Shell (LSE:SHEL) shares are up just 4% over the past 12 months. As such, an investment made a year ago would be worth £10,400 today. However, an investor would have also received around £400 in the form of dividends. So, 8% total returns. Not bad but not great.

What’s been going on?

Shell’s share price gains have been modest, despite the company’s efforts to streamline operations and improve financial performance. This sluggish performance can be attributed to several factors.

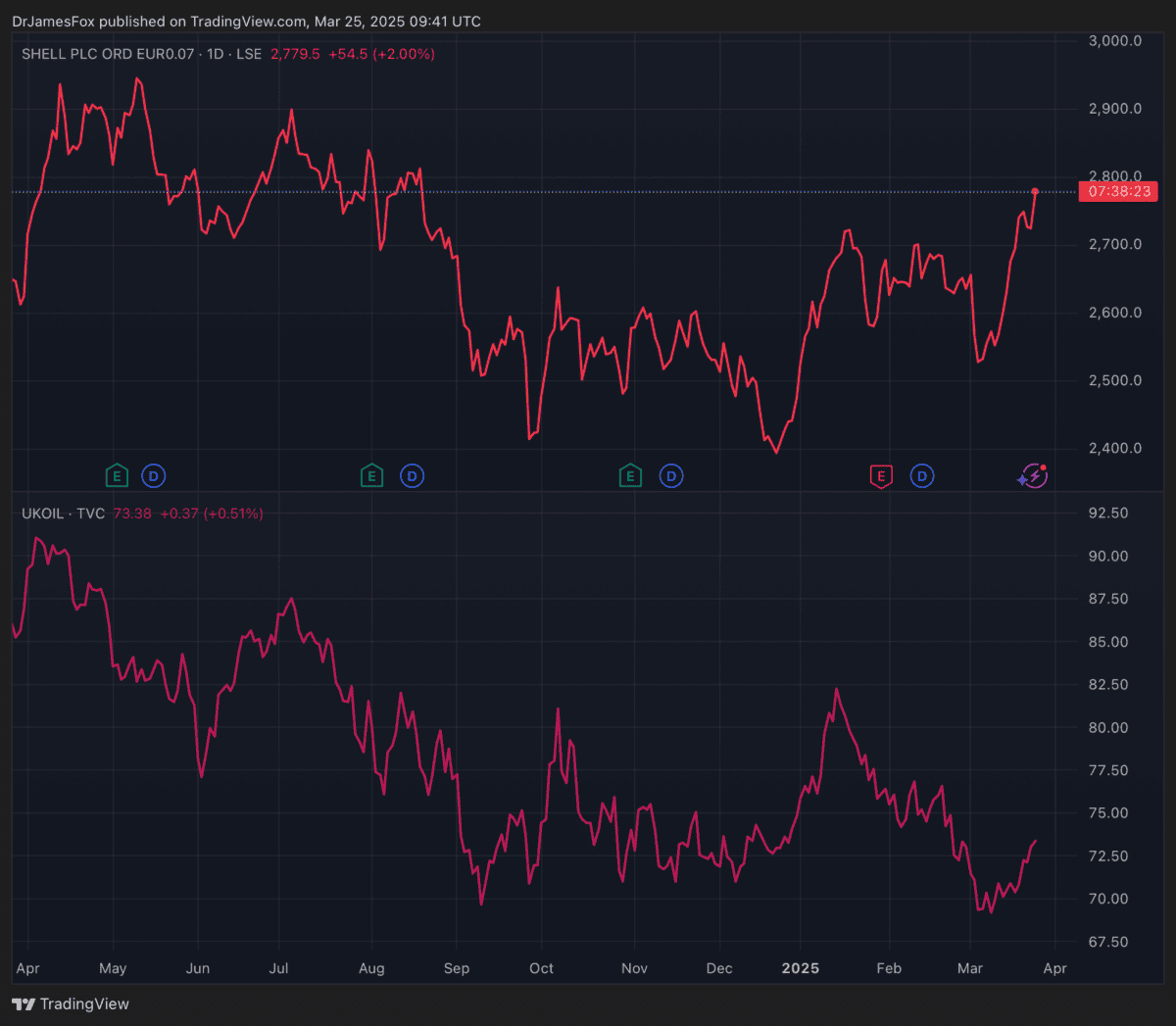

Firstly, oil prices have fluctuated over the past 12 months, but the general direction is downwards. As I write, Brent Crude prices are down 8.5% over the year, and this will have an impact on the bottom line.

Should you invest £1,000 in Shell right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Shell made the list?

While Shell has managed to expand its production by 2%, falling oil and gas prices have also squeezed downstream margins, resulting in a 17% decrease in income attributable to shareholders in 2024. This has dampened investor enthusiasm and limited share price growth.

Macroeconomic uncertainties have also played a role. China, the world’s largest oil importer, has experienced economic slowdowns, creating uncertainty regarding future energy demand. Additionally, geopolitical tensions and the lingering effects of the Russia-Ukraine conflict have contributed to market volatility.

