FTSE shares often attract value investors due to the UK stock market’s relative underperformance and appealingly low valuations. Compared to the US, many British companies trade at a price significantly below their fair value.

For investors targeting undervalued companies with strong growth potential, the UK market is rife with opportunities.

Seeking value

On average, UK shares tend to have low prices compared to their reported earnings. There may be a few reasons for this but the main one is the lure of American stocks. The rapid gains of big tech companies have proved irresistible to British investors for many years now.

Should you invest £1,000 in ITM Power right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if ITM Power made the list?

But before we get ahead of ourselves, there are certainly some highly valued shares on the Footsie. Since Brexit – and even more so, Covid – several top-quality companies have enjoyed spectacular price growth. Rolls-Royce being a prime example, but let’s not forget Games Workshop and 3i Group.

So, when searching for value, we need to consider a few factors.

The dividend angle

One of the best ways to extract value from low-priced shares is through dividends. As prices fall, yields rise and many FTSE shares are now over 10%. Investing in an undervalued stock with a high yield can be a great way to secure lucrative passive income for a small price.

But if the price keeps falling, it’s all for nothing. Especially if that money could have been directed to a growth stock offering better returns in the long term.

So how can I uncover a high-yield dividend stock that isn’t going to tank?

Why is it cheap?

Asky why a share is cheap is the most important question to ask. It may seem illogical, but many FTSE shares are cheap for no good reason. This is where value lies.

Consider the popular UK pub and hospitality chain, JD Wetherspoon (LSE: JDW). During Covid, it was hit hard, reporting its first loss in 36 years in 2020. It’s had a tough time since, with the stock down 55% in five years.

But it’s not doing badly, financially.

Its price-to-sales (P/S) ratio of 0.36 suggests it’s bringing in more revenue than its share price reflects. Equally, its price-to-earnings (P/E) ratio of 14.8 is far below the UK Hospitality average of 33.7.

What’s more, it recently reintroduced dividends at 12p per share.

So why is the stock undervalued?

There are some risks that could be giving investors reasons for caution.

Alcohol consumption is trending down among younger generations, bringing the future of pubs into question. Wetherspoons must adapt to these changing habits if it hopes to remain relevant.

On top of that, increases in the national living wage and national insurance contributions could ramp up operational expenses. If it passes these costs to consumers, it risks losing its main selling point: low prices.

Does that negate its value proposition?

I don’t think so. At least, not yet.

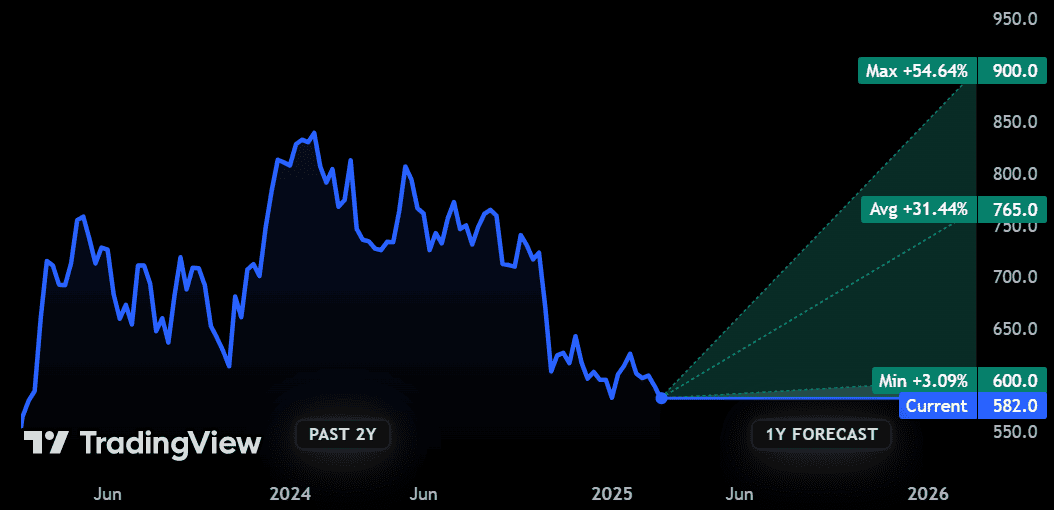

Wetherspoon not only has a thriving food and beverage business but also a growing portfolio of hotels. While many pubs may suffer in the coming years, I think ‘Spoons is well positioned to remain profitable. And so do analysts – the average 12-month target of 765p is 31.44% higher than the current price.

That sounds like a stock worth considering if you ask me.