Investing inside a Stocks and Shares ISA can be a brilliant way to build tax-free wealth. With money deployed regularly and wisely, someone can potentially build a sizeable portfolio over the long run.

Here, I’ll consider how much a 35-year-old could have by retirement investing £700 a month in an ISA.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Should you invest £1,000 in Scottish Mortgage right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Scottish Mortgage made the list?

Ingredients

Boiling things down, I think there are three main ingredients for building wealth in a Stocks and Shares ISA.

Firstly, there are regular contributions. Consistently investing over time allows someone to benefit from compounding while also smoothing out natural market gyrations. While £700 a month might not sound a lot, it is easily enough to build wealth, as we will see.

Next is a solid rate of return. By investing in a diverse set of quality assets (including stocks, investment trusts, and ETFs), I think a 10% annual return after fees is achievable. While not guaranteed, this return would be broadly in line with the global investment fund average, as well as that of the average Stocks and Shares ISA account.

Of course, this is just an average. In reality, markets fluctuate, which leads me to the final ingredient for success. That is time in the market. Again, this is crucial for a portfolio to compound, while also allowing investors to take advantage of bear markets (investing when stocks are temporarily cheaper).

Getting immediate AI exposure

In my eyes, a great stock to consider as part of a diversified ISA is Scottish Mortgage Investment Trust (LSE: SMT). The aim of this popular FTSE 100 trust is to find and invest in exceptional growth companies.

Now, I should mention straight away that the share price can be very volatile. For example, it has fallen 14% inside the last month due to a tech stock sell-off and uncertainty around President Trump’s tariffs.

There’s a risk these factors could worsen over the coming months. Also, Scottish Mortgage has stakes in private companies, which can be hard to accurately value.

Zooming further out though, the stock is up around 270% in a decade. This shows how it’s suitable for long-term investors who can tolerate stomach-churning periods of volatility.

One reason I like the trust is that it offers diversified exposure to a number of companies that are benefitting from the generative artificial intelligence (AI) revolution. This technology has the potential to make some firms much more profitable by boosting automation.

Our enthusiasm and conviction about the change that generative AI can bring over the next five to ten years has probably never been higher.

Lawrence Burns, portfolio co-manager

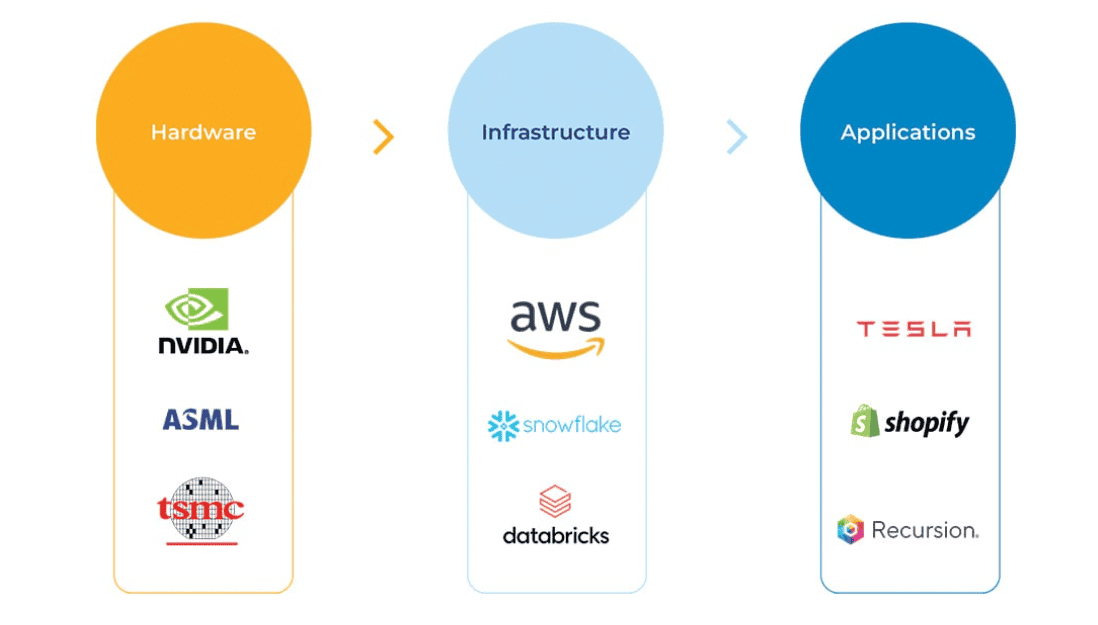

Scottish Mortgage’s portfolio’s has three layers of AI exposure. There is hardware, which includes chip manufacturers. Then there are infrastructure companies helping others use and access AI (cloud platforms like Amazon Web Services). Finally, there is the application side, where businesses are using AI as part of their commercial products.

Below are some of the trust’s main holdings spanning the three AI layers.

With the shares currently trading at a 12% discount to the fund’s underlying value, I think they’re definitely worth considering.

Putting all this together then, £700 invested each month by a 35-year-old would result in a £1,952,479 — £1.95m! — portfolio by retirement. This assumes the 10% return and that any dividends received are reinvested.