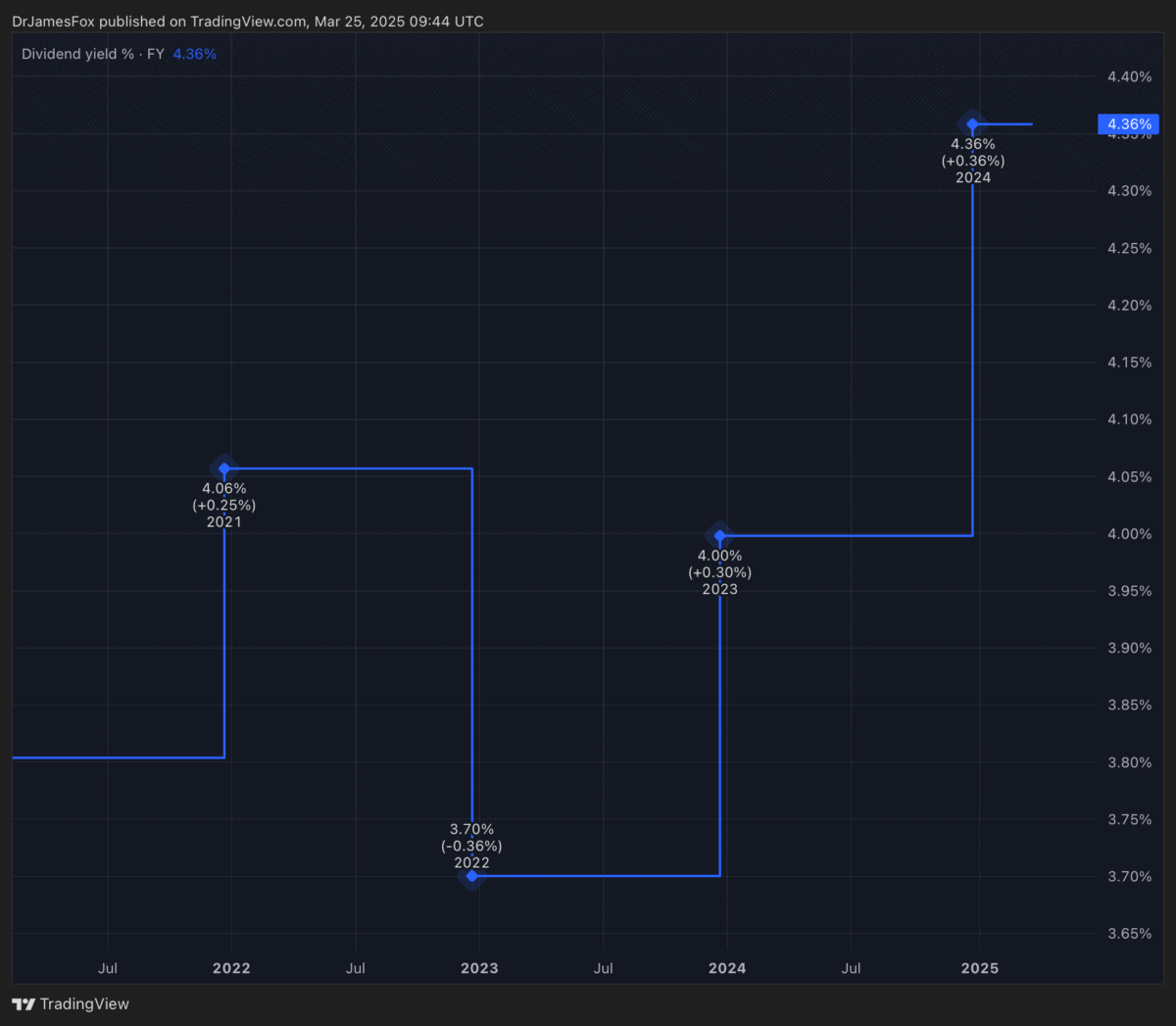

Despite these challenges, Shell has made progress in improving its financial position. The company has reduced its capital expenditure and net debt, while maintaining strong cash flows from operating activities. This has allowed Shell to launch a new $3.5bn share buyback program and increase dividends by 4%.

But what’s next?

Ahead of its Capital Markets Day on March 25, Shell said it would look to focus on delivering more value to shareholders while reducing emissions. The company revealed plans to increase shareholder distributions from 30-40% to 40-50% of cash flow from operations, while maintaining a 4% annual progressive dividend policy.

Shell also raised its structural cost reduction target from $2bn-$3bn by the end of 2025 to a cumulative cost saving of $5bn-$7bn by the end of 2028, compared to 2022 levels. The company also plans to lower its annual capital expenditure to $20bn-$22bn for 2025-2028 — down from $22bn-$25bn — the range for 2024 and 2025 guided back in 2023.

Moreover, the company aims to grow free cash flow per share by over 10% yearly through 2030 while maintaining a stable liquids production of 1.4m barrels per day. Meanwhile, CEO Wael Sawan sees LNG sales growing by 4-5% annually through 2030.

Nonetheless, Shell remains dependent on oil and gas prices. We’re now two months into the presidency of Donald Trump, a man who promised to keep oil prices low. An end to the war in Ukraine, which is also on his agenda, would likely see the normalisation of supply routes and place downward pressure on energy prices.

In short, there are several reasons I’d expect oil, and possibly gas, prices to remain lower over the next year and perhaps through Trump’s presidency. Despite the business lowering capex and raising returns, the broader economic outlook concerns me. That’s why I’m passing on Shell shares for now.