Many investors are attracted to the stock market by the prospect of generating a healthy level of passive income. But when a high-yielding stock’s also growing rapidly, the potential returns can be even more impressive.

Take M.P. Evans Group (LSE:MPE), the Indonesian palm oil producer, as an example.

Good for income and growth

In respect of its 2024 financial year, the group’s declared a dividend of 52.5p a share, an increase of 17% on the previous year. This means the stock’s presently yielding a very respectable 5.3%.

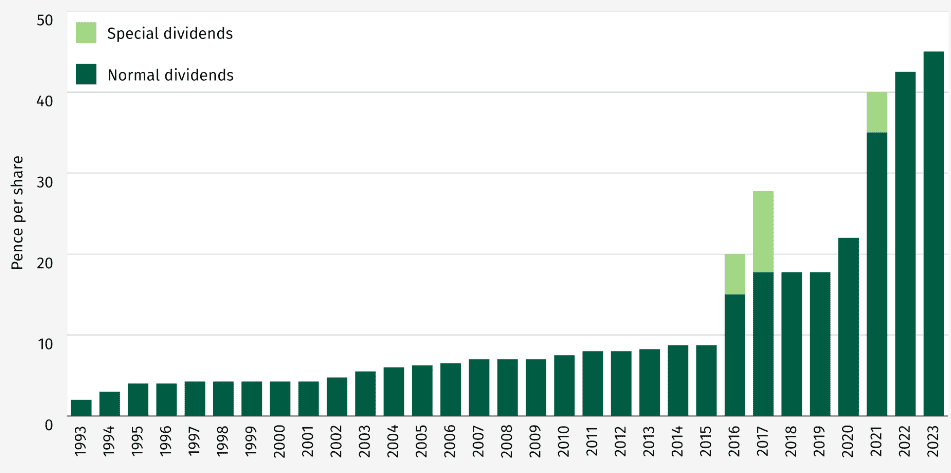

The company first paid a dividend in 1993. Since then, it’s increased (or maintained) its payout every year. More recently — since 2020 — it’s grown by an average annual rate of 24.3%.

Also, over the past five years, its share price has risen by an annual average of 17%.

This is an impressive combination.

Assuming the stock continues to yield 5.3%, and its share price performance over the past five years is repeated for another two decades, a £10,000 investment made today would grow to £649,060. This assumes all dividends are reinvested, buying more shares.

At this point, the stock would be generating annual passive income of £34,400.

However, this type of analysis comes with some health warnings. There’s no guarantee that history will be repeated. Almost inevitably, its rate of growth will slow. And it’s never a good idea to put all of your money into one stock.

But it does give an idea of the potential return available from a high-yielding growth share.

And now could be a good time to invest. That’s because, despite its impressive rate of growth, the company appears to be undervalued compared to its peers, including some of its larger Asian rivals.

In 2024, M.P. Evans Group reported earnings per share of 129.6p. This means its historical price-to-earnings (P/E) ratio is 7.8. In contrast, Sime Darby has a P/E ratio of 13.6. Wilmar International trades on a multiple of 10.1.

Some concerns

But the production of palm oil is controversial. Historical allegations of widespread deforestation and the exploitation of labour have damaged the reputation of the industry. M.P. Evans Group has sought to overcome this by promoting its sustainable credentials. It’s been certified by the Round Table on Sustainable Palm Oil (RSPO).

Also, it’s entered into a number of partnerships with local producers. In return for offering land to the group, members of these cooperatives receive compensation, a wage, and a share of the revenue.

Like other commodities, the price of palm oil can be volatile. It spiked after Russia invaded Ukraine, although it’s been relatively stable since the summer of 2022.

Crucially, weather conditions can affect a crop. In 2024, the group’s production was 1% lower than in the previous year. However, this was more than compensated for by a 13% increase in the average price earned.

Other potential problems include pests, disease, and floods.

But I think the stock has lots going for it.

Palm oil is used in half of the packaged products found in a typical supermarket. And the trees from which it comes are highly productive. The group’s track record of steadily increasing its dividend is also encouraging. On balance, I think it’s a stock that long-term investors could consider adding to their portfolios.