Measured over any time frame, the Relx (LSE: REL) share price has lived up to its reputation for being a growth stock. Driving the momentum over the past couple of years has been its growing AI offerings. But I am starting to see some potential chinks in the armour that could derail its rise.

Diversified business model

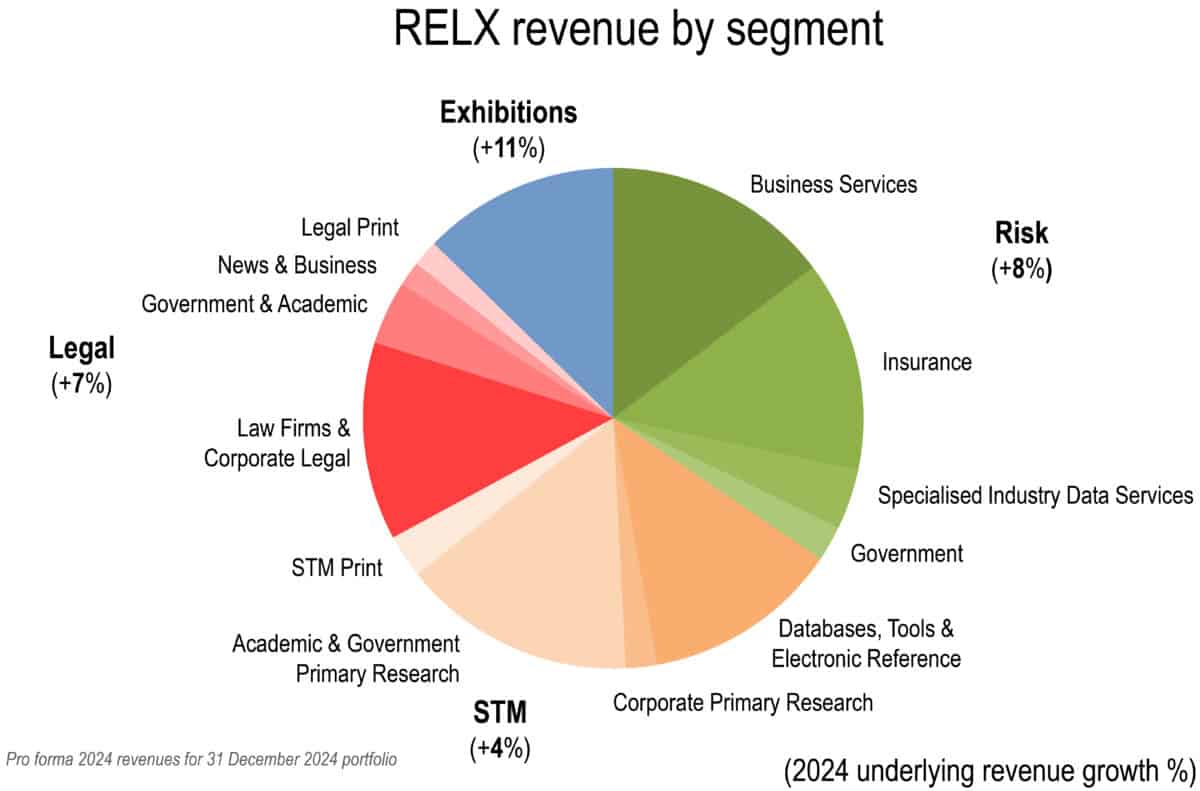

Relx is an information and data powerhouse. Virtually every knowledge sector of the economy relies on its analytics and decision-making tools. This includes government, law, academia, science, and insurance. The figure below highlights the sheer diversity of its revenue streams is highlighted.

Source: Relx presentation

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

One area that has seen tremendous growth is its legal offering. Lexis+AI is helping lawyers automate their workflows.

The business has a distinct competitive advantage here. Its databases host over 161bn legal documents and its AI model is back checked against the legal citation service, Shephard’s. This ensures that its content remains accurate and up to date, a given for any lawyer.

Scientific journals

Another area that’s seen explosive growth is in the Scientific, Technical and Medical (STM) division. Primary academic research and publications has seen incredible volume growth. In FY24, the number of articles submitted across the portfolio grew by over 20%, and the number of articles published was up 15%.

The sheer volume of published article growth since Covid has not gone unnoticed in the academic community, though. Many are beginning to question whether volume is more important than quality. The issue of scientific or research fraud has shot up the agenda.

Scientific fraud

Last December nearly every member of the editorial board of the pre-eminent Journal of Human Evolution resigned from Elseiver, the company’s publishing arm. They cited a dramatic downturn in quality as the main reason.

Something is clearly afoot here. In a recent open letter, a group of scientists accused Springer Nature of failing to “protect…scientific literature from fraudulent and low quality” research.

So what?, you might say. Why does this matter to a company with a market cap of £70bn, one of the largest in the FTSE 100?

Evolving subscription model

The traditional payment model for academic output involves institutions (such as universities) paying a flat fee for a bundle of journals. However, this model is being rapidly supplanted by open access models.

The description ‘open access’ is something of a misnomer. What the industry calls ‘processing charges’ have become standard. A quick look at Open Access Oxford quotes anywhere as much as £10,000 per paper. Although Relx does not report on such fees, estimates are that they were $583m in 2023.

My fear is that the entire business model propping up a huge slice of the company’s revenues is simply not sustainable. A model based purely on article volume will inevitably lead to a dilution of quality.

All this matters to a company with some very rich valuation metrics. Its trailing price-to-earnings ratio currently stands at 37; price-to-book is 20. The stock is priced for perfection. Its share price could be clobbered if growth slows.

For me, I see little margin of safety here, and therefore I am staying well clear for now.