As a long-term investor, I look for shares to buy and hold. That does not always happen, of course. Sometimes what seems like a great investment can turn sour for some reason and I decide to sell it.

But ideally, I would be happy to take the Warren Buffett approach to investing and buy shares in outstanding companies at attractive prices, then hold them for years, or even decades.

Defining the search area

To begin, it helps to know what you are looking for – and be likely to spot it when you see it! So again like Buffett, I stick to my “circle of competence” when investing. In other words, when looking for shares to buy, I search for businesses I can understand and assess.

Should you invest £1,000 in Legal & General right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Legal & General made the list?

Why a competitive advantage is important

Within those areas, I focus on businesses I think have a competitive advantage (what Buffett calls a ‘moat‘). That is important because such an advantage can help set a company apart from its rivals, giving it pricing power. When a company has some power to set its own prices not just follow the market pressure, that can be good for profits.

As an example, I own shares in Diageo (LSE: DGE). The FTSE 100 company owns brands such as Guinness and Smirnoff. That helps give it pricing power.

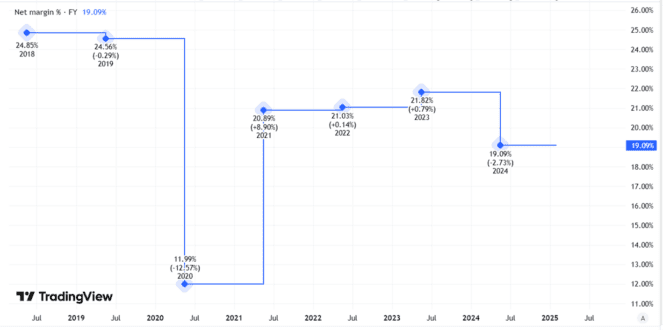

So Diageo has a net margin of around 20%, meaning that even after it pays all its costs and taxes, it still makes around 20p for each £1 of products it sells.

Created using TradingView

For a company whose revenues topped £20bn last year, that adds up to a lot of profit!

Figuring out how I can profit

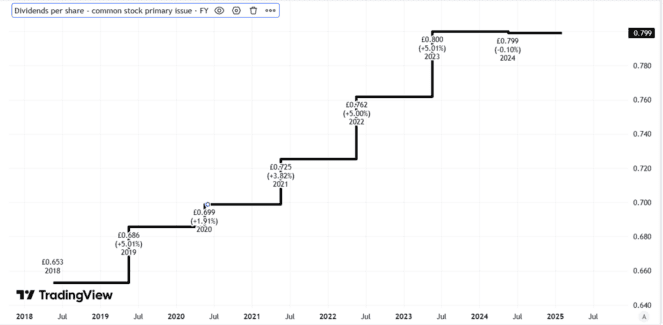

So what does Diageo do with all those profits? It uses some of them to pay a dividend. Indeed, Diageo is a rarity among FTSE 100 firms because it has raised its dividend per share annually for decades.

Created using TradingView

Hopefully, that will last. But it may not as dividends are never guaranteed. Diageo faces a number of risks that could eat into profits, from weak demand in Latin America to rising levels of teetotalism among younger generations.

Dividends are only one way I might make money from owning a share though. I could also benefit from share price growth (though only when I come to sell the shares).

Like dividends though, such growth is not guaranteed. Indeed, a share could fall so I end up losing money when I sell it.

Indeed, if an investor bought Diageo shares five years ago and sold them today, they would get back 22% less than they paid for them. Even taking five years’ worth of dividends into account, they would still have lost money overall.

So when looking for shares to buy, I always ask myself how I might make money from them. If I pay more than I think they are worth, it hardly seems like I am setting myself up for probable success.

Instead, I try to find shares I can buy for less than I think their long-term value will be – and any dividends along the way could be a welcome bonus.

That is why I bought Diageo shares for my portfolio last year.