Alphabet (NASDAQ:GOOGL) shares are on my watchlist. The stock’s fallen 11% over the past month and even more from its early February highs. Because of this dip, the stock’s one-year performance is now just 10%.

As such, £10,000 invested a year ago would now be worth just under £11,000. That’s also factoring in the fact that Alphabet shares are denominated in dollars and the pound has appreciated slightly over the past year.

Clearly, this isn’t a bad return. However, while Alphabet lacks the sparkle of some of its mega-cap, big tech peers, I’m starting to wonder if it’s a little overlooked.

Should you invest £1,000 in Alphabet right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Alphabet made the list?

What the data tells us

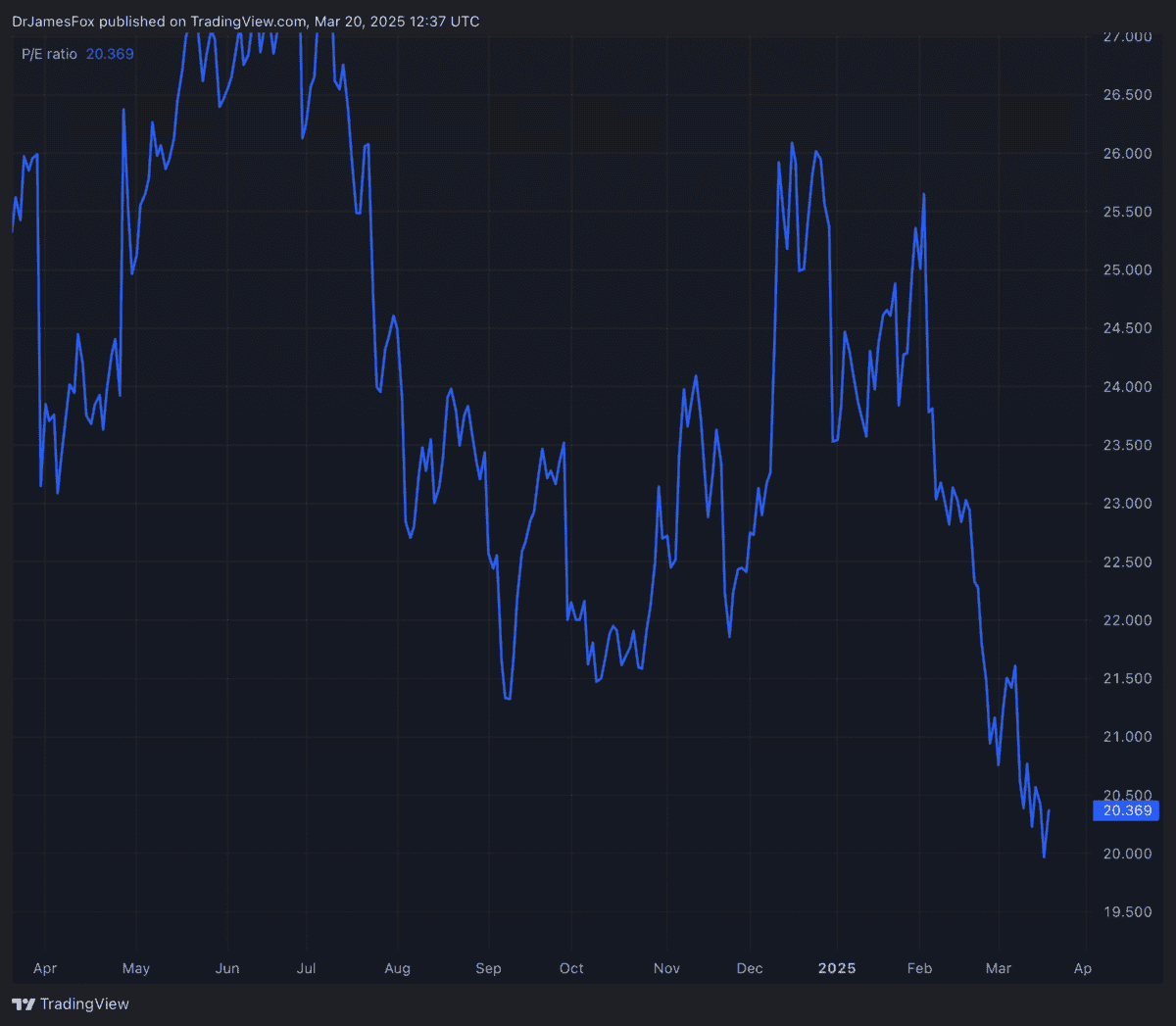

Let’s start with the boring but most important part. In terms of valuation, Alphabet’s forward price-to-earnings (P/E) ratio is 18.3 times, which does represent a significant premium to the communication services sector average (13.3 times), but a discount to the information technology sector average (21.8 times).

It’s also the cheap ‘Magnificent Seven’ stock, based on the forward P/E ratio. The closest peer is Meta, at 23.5 times.

Alphabet’s price-to-earnings-to-growth (PEG) ratio is also a key sign of an undervalued stock. Currently, Alphabet’s PEG ratio stands at 1.10, which is lower than the communication service sector median of 1.27 and information technology sector 1.67. The metric’s achieved by dividing the forward P/E ratio (18.3) by the expected earnings growth rate. Interestingly, this is also the second-cheapest PEG ratio among the Magnificent Seven, with the exception of Nvidia.

This combination of a solid cash position, manageable debt, and attractive valuation is certainly appealing to me. Alphabet has $95.6bn in cash, though its recent purchase of Wiz might have slightly reduced this. Total debt current sits at $28.1bn.

Catalysts and risks

Alphabet’s a tech giant with its business strength coming from its dominant position in digital advertising. It controls more that 90% of the search market share, and continues to see growth is YouTube and Google Cloud. Collectively, its diversified revenue streams, including cloud services and hardware, provide stability amid sector shifts.

Catalysts include Waymo’s expansion, including key markets like Tokyo and Silicon Valley, marking its first international foray and scaling autonomous ride-hailing services. Partnerships with Uber and plans to increase rides from 200,000+ a week highlight near-term growth potential.

Long-term prospects include the business’s investments in quantum computing. Alphabet’s Willow processor recently demonstrated breakthroughs in error reduction and processing speed, though commercialisation remains years away. And while there are plenty of small competitors in this sector, I’m backing a mega-cap stock like Alphabet to be the first to commercialise the technology.

However, risks loom from regulatory scrutiny (antitrust cases), artificial intelligence (AI) competition and high capital expenditure, which could put pressure on profitability. What’s more, Google Cloud’s slower-than-expected growth and quantum computing’s unproven practicality add uncertainty as we look further into the future. Tesla will also be a major competitor in autonomous ride-hailing when it catches up.

Nonetheless, I’m still considering adding this stock to my portfolio. In addition to the above, the Relative Strength Index — a technical indicator that measures share price movements — suggests the stock’s close to ‘oversold’ territory.