The US election took place on 5 November 2024, and, as we all know, was won by Elon Musk ally Donald Trump. £10,000 invested in Tesla (NASDAQ:TSLA) stock two weeks before Trump’s election would now be worth £12,723, representing a significant 27% increase in value over the past five months. The pound is pretty much flat against the dollar over the period, so there’s no need to factor in exchange rate fluctuations.

What’s been going on?

Despite the gains over the period, it’s been a roller-coaster ride for shareholders. Initially, the stock jumped following Donald Trump’s victory in the US presidential election. Tesla CEO, Musk, had publicly supported Trump’s campaign and was seemingly ready to play an important role in the administration — we now know that role is with DOGE (the Department of Government Efficiency).

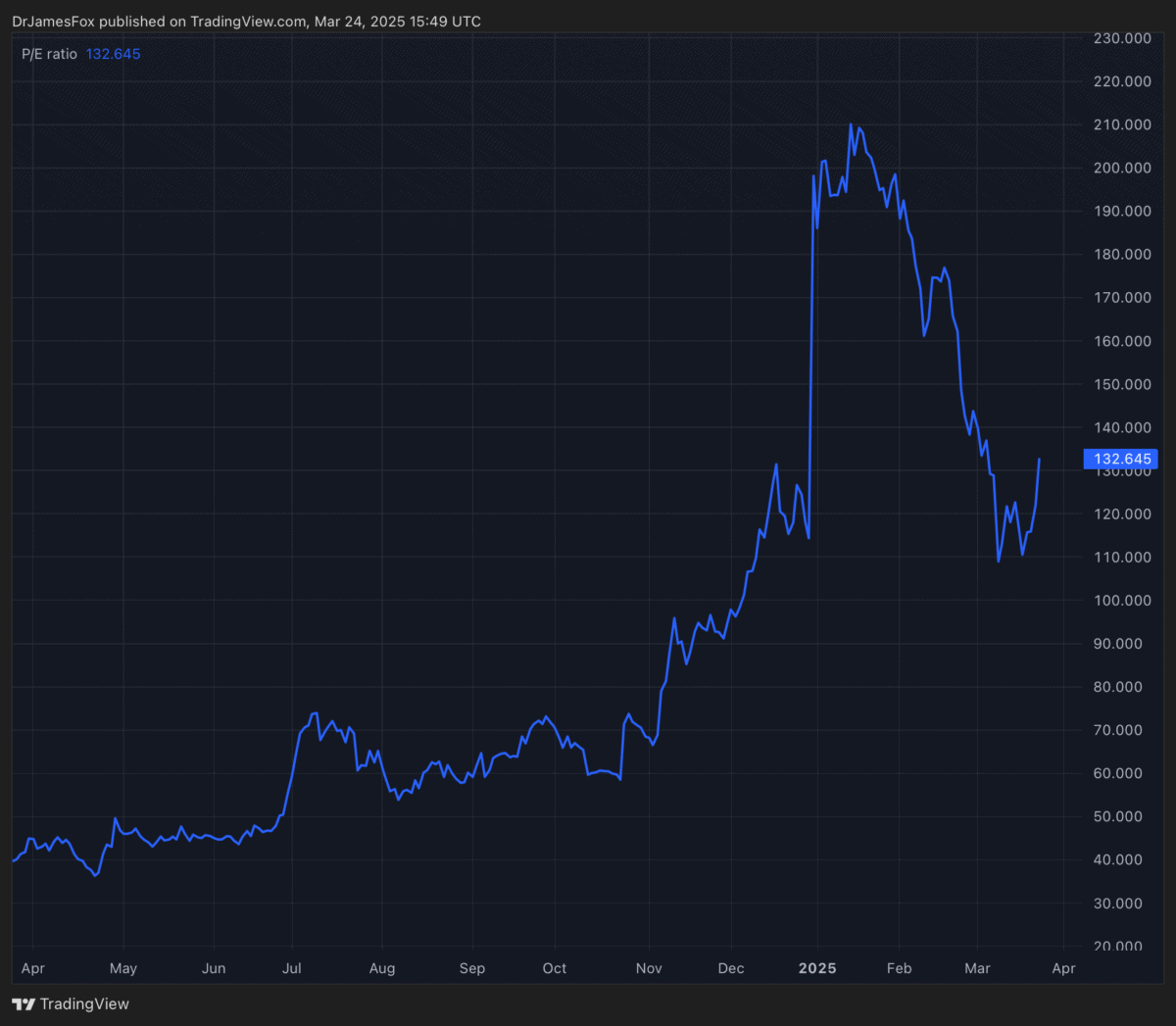

Tesla’s share price rocketed 38% in November 2024, but that was just the start. The stock peaked in December, just 2% below $500 a share. This partially reflected the belief that with Musk part of the administration, he would be able to secure regulatory approval for his autonomous driving project — this is critical to Tesla’s value proposition. What’s more, there was some belief that Trump’s policy would support the US car manufacturing industry.

Should you invest £1,000 in Londonmetric Property Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Londonmetric Property Plc made the list?

The collapse

However, the euphoria was short-lived. Since the beginning of 2025, Tesla’s stock has crashed. To start with, Trump’s tariffs have endangered Musk’s supply chain, with China, Canada, and Mexico first in the firing line. The administration has also become largely unpopular overseas due to its hard bargaining/some may say blackmail.

