Trading at an eight-year low, things look dark and stormy for the Diageo (LSE:DGE) share price. The FTSE 100 alcoholic drinks manufacturer behind Bailey’s, Guinness, and Captain Morgan has lost nearly a third of its value in the past year. As a shareholder, I’m dismayed that Diageo shares are weighing on my portfolio with my position firmly in the red.

Investor confidence is evaporating thanks to falling alcohol demand, successive weak financial results, and the company’s vulnerability to US tariffs. But might the stock now be in deep value territory, offering investors an opportunity to consider buying on the cheap?

Here’s my take.

Low spirits

Looking at Diageo’s interim results, some disappointing numbers jump out. Reported net sales of $10.9bn marked a 0.6% decline. Reported operating profit‘s also heading in the wrong direction, down 4.9%. Worryingly, the group abandoned its medium-term target for 5% to 7% organic sales growth.

A key factor underpinning the revised outlook is the Trump Administration’s love affair with tariffs. The current suspension on 25% duties for US imports from Canada and Mexico is due to be lifted tomorrow (2 April). Considering Diageo sells huge volumes of Mexican tequila and Canadian whisky stateside, this is no late April Fool’s joke for the company’s share price.

Unfortunately, the conglomerate’s woes don’t end there. There’s evidence that declining alcohol consumption may be a structural phenomenon rather than a cyclical one. According to a World Finance report, Millennials are less fond of a tipple than previous generations. Gen Z, even less so. For Diageo, overcoming a dwindling consumer base is a mighty challenge.

Furthermore, the firm’s losing prominent backers. Veteran investor Terry Smith, often dubbed ‘Britain’s Warren Buffett‘, dumped the stake in Diageo last year from Fundsmith Equity‘s portfolio — a position previously held since inception. Notably, Smith’s exit was accompanied by barbed comments aimed at the new management team. CEO Debra Crew’s less than two years into the job.

A glass half full

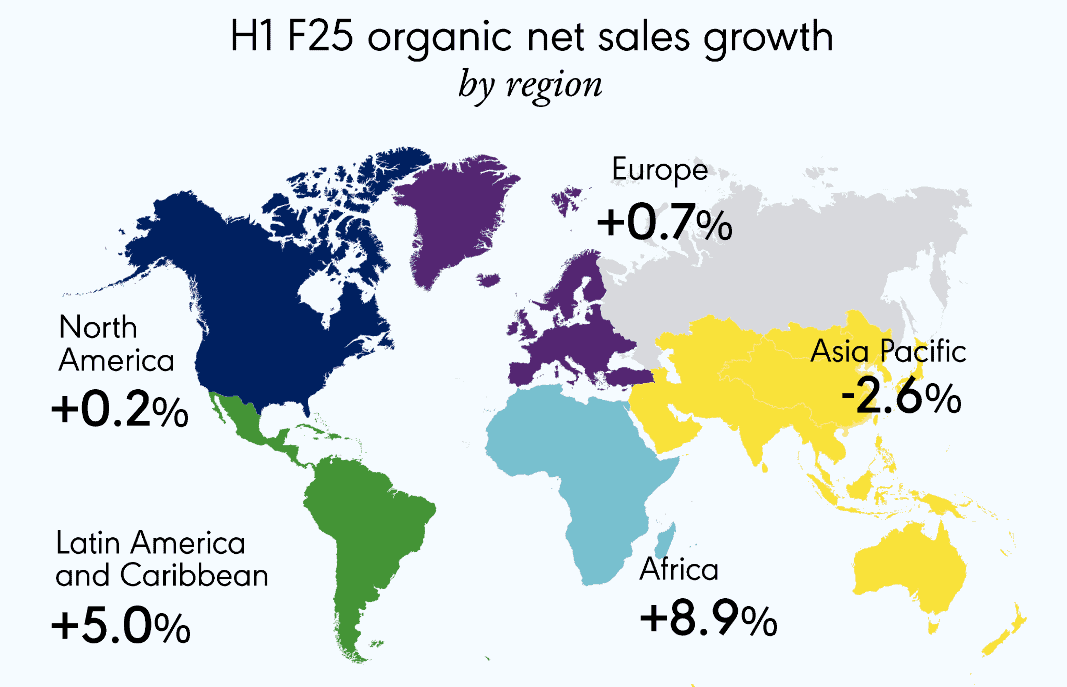

That said, Diageo’s interim results showed some glimmers of light. Although reported net sales suffered due to an adverse foreign exchange impact, organic net sales returned to growth with a 1% improvement. Encouragingly, the firm’s moving in the right direction in four of its five global regions on this benchmark.

Another attractive point is the valuation. Following a significant slump in Diageo’s share price, the company’s price-to-earnings (P/E) ratio has compressed to 16.1. That compares favourably to an average multiple of 23.1 over the past decade, suggesting the stock is possibly undervalued.

Finally, it’s also good to see that a widely feared dividend cut didn’t materialise. Diageo maintained interim payouts at 40.5 US cents per share, providing comfort for passive income investors. The stock’s dividend yield has crept up to nearly 4% today, well above recent historical averages.

Time to buy?

Although the Diageo share price appears cheap today, I’m wary of the risks facing the business. In a challenging trading environment, there’s a strong chance things could get worse before it’s happy hour again.

I’ll continue to hold my shares for the handy dividend payouts, but I’m reluctant to add more exposure right now. Overall, I prefer the risk/reward profile of other FTSE 100 shares today.