One UK stock that I’ve been following is Fevertree Drinks (LSE: FEVR). Yesterday (25 March), it jumped 4.4% to 778p after the premium mixers maker released its preliminary 2024 results.

This means the share price is up 16% so far this month, but still down 71% since late 2021.

Should I invest? Let’s look at some details.

Should you invest £1,000 in Imperial Brands right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Imperial Brands made the list?

Recovering profits

Fevertree’s profitable growth came to a shuddering halt in 2022 when the business was hit by surging glass and transatlantic freight costs. Its gross margin fell sharply, causing the share price to plummet.

However, there are signs that things are getting back on track. Group revenue rose 3% at constant currency to £368.5m last year, while core Fever-Tree brand revenue growth accelerated 7% in the second half of the year.

This resulted in full-year brand revenue growth of 4% as the firm capitalised on growing demand for non-alcoholic drinks.

In the key US market, Fevertree recorded impressive constant currency revenue growth of 12%, with the brand outpacing all of its competitors. And it extended its market-leading share in both the tonic and ginger beer categories.

However, UK sales fell 3% due to subdued consumer spending, while there was also softness in Europe. The rest-of-the-world region did much better, growing 22% on a constant currency basis, but it remains a small part of the overall business (around 8% of sales).

Even more encouraging, the company’s gross margin improved by 540 basis points to 37.5%, largely due to lower glass and freight costs. This resulted in adjusted EBITDA of £50.7m, a 66% increase. Normalised earnings per share surged 82% to 28.01p.

The stock currently carries a 2.1% dividend yield.

Potential game-changing deal

In January, Fevertree signed a strategic partnership with Molson Coors, the North American drinks firm that owns beer labels like Carling, Staropramen, and Coors Light.

This grants Molson Coors exclusive rights to sell, distribute, and produce the brand in the US. As part of the deal, Molson Coors acquired an 8.5% stake for £71m, along with the US trading entity for $23.9m.

Fevertree plans to use the proceeds to increase its share buyback programme by £29m, adding to the £71m announced in February.

The company will benefit from Molson Coors’ massive distribution network, with significantly more marketing investment going into the brand. Meanwhile, Molson Coors will manage the on-shoring of US production, reducing exposure to volatile transatlantic freight costs.

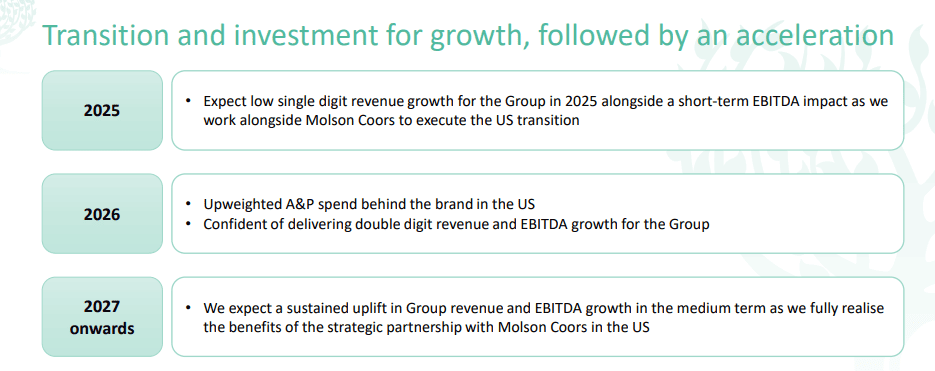

The company will recognise a guaranteed share of profits through royalty fees between 2026 and 2030. And from 2027 onwards, management expects a “sustained uplift in group revenue and EBITDA growth” as it fully realises the benefits of the partnership.

My move

The Molson Coors deal could eventually prove to be a gamechanger for Fevertree’s profitability. If so, the stock today may prove to be a bargain, despite trading at 31 times forward earnings.

However, I’m mindful that consumer spending remains weak in the UK and Europe, while the US could still enter a recession. These are risks to growth here.

Meanwhile, management has warned that 2025 will be a “transition” year, with low single-digit revenue growth and a short-term impact on margins.

I’m not ready to invest in Fevertree yet, but I’m going to keep the stock on my radar. I reckon it has big turnaround potential.