Choosing income stocks has never been easy. And with so much global uncertainty it’s hard to know which sectors or companies are likely to maintain their earnings and dividends.

On paper, companies with an international footprint should do better as they’re less vulnerable to a slowdown in one particular territory. But with President Trump’s erratic approach to tariffs, it’s unclear who the short-term winners and losers will be in the global marketplace.

Then there’s the threat of competition. Due to clever technologies, traditional barriers of entry are now easier to overcome than previously.

Should you invest £1,000 in Jersey Electricity Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Jersey Electricity Plc made the list?

And if that’s not enough to contend with, the arrival of artificial intelligence is threatening to disrupt traditional industries. Some companies may be left behind as they fail to embrace what has been described as the fourth industrial revolution.

For these reasons, picking dividend stocks can be a bewildering experience.

However, there’s one company that I recently came across that doesn’t have to cope with any of these problems. And because of its healthy dividend, I wonder whether Jersey Electricity (LSE:JEL) is a perfect income stock.

A finger in many pies

When it comes to electricity, there’s not much the company doesn’t do.

It oversees the import of electricity from France, generates power using its solar arrays, operates the transmission and distribution networks across the island, provides metering services to domestic and commercial customers, sells white goods and provides consultancy services. Because it has no competitors for the supply of electricity, there’s less pressure to innovate.

Approximately 95% of the energy needs of Jersey are met by importing power from France. The interconnector between the two jurisdictions is jointly owned with Guernsey Electricity. The balance of electricity for the island is purchased from local generators, with a tiny proportion produced by the company itself. With no exports, it will never have to worry about Trump’s tariffs.

To my surprise, although having monopoly status, the company isn’t directly regulated. However, its activities are overseen by Jersey’s competition authority and the island’s government is the largest shareholder. But customers enjoy lower prices than their counterparts in mainland Britain.

A closer look

With limited opportunities to expand its customer base, its earnings will be heavily dependent on the amount charged by EDF in France. But Jersey Electricity knows that if its costs are rising, these can be passed on to customers via higher tariffs.

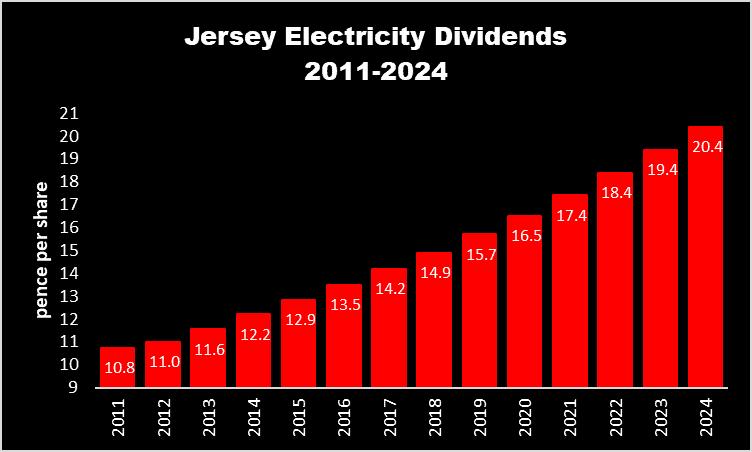

This certainty over earnings means dividend has been reliable. And as the chart below shows, it’s increased its payout for 13 consecutive years. The stock presently yields a very respectable 4.8%.

Based on its 2024 accounts, its price-to-book ratio is only 0.2. In theory, if the Jersey government wanted to buy the 38% of the company that it doesn’t own — assuming it offered a fair price — it would have to pay shareholders more than the current (10 March) value of their shares.

What’s not to like about this stock? Well, with a market cap of just over £50m, it lacks the financial firepower to withstand a major shock. And I can’t see its share price growing significantly.

But principally due to is lack of exposure to the outside world and its healthy dividend, I think it’s a stock that income investors could consider adding to their long term portfolios.