Some say the FTSE 100 lacks good growth stock opportunities, but a glance at the Rolls-Royce (LSE:RR.) share price chart tells a different story. Returns for investors in the aerospace and defence pioneer over recent years have been exceptional.

Under Tufan Erginbilgiç’s leadership, the jet engine maker has roared into action with a remarkable turnaround from its pandemic woes. As the company upgrades its mid-term outlook, Rolls-Royce shares continue to smash through new highs in 2025. Consequently, I’m a very happy shareholder.

Let’s explore the reasons underpinning the stellar performance and where the share price could go next.

Should you invest £1,000 in ITV right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if ITV made the list?

Beating market expectations

Rolls-Royce’s FY23 results were exceptional, but its FY24 earnings might be even better. Operating profit soared 55% to hit £2.5bn, and free cash flow nearly doubled to £2.4bn. The balance sheet has also fully recovered. The firm now enjoys a net cash position of £0.5bn compared to a net debt burden of £2bn the year before.

Furthermore, shareholders were treated to a surprise £1bn share buyback plan for 2025 and the resumption of dividend payments for the first time since Covid-19 almost wrecked the business. Looking at these numbers together, it’s little wonder the Rolls-Royce share price is booming.

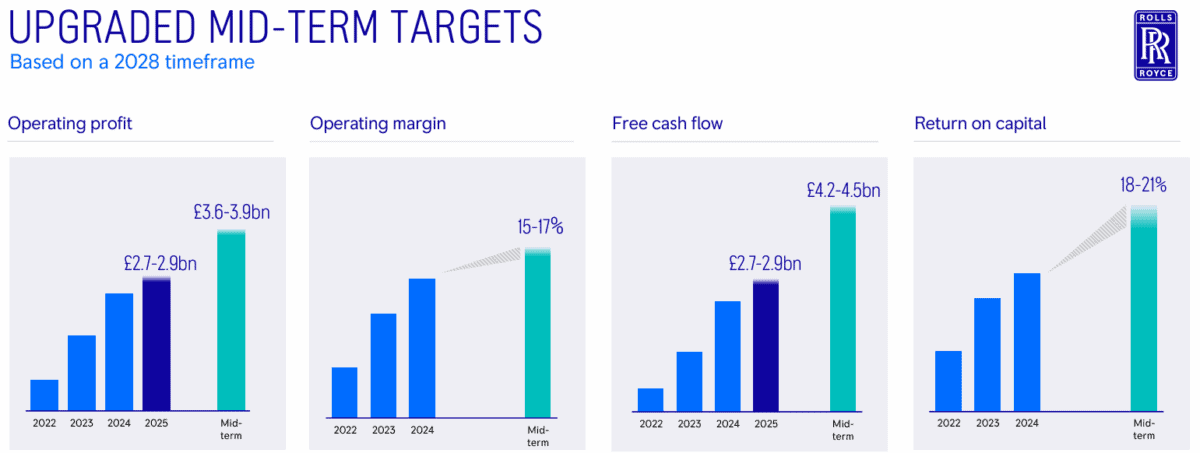

Having achieved some of its 2027 targets two years in advance, the board has also raised its ambitions across a variety of key metrics.

Can the growth continue?

A surging share price has pushed Rolls-Royce’s valuation higher. The blue-chip stock’s currently trading at a price-to-earnings (P/E) ratio of 26.5 and a forward P/E of 36.8. Those aren’t cheap multiples, which raises questions about the future growth trajectory.

However, the company’s forward guidance suggests these concerns might be unfounded. Large engine flying hours are expected to reach 115% of 2019 levels this year, driven by robust international travel demand. That’s crucial considering over 50% of the firm’s revenues comes from the civil aerospace division.

The outlook for the defence arm is equally rosy. Prime Minister Sir Keir Starmer’s committed to boosting UK defence spending to 2.5% of GDP by 2027. As one of the government’s preferred military contractors, this bodes well for Rolls-Royce shares.

Hopefully, we’ll see further good news following the firm’s biggest ever MoD contract win earlier this year. The eight-year deal is valued at £9bn. Rolls-Royce will provide design, manufacturing, and support services for nuclear reactors to power Britain’s submarine fleet.

Technological advances for the power systems unit provide further encouragement. Rolls-Royce has established itself as a market leader in small modular nuclear reactors. Potential growth opportunities for applications in space missions and energy-hungry data centres add another string to the company’s bow.

These reasons for optimism should be balanced against supply chain disruption for Trent 1000 engine parts, which could prevent the business from achieving its goals. In addition, recent technical faults for the firm’s engines raise safety concerns and reputational risks.

What I’m doing

Further growth in the Rolls-Royce share price isn’t guaranteed, but I see few reasons to sell my shares just yet. I’ve enjoyed some spectacular gains from my investment thus far, and I’m hopeful there will be more to come in the future. For investors who don’t own the stock, I think it deserves serious consideration.