The S&P 500 remains a focal point for investors hoping to navigate a confusing mishmash of political developments and tumultuous markets in 2025.

To get a grip on what’s happening, I’ve looked at the advice of finance gurus from Reuters, Moody’s and the London Stock Exchange Group (LSEG), plus various brokers. They offer a complex and often contrasting view of the market’s potential direction.

Conflicting figures

As Reuters notes, the US economy presents a paradoxical scenario. Despite forecasts of a slowdown in growth for 2025, Wall Street analysts project record-high corporate profits.

Should you invest £1,000 in JD Sports right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if JD Sports made the list?

According to the LSEG, the S&P 500’s estimated earnings per share (EPS) for 2025 stand at a record $269.91. That’s 10% up from last year — and a further 14% is anticipated for 2026.

US politics aren’t helping. Moody’s recently issued a warning about the state of the country’s fiscal outlook, citing worries about trade tariffs, unfunded tax cuts and other economic risks. The federal budget deficit has already increased to $1.8trn, prompting understandable concern among market participants.

Low confidence

In 2024, the US stock market enjoyed a spectacular rally, with the S&P 500 rising 28% to record highs. This momentum was driven by a strengthening economy, lower interest rate expectations and anticipated policy changes from the Trump administration.

Unfortunately, the new year began on a sour note, with trade tensions and overvaluation concerns shaking market confidence.

Compounding these concerns is a notable drop in US consumer confidence. A recent Conference Board survey indicates it’s at its lowest in four years. The tariff situation continues to be volatile and talks with the EU remain unresolved.

What does it mean for the S&P 500 this year?

Analysts offer varied forecasts for the S&P 500’s performance in 2025. Deutsche Bank projects an optimistic end-of-year target of 7,000 for the index, while BMO Capital Markets forecasts a 6,700 target — an 11% gain. These projections are based on expectations of earnings growth and potential Federal Reserve interest rate cuts.

Amid all this uncertainty, some investors are turning their attention to international markets. The FTSE 100, for instance, is projected to potentially outperform the S&P 500 in 2025. This belief is largely supported by favourable valuations and certain UK sectors that may benefit from shifting global economic trends.

JD Sports Fashion (LSE: JD.) is one example of a Footsie stock worth considering in 2025. It’s down 37% over the past year, suggesting it’s now heavily undervalued with a price-to-earnings (P/E) ratio of 11.7. The sportswear market is projected to grow at an annual rate of 6.6% over the next five to seven years, hinting at a potential recovery.

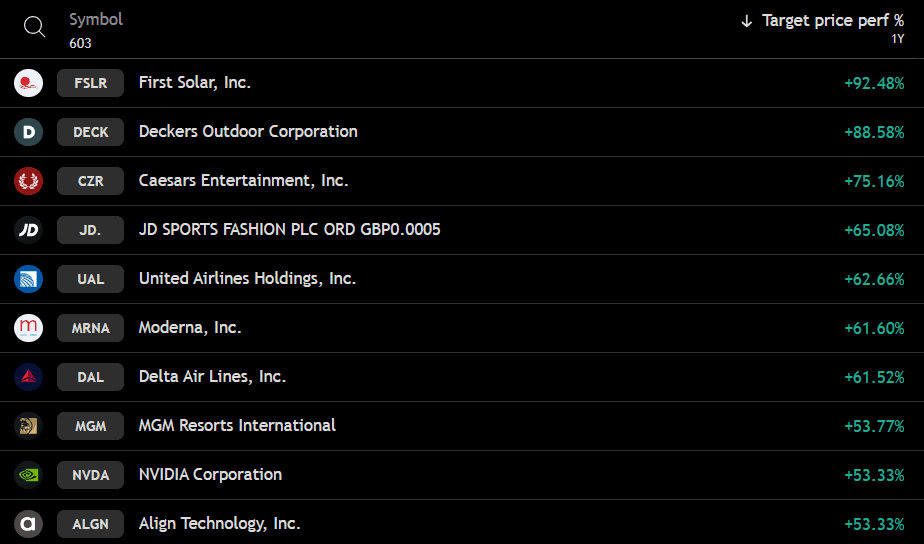

The popular UK retailer is forecast to rise 65% on average in the coming 12 months. That’s higher than 99.5% of stocks on the S&P 500. Only First Solar, Decker’s Outdoor and Caesars Entertainment are expected to perform better.

But challenging market conditions continue to pose a risk, with a 1.5% decline in sales in the recent festive season prompting the company to lower its annual profit forecast. And with Nike accounting for approximately 45% of sales, any disruption in its supply chain could seriously hurt JD’s performance.

But recent acquisitions, such as an 80% stake in Australian retailer Next Athleisure and 80% of Cosmos Sport in Crete, could also drive growth.