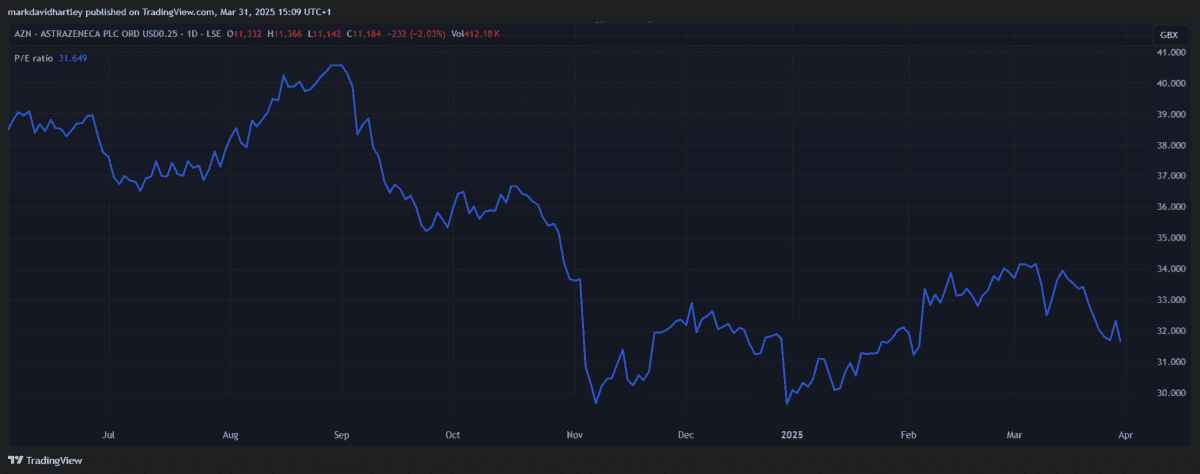

My AstraZeneca (LSE: AZN) shares have made moderate gains of 7% since Christmas — slightly above the 5% gain of the FTSE 100.

A £10,000 investment back then would have returned about £755 (including returns from the 2.2% dividend yield). It’s not much to write home about, but not bad for such a short period.

And it’s certainly a nice change from the 27% drop suffered in late 2024. That came as a bit of a shock, especially since I bought the shares as a hedge against volatility.

Should you invest £1,000 in Burberry Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Burberry Group Plc made the list?

Now, at approximately £11 a share, it’s edging ever closer back to its all-time high of £13.38. But should I keep holding on to them or is more volatility on the cards?

To answer those questions, I need to consider several factors.

Still a safe bet?

I bought the shares as a key part of the defensive segment in my portfolio. As a company that usually maintains steady revenue during times of economic upheaval, it should help keep my profile stable. Defensive stocks play a key role in avoiding risk and securing long-term gains.

But lately, it’s made some unusually large price moves. If it were a strong dividend-payer, this wouldn’t be a huge issue but the 2.2% yield only adds minimal value.

When calculating gains over a decade, these short periods of volatility seem less extreme. It’s up 140% from 10 years ago, when it was trading at £46.45 a share. That’s an annualised gain of 9.19% per year — notably higher than the FTSE 100 average.

But past performance isn’t indicative of future results, so I should dig deeper for answers to my questions.

Recent developments

A few recent developments might help catapult the stock back up to new highs.

On 31 March 2025, AstraZeneca’s Imfinzi treatment for bladder cancer was approved in the US. Trials have shown evidence that the drug could lead to a 25% reduction in the risk of death compared to chemotherapy.

Brazil has also approved the drug but applications in Japan and the European Union remain pending.

Another of its cancer-fighting drugs, Calquence, has received positive reviews from an EU panel. The drug treats a rare type of blood cancer and, when combined with other drugs, could help reduce the risk of death by 27%.

These are both notable developments for the pharmaceutical company, bolstering its chances of more promising growth in 2025.

Financials

With a market cap of £177bn, AstraZeneca is the largest company on the FTSE 100. That in itself makes it a relatively safe investment. Its debt has remained fairly stable around £23bn for the past four years, while its free cash flow has been slowly increasing. And at £62.4bn, its long-term assets far outweigh its long-term liabilities.

However, it might be slightly overvalued with a price-to-earnings (P/E) ratio of 32.3 and price-to-sales (P/S) of 4.2. Both these metrics are above average, which limits room for further growth. There’s a risk the stock could fall this year if the high price deters new investors.

Overall, I’m confident the stock will continue to add defensive qualities to my portfolio, and I think investors looking for the same should consider it.