It seems a while ago already that Tesla (NASDAQ: TSLA) was a darling growth stock, with a market capitalisation well north of a trillion dollars. Tesla stock has now lost over half its value from the high point it hit over the past 12 months. It has crashed 42% since the beginning of the year.

However, that still puts it 37% higher than just one year ago – and 729% up over a five-year period.

Back in 2020, Tesla was trading below $100 a share.

Could it get down there again – and if so, ought I to buy some for my portfolio?

Tesla’s growth has been phenomenal – but it may be over

A large part of what has spurred the Tesla stock price has been its outstanding growth story.

This has not merely been a prospect dangled in front of investors – it has been a large-scale business reality.

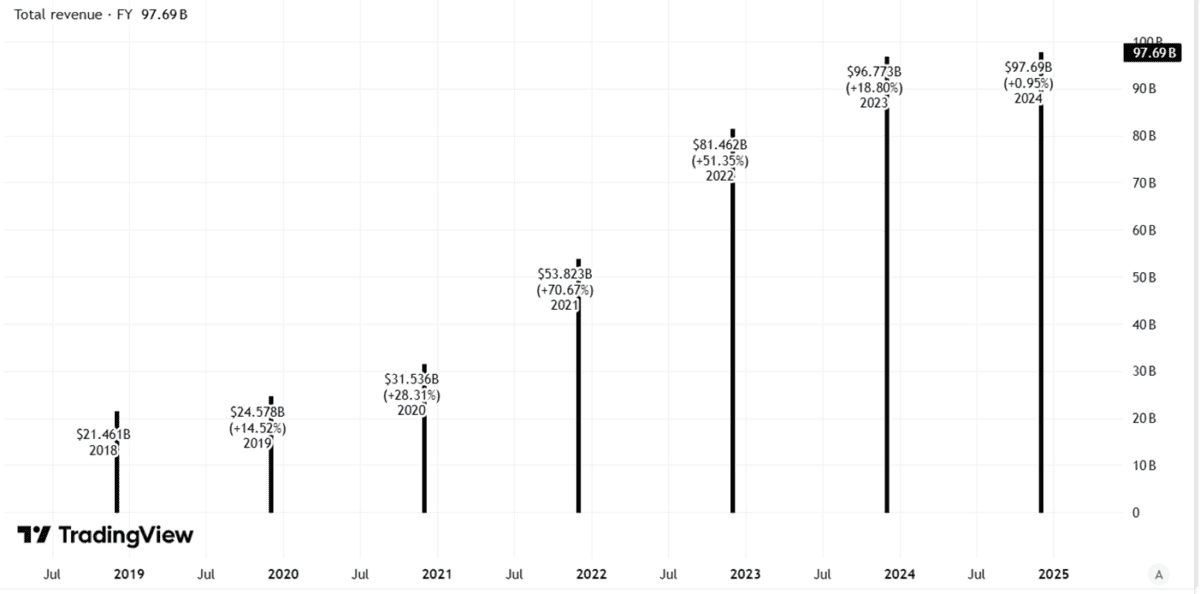

Look at the company’s revenues, for example.

Created using TradingView

It has close to quadrupled since 2020, from a high base.

But last year’s growth of barely 1% was a step change compared to the prior years. It was also the first year when deliveries of Tesla cars declined rather than grew.

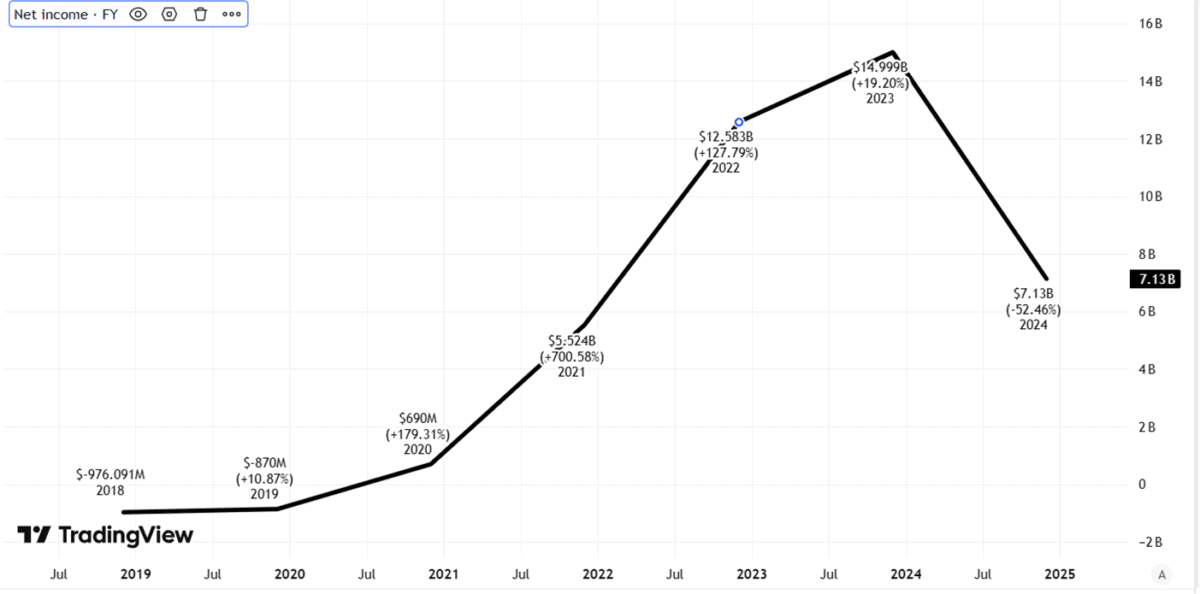

What about profit?

Last year net income was a beefy $7bn. But not only was that less than half the previous year’s number, it also represented an inflection point, as the chart turned from many years of growth to contraction.

Created using TradingView

There could be worse to come. An increasingly competitive electric vehicle market may hurt both sales volumes and profit margins. Add to that the potential impact of Tesla boss Elon Musk’s high-profile political activities and I see a risk that Tesla will report falling sales revenues and weaker profits this year.

That does not mean it is not still a solid business. But Tesla stock soared because investors loved the growth story. If that growth story is over, it could be bad news for the share price.

Tesla looks badly overvalued to me

At the moment, the company trades on a price-to-earnings (P/E) ratio of 116. That looks very expensive to me.

If it was to fall in line with the S&P 500 average P/E ratio of 28 (still hardly a bargain, in my view), that would mean Tesla stock losing just over 75% of its current value. That would take it down to around $57 apiece.

That is if – and I see it as a big if for the reasons I explained above – Tesla can even maintain earnings at last year’s level.

I’d like to invest, at the right price

Still, Tesla has confounded critics for years and may keep doing so.

The firm has a large following among investors, has built an incredible business at speed and could continue growing. It has a strong brand, large user base, and financially attractive vertically integrated manufacturing and sales model.

On top of that, its power generation business looks set to keep growing at pace.

I see a case for the price crashing well below $100. For now, I think Tesla stock still looks badly overvalued. But if it got cheap enough, I would happily start buying.