As the new tax year rapidly approaches, many UK investors will be considering how to allocate assets in their Stocks and Shares ISA.Taking into consideration the multi-faceting geopolitical storm that’s brewing, a delicate approach may be the best option.

After a good start to the year, the US trade war has thrown a spanner in the works. This adds to an already fraught economy hit by conflicts in Ukraine and the Middle East. The result is widespread fear and uncertainty, leading to volatility in markets. Such an environment requires a more cautious approach.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Should you invest £1,000 in Gsk right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Gsk made the list?

ISA allocation

Last year, I focused heavily on dividend returns. Prices were low and forecasts looked good, offering the perfect environment to capitalise on discounted shares with high yields. Now, the market has shifted considerably. The Footsie it near all-time highs, the S&P 500 is in freefall and tariff uncertainty threatens even more chaos.

When things get wobbly, I head for the bunkers — that is, the calm, warm embrace of defensive stocks. While I always hold some defensive stocks in my portfolio, I plan to add more weight to them in the coming months.

My top UK defensive stocks for 2025

Defensive stocks (not to be confused with defence stocks) are those which protect a portfolio from unwanted volatility. Recently, many portfolio’s focused on US tech stocks took a hit. Last week, the five worst-performing stocks in my portfolio were US tech stocks.

Luckily, my defensive UK shares helped keep things things afloat. Here are five that I think risk-averse investors should consider: Unilever, Tesco, AstraZeneca, British American Tobacco and GSK (LSE: GSK).

These blue-chip stocks all share similar characteristics. They have large market-caps, are well-recognised businesses with a dominant market position and enjoy consistent demand.

The caveat is that they seldom experience spectacular growth and are often considered ‘boring’. They’re unlikely to make anyone rich overnight — but equally, they’re unlikely to leave anyone broke.

They are simple, solid, and reliable.

One example

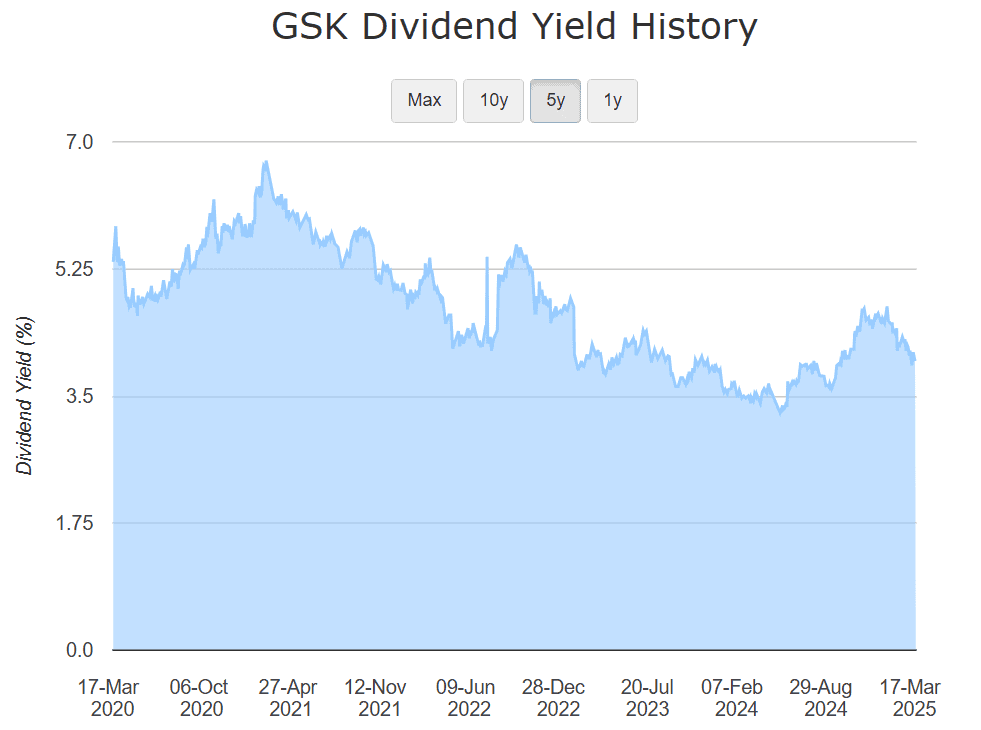

Let’s take the popular multinational pharmaceutical company GSK as an example. It tends to focus on dividends more than growth, so the price has seen little action in five year (up 4.6%).

However, it pays a reliable and consistent dividend with a yield between 4% to 6%.

In 2022, the post-Covid market decline combined with the Zantac lawsuit wiped 27% off the share price in a matter of months. Consequently, it was forced to reduce dividends by 27.8%. Prior to that, they had held steady at 80p per share for eight years.

In the same year, it demerged its Consumer Healthcare business to form the company Haleon. Now, GSK focuses purely on pharmaceuticals and biotechnology.

During periods of high inflation, cash-strapped consumers often opt for cheaper alternatives. Offloading its consumables division may help it avoid losses in the event that inflation rises again.

But now another risk looms. The Trump administration’s appointment of vaccine-skeptic Robert F Kennedy Jr could impact GSK’s bottom line. It’s heavily-focused on vaccine development and the US is one of its largest markets.

Still, through it all, it’s maintained a steady price and decent dividend. That type of resilience makes for a good defensive stock to consider.