One fascinating share I find in the stock market today is Joby Aviation (NYSE: JOBY). It’s at $6.60 after rising 24% over the past year, but has fallen 35% since hitting $10 in January.

Here’s why I think it has the potential to produce big returns over the next few years.

eVTOLs

Joby Aviation is leading the race to commercialise electric vertical take-off and landing (eVTOL) aircraft. More commonly known as flying electric taxis, they can take off vertically like a helicopter, which means no need for lengthy runways. Unlike helicopters, they fly quietly like a drone.

Should you invest £1,000 in Ocado right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Ocado made the list?

Joby’s aircraft currently has a 100-mile battery range and carries four passengers and a pilot, reaching speeds of up to 200mph. They offer an emission-free alternative for regional transport.

For example, an eVTOL can fly from JFK Airport to Manhattan in about 7 minutes, compared to 60–90 minutes by car, saving passengers up to 80 minutes of travel time. The company is building vertiports for airport routes first to target this low-hanging fruit.

Last year, the firm signed a six-year exclusive deal to launch air taxi services in Dubai, starting in 2026. A flight from Dubai International Airport to Palm Jumeirah could take just 10 minutes, compared to 45 minutes by car. Its partners have broken ground on the first vertiport in its Dubai network.

To start with, Joby will offer Uber Black pricing at a per-seat-mile basis. Then it plans to eventually drive prices down to the level of UberX, which is the budget-friendly service. Given the amount of wealth in Dubai, I doubt demand will be a problem!

Blue-chip backing

Speaking of Uber, Joby bought the ride-hailing giant’s eVTOL venture in 2021. As part of the deal, Uber took a stake and agreed to integrate their services, meaning Joby’s air taxis will be accessible via Uber’s app.

Another partner is Delta Airlines, which plans to integrate the service into its app to ferry passengers between airports and urban centres.

Finally, there is Toyota. The automaker recently made another $500m capital commitment, bringing its total investment in Joby to almost $1bn. It is working closely with the firm on manufacturing and certification.

Another thing to note is that Joby recently delivered its second aircraft to the US military. eVTOLs have defence applications.

Certification

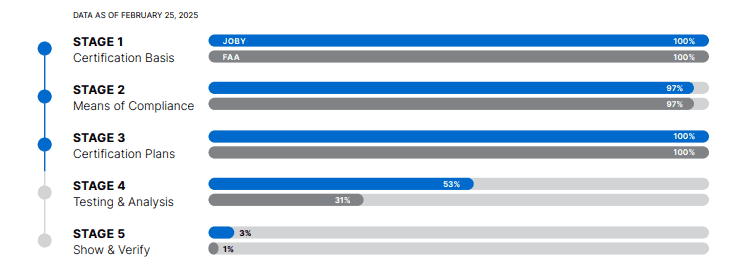

Joby is currently progressing through the fourth of five stages to get the aircraft certified. It expects this to be completed by late 2025 or early 2026. So a delay (or worse) is probably the biggest risk here right now.

Another challenge would be weak consumer demand, though a recent Honeywell survey found that 98% of US airline passengers would consider taking an eVTOL.

A positive here is the balance sheet. At the end of 2024, it had $933m in cash, no debt, plus the additional $500m commitment from Toyota. At the current cash burn rate, this $1.4bn should easily see it through to commercial operations.

More cash will then be needed, though I doubt Toyota will abandon its $900m investment. Funding therefore shouldn’t be an issue, though shareholder dilution could be.

Foolish takeaway

Joby is pioneering flying taxis and they have massive disruptive potential. But it’s pre-revenue, making the stock highly speculative. This means it’s only suitable for risk-tolerant investors with a long-term horizon to consider.