Tension and confusion over US plans for major new trade tariffs are putting stock markets in a tailspin. The FTSE 100 leading index of shares has dropped 281 points in just over a week to 8,590 points.

This is no surprise. Tariffs often disrupt global supply chains, increase production costs, and put the dampener on consumer and business spending.

Yet the potential impact won’t be the same for all Footsie companies. New import taxes could be a major problem for Rolls-Royce, for instance, given its complex supply chains and dependence on foreign markets. Yet the impact on domestic utilities shares like National Grid could be more negligible, given their focus on the UK and the essential services they provide.

Should you invest £1,000 in Cineworld right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Cineworld made the list?

With this in mind, here are two more FTSE 100 shares to consider in the current landcape.

1. Coca-Cola HBC

Coca-Cola Hellenic Bottling Company‘s (LSE:CCH) non-US operations provides great protection from the threat of Washington-led trade tariffs.

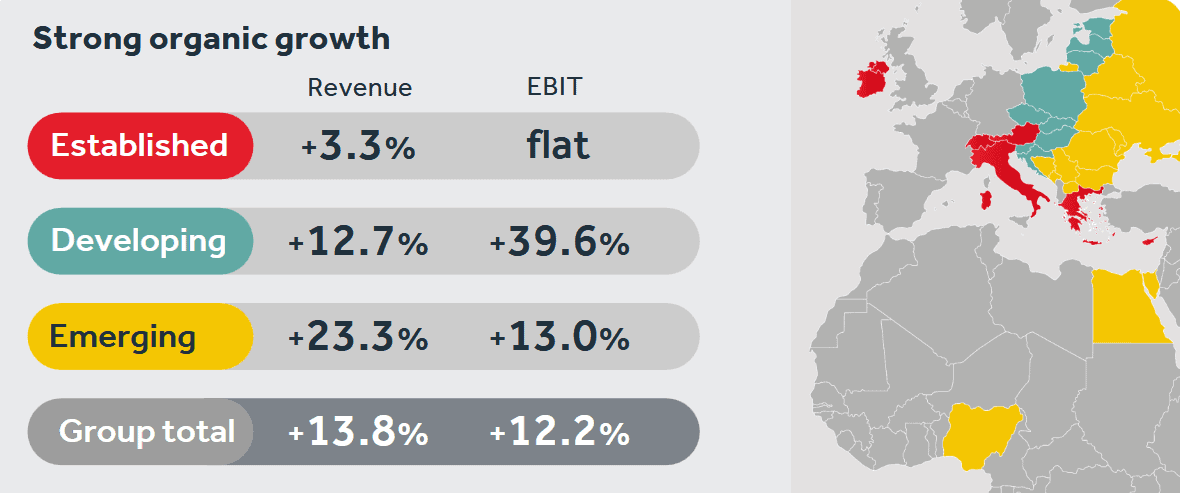

As you can see, the business focuses its efforts on the developed and fast-growing territories of Africa and Europe. This regional mix provides an added bonus too. As you can see, substantial exposure to emerging and developing markets is supercharging sales and earnings growth.

Trade wars may have wider economic implications for Coca-Cola HBC’s markets. But I’m not expecting this to have a substantial impact on consumer demand, reflecting the star power of drinks brands like Coke, Fanta and Sprite.

I’m more concerned about the highly competitive environment that the company operates in. Pressure from the likes of PepsiCo and Nestle is a constant threat to sales volumes and margins.

That said, I’m confident that Coca-Cola HBC on balance can keep delivering the goods, supported by its packed portfolio of heabyweight labels and strong record of innovation.

2. Fresnillo

Precious metals stocks like Fresnillo (LSE:FRES) could be among the greatest beneficiaries of US-led trade tariffs.

Import taxes could elevate inflation and slow the global economy, both of which are historical price drivers for gold and silver.

The US dollar could also continue to weaken should tariffs hammer the American economy more specifically. This naturally boosts demand for dollar-denominated commodities by making them more cost effective to buy.

Estimates from the National Institute of Economic and Social Research (NIESR) illustrate the scale of the potential damage. They think fres trade wars could boost US inflation by 3.5-5% over the next two years. It also suggests US real GDP could be up to 4% lower than it would be without new tariffs.

Fresnillo isn’t completely without risk though. Silver’s used for a wide array of industrial applications, and so its demand is heavily sensitive to broader economic conditions.

But weakness here could be offset by strong investment demand for silver, reflecting the metal’s safe-haven properties. The Mexican miner’s gold sales would also likely rip even higher if the economy tanks.