There aren’t that many FTSE 100 companies that can claim to have posted £1bn in annual profit. But that’s exactly what this popular high street fashion retailer did when it posted its full-year results this morning.

Next

Next (LSE: NXT) is a well-loved and recognisable high street fashion brand, specialising in clothing, footwear and home products. Established in 1982, the company has grown to become a staple on the UK high street, operating over 500 stores nationwide.

Beyond its physical presence, it’s developed a successful online platform catering to customers both domestically and internationally. The retailer offers a wide range of products, including men’s, women’s, and children’s fashion, as well as home furnishings and accessories.

Should you invest £1,000 in Next right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Next made the list?

For the fiscal year ending January 2025, Next just managed to cross the £1bn profit milestone, posting pre-tax profit of £1.011bn. This equates to a 10.1% increase in annual profits.

Meanwhile, group sales rose by 8.2% to £6.32 bn, driven by expectations-beating sales in the initial eight weeks of the fiscal year. As a result, the company has revised its sales growth forecast for the first half of the year from 3.5% to 6.5%, leading to an anticipated annual growth rate of 5%.

Additionally, the retailer increased its pre-tax profit guidance by 5.4% to £1.066bn.

Tariff chaos continues

In other news this morning, President Donald Trump plans to impose a 25% tariff on all imported automobiles to the US. The announcement sent ripples through global financial markets, with the FTSE 100 taking a minor hit. The UK supports several major automotive manufacturers and related industries, all of which could suffer as markets take on the impact of declining car exports to the US.

Of course car tariffs aren’t an issue for the firm, but while upcoming changes to de-minimis customs thresholds are, they’re expected to have little impact on the company’s overall sales and profits. In the EU, most of the company’s business already runs through a local subsidiary, meaning it won’t be affected by the rule change. The remainder, sold via a UK entity and imported by consumers, will face additional duties from 2028. However, the financial impact is expected to be minimal, with an estimated net cost of under £1m.

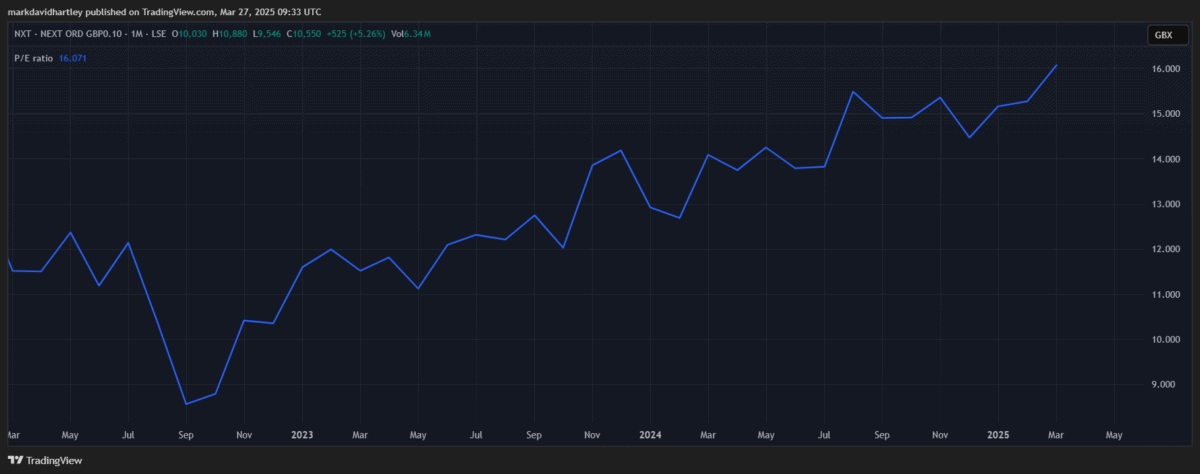

Still, the risk of losses from a broader economic downturn remains a possibility. It’s also moving towards overvalued territory, with a price-to-earnings (P/E) ratio rising from 8.5 to 16. Add to this shifting consumer behaviour and increasing competition from the likes of Marks & Spencer, ASOS and Debenhams Group.

While these specific trade policies may not directly impact the retailer, rising geopolitical tensions and market fluctuations remain a cause for concern. All these factors could influence the company’s overall operations and business conditions.

On the right track

Looking at today’s numbers and financial performance, there are notable signs of strong management and a resilient business model. The company’s successful integration of online and physical retail channels positions it well in the evolving retail landscape.

It’s doing well to reaffirm its position as a leader within the British fashion retail sector. Today’s results reveal its ability to boost sales through market adaptability. Despite the economic challenges, I think this strategic approach, combined with a strong market presence, could equate to a promising future for the firm.

Overall, I think it’s a good stock to consider as part of a portfolio aimed at leveraging UK growth and sidestepping the impact of US trade tariffs.