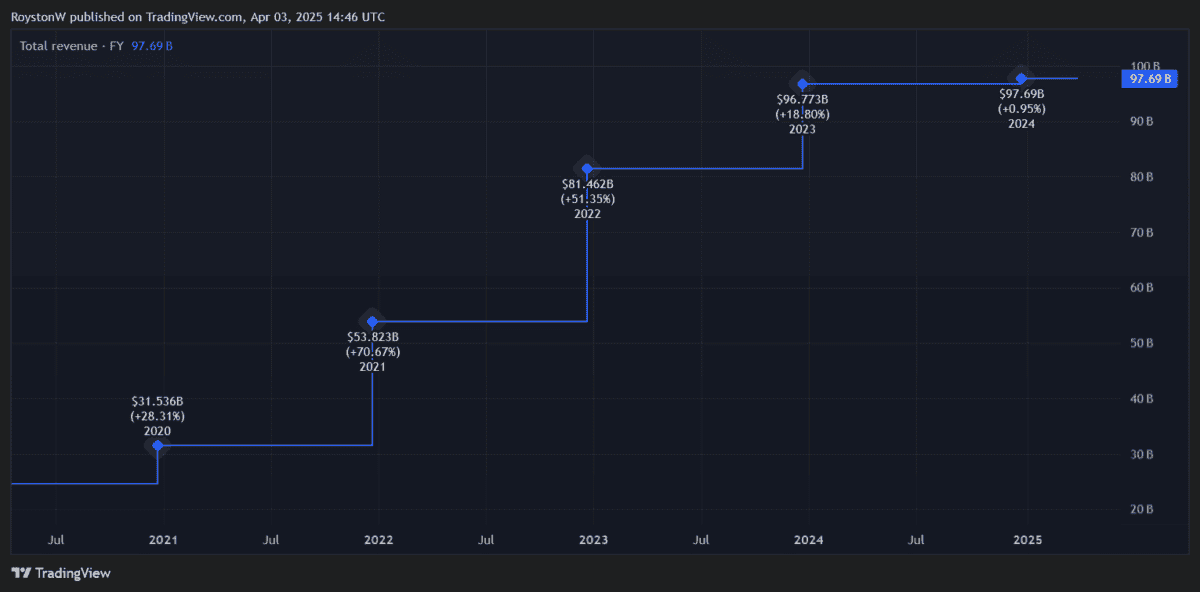

I can’t help but feel more than a little sceptical over market bullishness, though. As the chart above shows, Tesla’s sales growth has slowed to a crawl in recent years.

Concerns over quality continue to dog the business, exacerbated by a steady stream of product recalls (some 46,096 Cybertrucks have just been recalled over detaching panels). The firm’s also struggling against rising competition, and especially from China, as its rivals scale up production and improve their technologies.

Last year, BYD and Tesla both sold the same number of vehicles (1.8m).

In fact, things seem to be going from bad to worse as the company suffers from a growing brand crisis. Tesla sales dropped 13% year on year in the first quarter, with founder Elon Musk’s close association with the controversial Trump administration said to be turning customers (and especially those from overseas) off.

A ramping up in global trade tariffs also threatens to damage company sales, as well as disrupt supply chains and significantly elevate production costs.

Still pricey

Some may argue, though, that Tesla’s troubles are now baked into its much lower share price, providing the base for a share price rebound.

It’s not a view I personally subscribe to. And especially when one considers the huge valuation the carmaker continues to command.

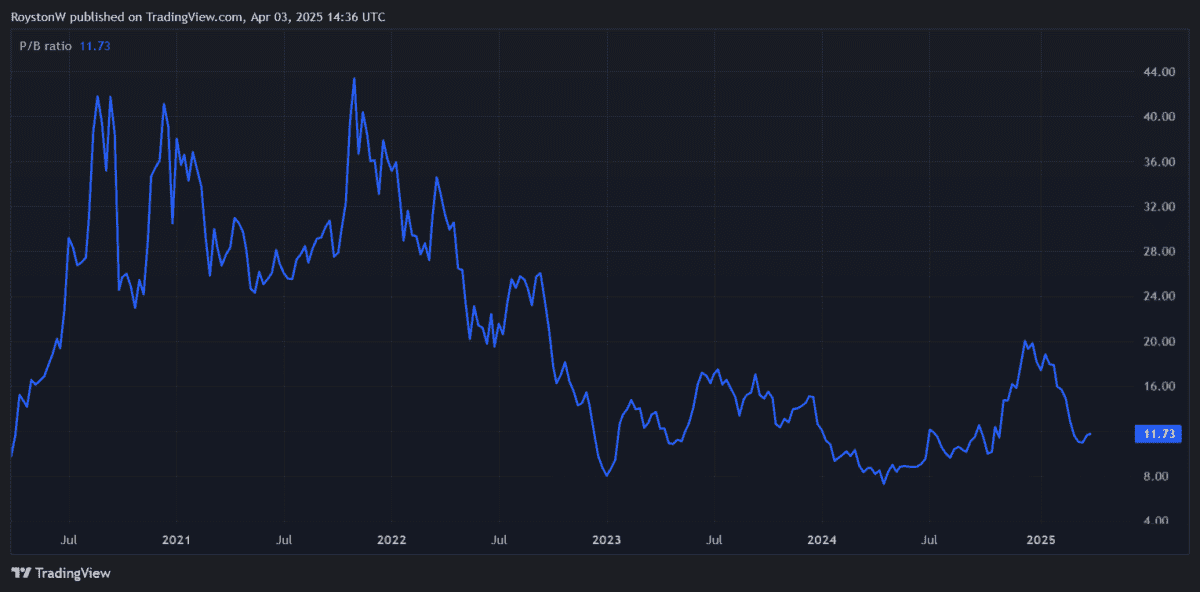

Predictions of an 18% earnings rise in 2025 results in a sky-high price-to-earnings (P/E) ratio of 102.4 times. Meanwhile, its price-to-book (P/B) ratio is miles above the accepted value watermark of one and below.

In fact, this sort of high valuation leaves Tesla vulnerable to further share price drops, in my opinion.

Reports that Musk will soon leave his job as Trump’s efficiency tsar provide some cause for optimism. This could help Tesla repair its broken image, and would likely see its experienced chief executive give the company more of his attention.

Yet this isn’t enough to encourage me to invest. I think Tesla shares remain far too risky, so I’d rather buy other US and UK shares today.