Illustrating this, Danish pension funds, AkademikerPension, has officially blacklisted Tesla and sold off all its shares in the automaker. While the fund specifically highlighted issues with Musk, it’s worth noting that Trump has demanded the country hand over Greenland to the US.

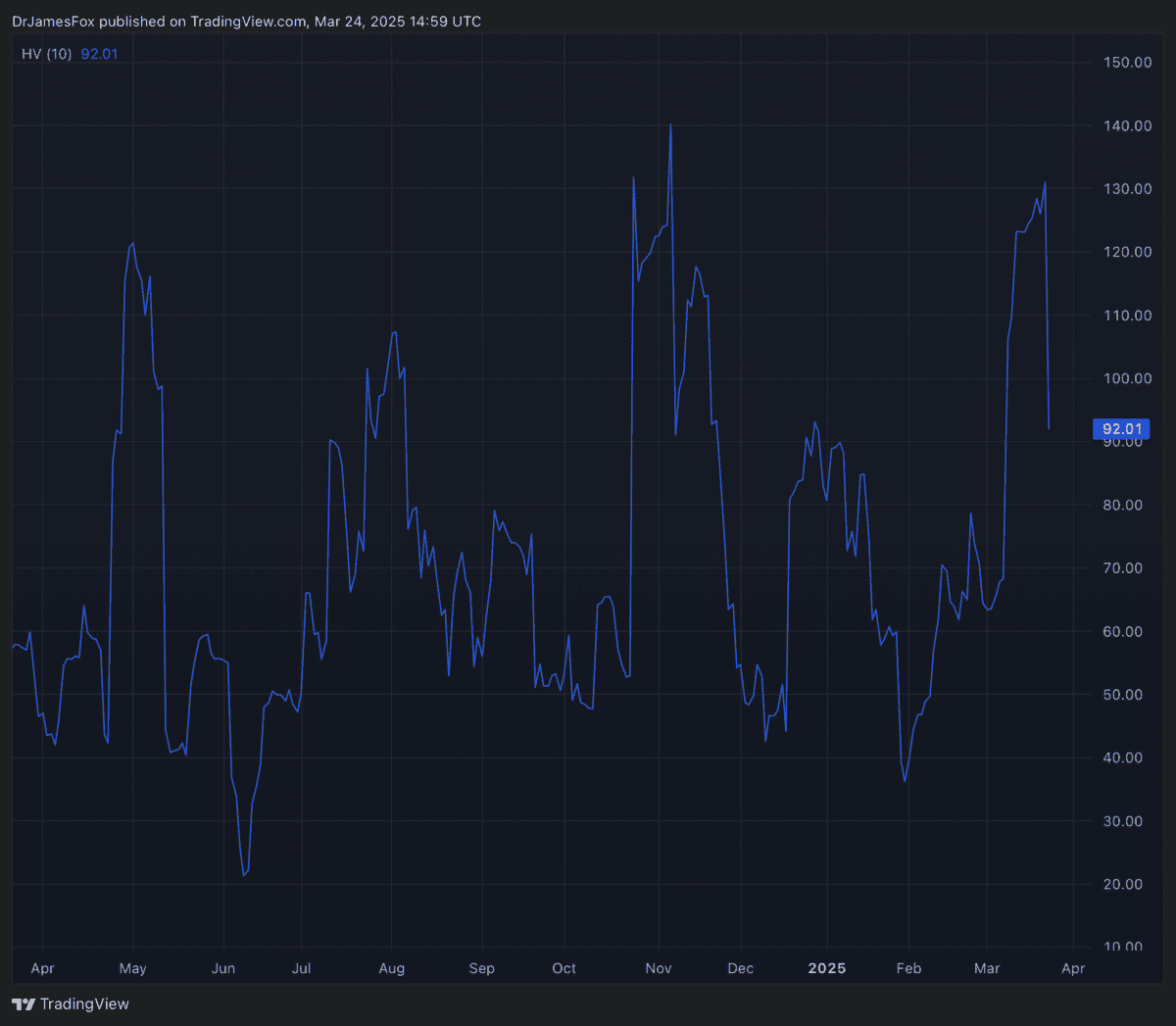

But it hasn’t all been Trump’s fault. Musk has seen his public approval rating plummet in recent months with the often-eccentric billionaire firing huge numbers of federal workers. What I call the ‘Tesla salute’ didn’t go down all that well, either. Sales figures have also disappointed.

Where next?

Despite the recent downturn, it’s crucial to understand that Tesla’s valuation is not based solely on its current financial performance. The company’s price-to-earnings (P/E) ratio has been notoriously high. Tesla stock currently trades at 94 times forward earnings.

The P/E-to-growth (PEG) ratio, which factors in a company’s expected earnings growth, is also exceptionally high at 5.7. This indicates that investors are pricing in substantial future growth, which analysts are yet to quantify, particularly in Tesla’s autonomous driving and robotics divisions.

As such, Tesla’s valuation is largely based on its potential in the autonomous vehicle market and its advancements in artificial intelligence (AI) and robotics. However, for now at least, it does seem to be falling behind its peers. Only time will tell whether Tesla really does have technological dominance here.

Personally, I’d rather Tesla succeeded than its Chinese peers. However, I’m struggling to put my money behind the stock at the current valuation. I don’t expect to invest anytime soon.